August 18, 2020

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

- In large part due to COVID-19, large employers have turned their focus to all the ways that employees receive medical care: from traditional brick-and-mortar providers, telehealth for acute symptoms, virtual care to improve well-being and maintain health, to on-site services and advanced primary care offerings.

- While there were small gains in centers of excellence (COE) offerings, employers are likely waiting on heavy promotion of those opportunities because of travel limitations and delays in care.

- Virtual care experienced growth across the board due to the need to reach employees staying at home. Musculoskeletal virtual care is expected to double within 2 years; mental health virtual services will reach near ubiquity by 2023.

- On-site services, including clinics and mental health therapists, have proven to be flexible enough to adapt to the current landscape and provide COVID-19 testing and virtual counseling. For most employers, on-site services will continue to be a part of their approach to health care.

Evolving Views on Health Care

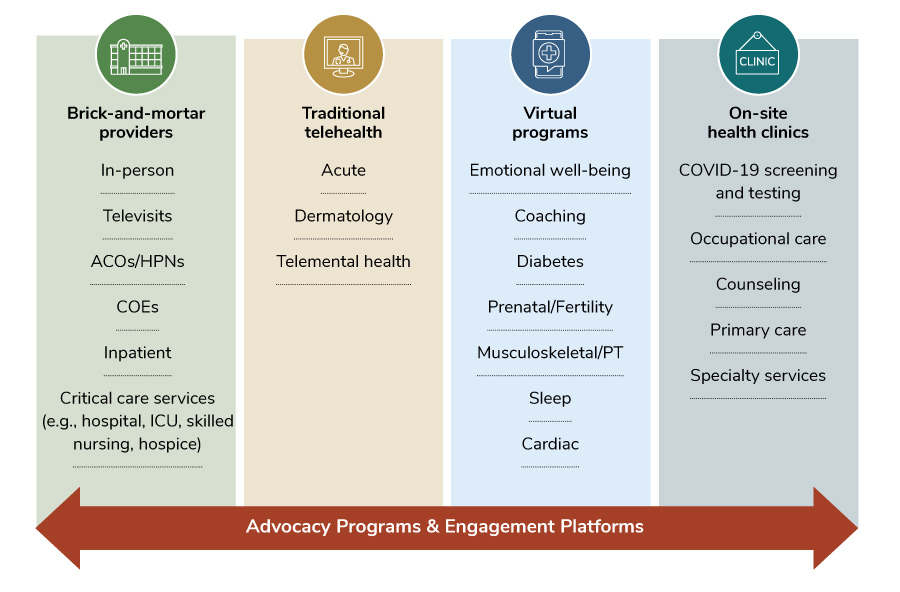

Views of health care have shifted markedly throughout the pandemic. While many providers had to shutter offices and pivot to televisits, telehealth providers and virtual solutions were able to step up to fill a very real gap in care available to employees. Figure 3.1 shows the evolution in how health care is delivered, featuring many types of modalities. This part of the report will explore prevalence and trends for available services.

Health Care Delivery: Primary Care, COEs, ACOs, and Mental Health

Primary Care

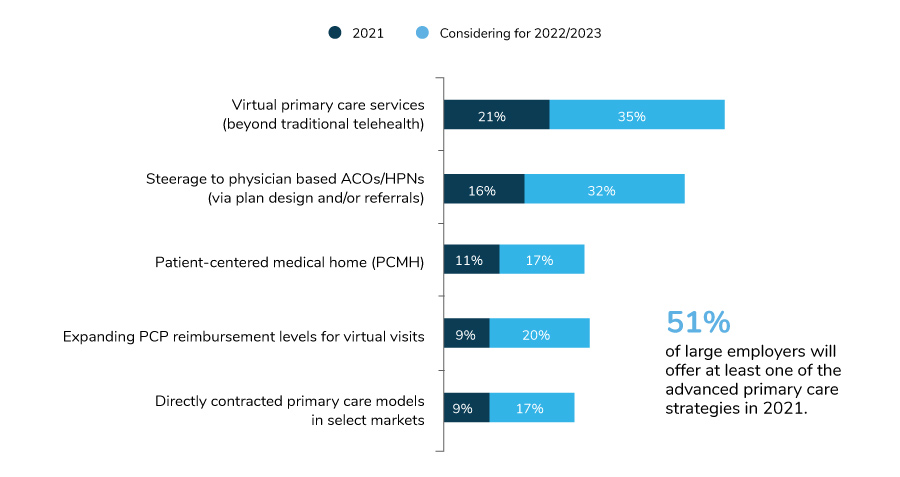

Given the growth of advanced primary care strategies (Figure 3.2), it’s clear that employers recognize these arrangements as having a positive impact on care. Advanced primary care models move away from fee-for-service, encounter-based reimbursement to more comprehensive, patient-centered population health management. While primary care doesn’t directly drive the burdensome health care costs in an employer’s plan, it does directly influence many other downstream impacts of care (e.g., referrals, labs, imaging, prescriptions, chronic disease management, preventive screenings, mental health). Additionally, as employers focus increasingly on the employee experience and navigating the delivery system, these types of primary care arrangements have proven to be effective.

In 2021, 51% of large employers will have at least one advanced primary care strategy in place, up from 46% in 2020. Primary care arrangements aimed at prevention, chronic disease management, mental health and whole person care are clearly key focus areas for employers. Other measures, such as directly contracting for primary care and patient-centered medical homes (PCMHs), stayed steady.

COEs

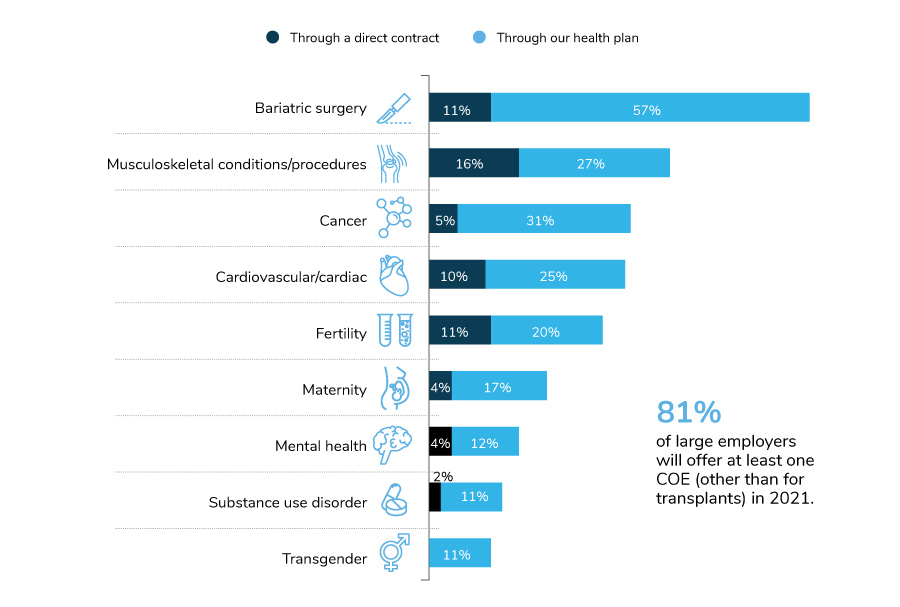

Last year, employers doubled down on COEs to drive delivery reform—through employee incentives, bundled payments and tightening the network—as a way to promote quality care in specific specialties. This year’s data show a continuation of that trajectory, although anecdotally, employers are sharing that use of COEs, particularly those that require long-distance travel, is down in 2020. In all, 81% of employers will have at least one condition-targeted COE in place by 2021.

As seen in Figure 3.3, bariatric surgery is the most common procedure for which employers are pursuing a COE; 68% of employers do so. Most bariatric surgery COEs are embedded right into the health plan design.

When it comes to potential growth, COEs targeting musculoskeletal conditions and cancer will see the steadiest progression – reflecting employers’ top drivers of health care cost increases (Figure 2.3 in Part 2). Employers are increasingly interested in COEs to treat mental health, including substance use disorder, as these networks are established and promoted among the employer community.

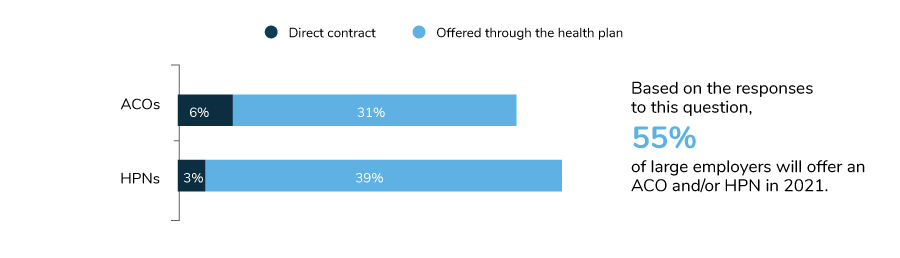

ACOs and HPNs

ACOs and HPNs have been steadily growing among large employer plans, whether through a directly contracted arrangement or through the health plan. While fewer employers report a huge focus on ACOs/HPNs for 2021 due to near term prioritization of COVID-19 (Figure 1.3), more are reporting the presence of ACOs within their health plans. Last year, 31% of large employers had ACOs/HPNs within their health plans; in 2021, 55% will offer an ACO and/or HPN.

In comparing the data year over year, most of the growth can be attributed to health plans embedding these payment strategies within their network design. Only 6% of employers have a directly contracted ACO, and 3% have a directly contracted high-performance network.

Accountable Care Organizations

Health care providers who come together in a value-based delivery model that ultimately accepts responsibility for the quality and cost of care for a defined population.

High-performance Networks

Typically include smaller provider networks that encourage enrollees to select providers deemed higher performing based on efficiency, quality and other measures.

Mental Health Access, Culture and Benefit Design

In 2020 and 2021, employers have and will continue to put a tremendous amount of time and resources into employee mental and emotional well-being. The COVID-19 pandemic reinforced anti-stigma efforts by shining a light on how vulnerable every employee can be in trying times.

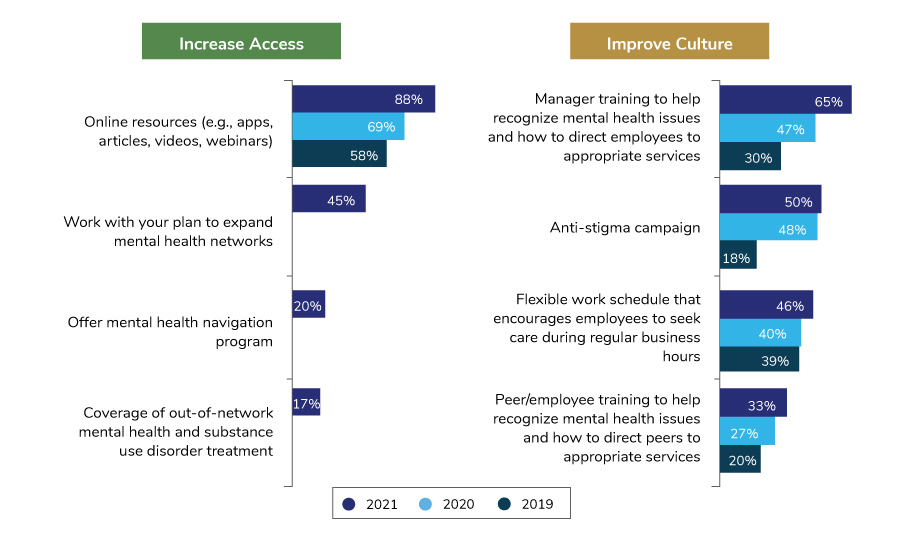

Relevant to this survey, employer strategies to address mental health can be divided into three categories: access, culture and benefit design. In terms of access, the most significant change was that more employers plan to offer online resources such as apps, articles, videos and webinars; 88% of employers will do so in 2021, compared to 69% who have them in place this year. In the culture arena, employers have become more focused on helping managers recognize when an employee needs support. They have provided increased training on resources and communications.

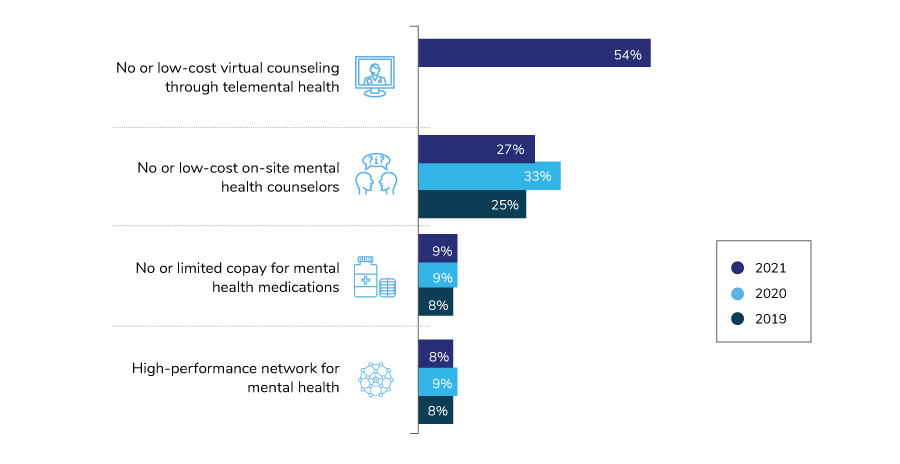

When it comes to mental health treatment and providers, employers are enhancing access and reducing out-of-pocket costs for employees in four key areas (Figure 3.7). The most common way for employees to access lower (or no) cost mental health support is through their telemental health provider. Fifty-four percent of large employers are making this available in 2021. Twenty-seven percent of employers are offering lower cost counseling services right at the worksite, supporting the trend to bring services directly to employees.

Virtual Care: Telehealth and Innovative Digital Solutions

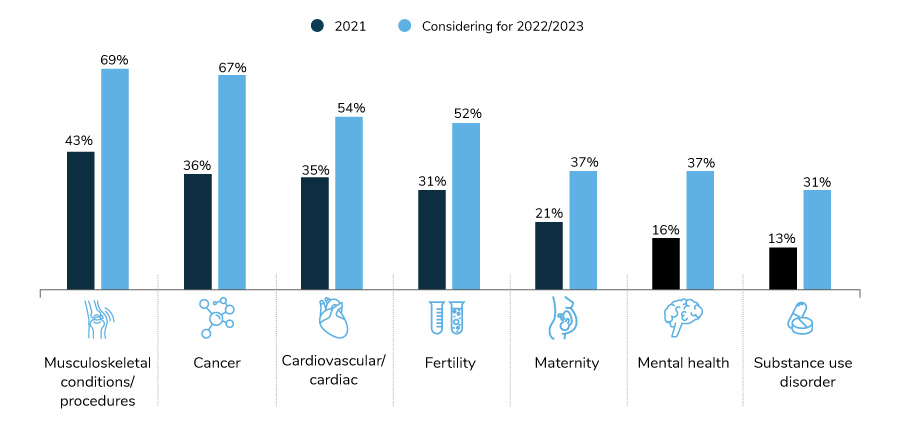

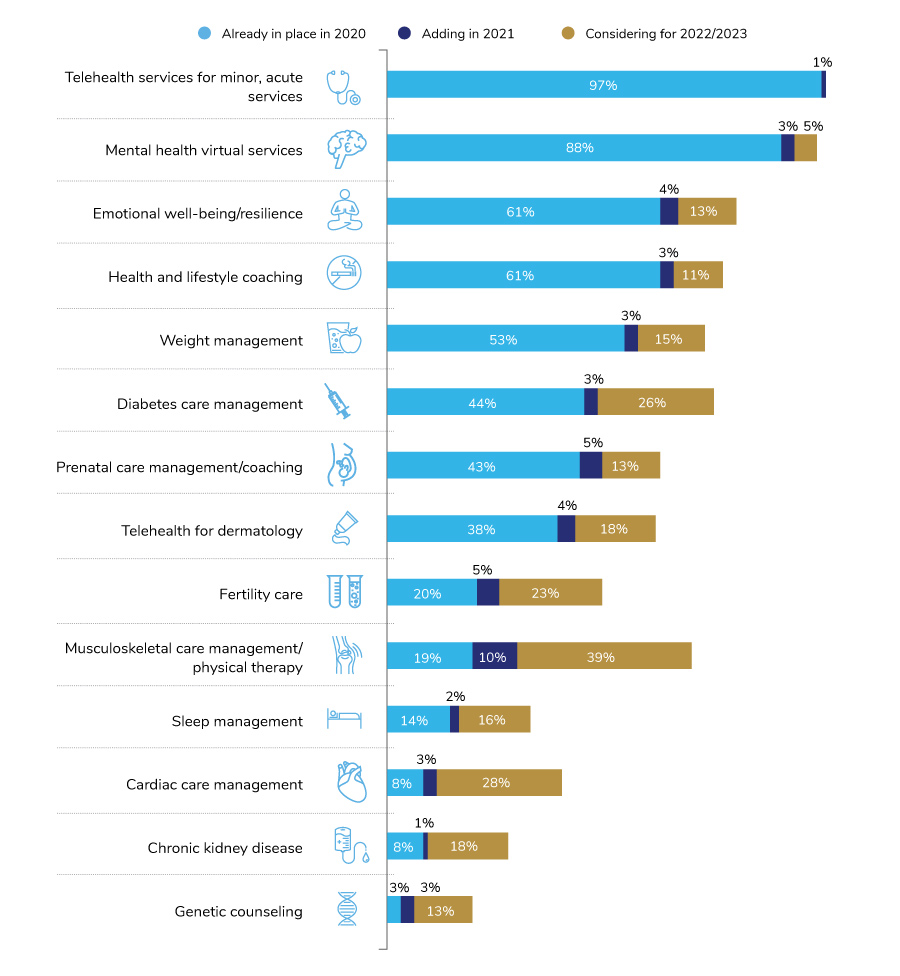

There’s no doubt that virtual care has accelerated exponentially – playing a critical role in providing care during the pandemic, as well as garnering increased interest and receptivity from employees and providers, both of whom increasingly see its benefit. Employers are leveraging this opportunity by promoting all the impactful virtual services, from those delivering primary care to musculoskeletal to mental health, as well as many others. Figure 3.8 shows the prevalence of many types of virtual solutions offered by employers.

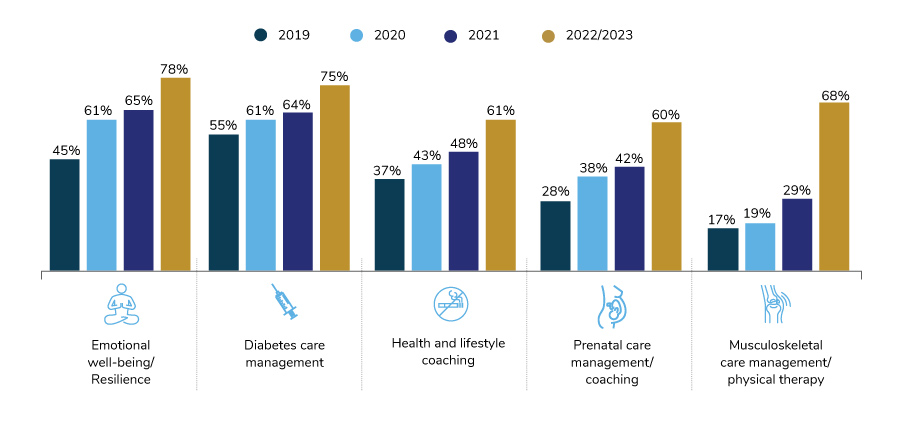

Not surprisingly, telehealth, mental health, emotional well-being and health and lifestyle coaching are the most prevalent virtual services offered by employers. Significant growth is forecasted for virtual solutions addressing specific conditions such as musculoskeletal, cardiac, diabetes and fertility care.

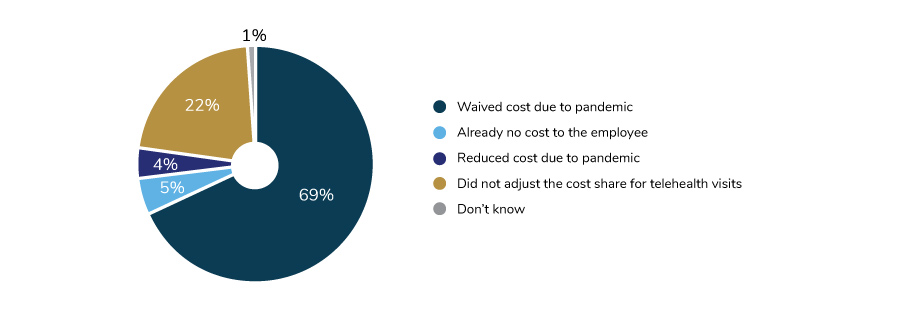

The growth in virtual care is something that employers have supported for the past 2 years as a key initiative. Undoubtedly, the pandemic has fueled this movement even more, and at an exponential rate. As mentioned in Part 1, easing access to telehealth and virtual care, along with accelerating the number of these services offered, were the two top strategies put into place because of the pandemic. In fact, three in four employers reduced or waived cost sharing to basic telehealth services during the pandemic in an effort to address barriers to accessing care at a time when most individuals were unable to visit their provider in a traditional office environment.

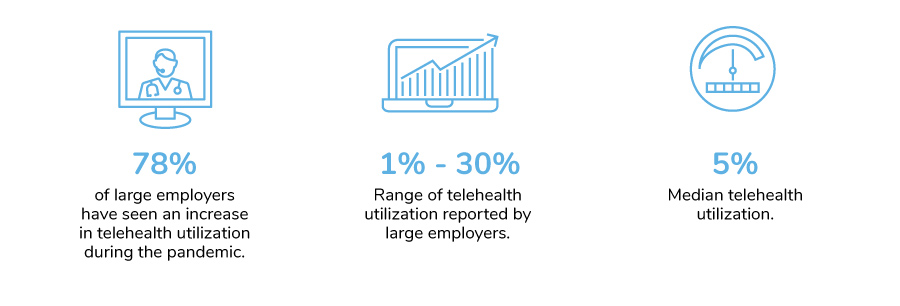

Seventy-eight percent of companies did see increases in their utilization, largely attributed to these expanded offerings. Telehealth utilization in the first half of 2020 has outpaced utilization rates for all of 2019. As illustrated in Figure 3.10, some employers saw upwards of 30% utilization in the first half of 2020.

For virtual care services beyond telehealth, employers are continuing to add to the programs available to employees. Offerings like those delivering health coaching and emotional well-being support are expected to rise over time, perhaps as some employers move more employees in an office setting to a work-from-home status for the long term.

The largest growth is expected among offerings to address musculoskeletal care management, including remote physical therapy platforms. Only 17% of employers offered such a benefit in 2019; by 2023, that number may increase by 300%. Musculoskeletal services may be well-suited for virtual care due to the ability to reach a wide audience of employees struggling with joint and muscle issues and the increase in available technology able to demonstrate physical therapy exercises, which are often viable and low-cost remedies compared to surgical intervention.

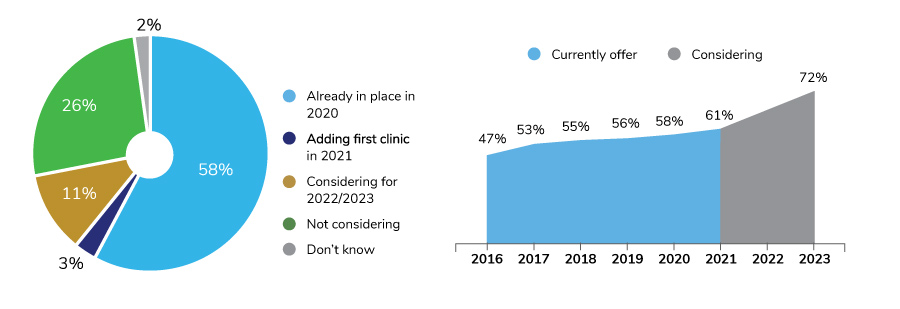

On-site Services

On-site clinics have proven to be flexible enough to adapt to the current landscape and provide COVID-19 testing and virtual counseling. Seventy-two percent of employers either have a clinic in place or will have one in the near future and consider these services part of their approach to health and well-being. Despite the pandemic-driven movement to a work-from-home setting for many employees, employers are sustaining, and for some, considering expanding their on-site services. One example of expansion is bringing primary care directly to employees at the worksite: 34% of surveyed employers offered this in 2020 and an additional 26% plan to have this service available by 2023.

Engagement and Navigation Tools

Navigating health care and making informed decisions can be challenging – perhaps even more so with the increased prevalence of virtual solutions. For many employees, knowing which solution to use, when to go to a doctor, which type of provider to see, which app to use, when to seek a second opinion and many other decision points along an individual’s health care journey can be overwhelming.

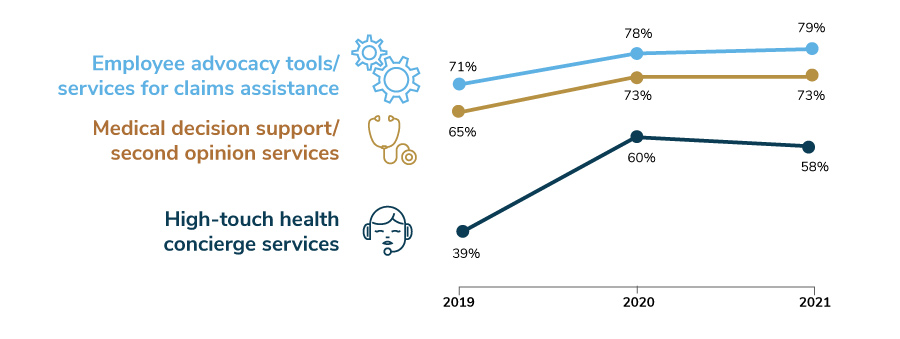

Employers continue to recognize these complicated decisions and are providing navigation support and engagement platforms to help guide employees to the provider or solution best suited to their needs. In 2021, 9 in 10 employers will offer some type of navigation support to employees. Navigation support can come in the form of employee advocacy, medical decision support/second opinion services or a high-touch concierge offering. Each of these saw increases in last year’s survey (particularly for high-touch concierge services) and are indicating sustained prevalence in this year’s findings (Figure 3.13).

Engagement platforms bring together benefits and program offerings under one website, designed to be user-friendly, simple and personalized. While these platforms haven’t been available as long as the navigation programs listed above (only 20% have had one in place longer than 5 years), their role in navigation is an important one; employees are accessing online resources more than ever. The benefit of these platforms is that they can link to important resources, such as the health plan, telehealth provider and other virtual programs, in a seamless way for the employee, making them the go-to place to access the suite of programs an employer offers.

Only 23% of employers have an engagement platform in place in 2020; an additional 8% will have one available in 2021. Another 24% have it on the horizon for the next few years.

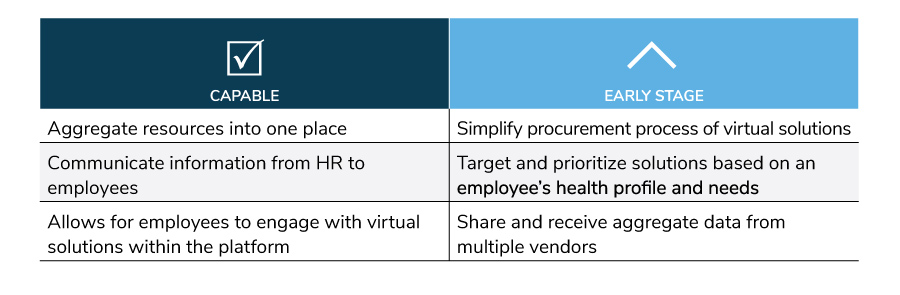

If these platforms are available, why don’t all employers implement them? This year’s survey explored the maturity of engagement platforms' capabilities, recognizing that the ability for the sites to deliver on personalization and seamless integration will make or break the employee experience. Figure 3.15 lists the top three strengths of engagement platforms as well as the three capabilities that have the greatest room for improvement.

Based on these employer views, engagement platforms are performing the basic need of providing easy access to programs and benefits. The next stage is to excel at leveraging data so that health care and virtual solutions can be personalized to the employee, based on their needs, interests and preferences.

-

Introduction2021 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2021 Plan Design Survey: Full Report

-

Executive Summary2021 Plan Design Survey: Executive Summary

-

Infographic2021 Plan Design Survey: Strategic Implications of COVID-19

-

Chart Pack2021 Plan Design Survey: Chart Pack

-

Part 12021 Plan Design Survey: Employer Perspectives on the Health Care Landscape

-

Part 22021 Plan Design Survey: Health Care Strategy, Plan Design and Medical Costs

-

Part 32021 Plan Design Survey: Health Care Delivery System

-

Part 42021 Plan Design Survey: Pharmacy Strategy and Design

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()