August 18, 2020

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

- Due to COVID-19, which triggered delays in preventive and elective care, projected health care trend for 2020 (5%) may turn out to be too high. Similarly, if people resume receiving care in 2021, the projected trend (5.3%) may prove to be too low. It’s difficult to know how these projections will play out.

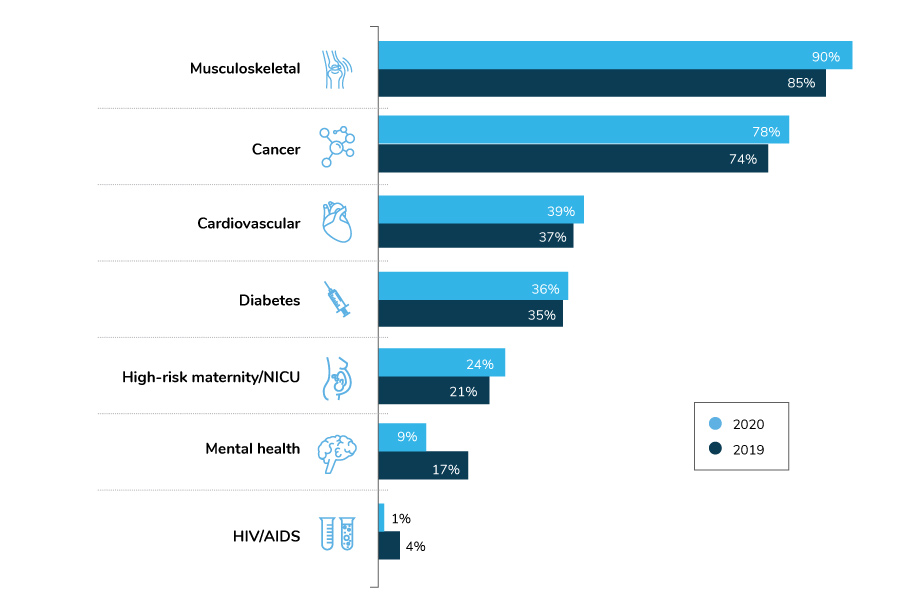

- As of the fielding of this survey, COVID-19 was not among the top three cost drivers. Musculoskeletal conditions and cancer were the top two drivers, followed by diabetes and cardiovascular disease, as was the case in previous years.

- Full replacement of CDHPs continues to decline, reflecting employers’ desire to add choice back into their offerings. Median enrollment in CDHPs is down slightly, dipping from 46% in 2019 to 42% in 2020.

Health Care Trend for 2019 and 2020

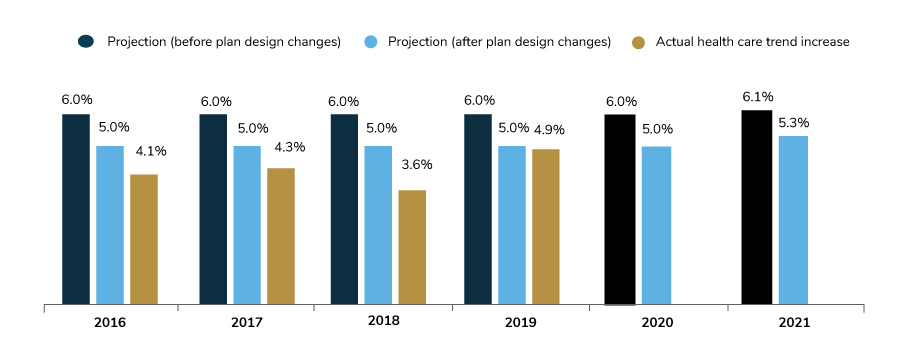

In 2019, actual health care trend (4.9%) was very close to the projected trend after design changes were made (5%). But in 2020, employers faced a new set of challenges, brought on by the COVID-19 pandemic. Trend projections for 2020 may be overstated due to the impact of deferred care. However, many employers are speculating that health care costs will increase in 2021, a result of both the pandemic’s prolonged impact and a likely resumption of deferred services. Therefore, the projected trend of 5.3% may turn out to be too low.

Another variable affecting cost in 2021 is how the delivery system responds to these issues. (See Part 3 for more information on this important topic.) Time will tell how these theories play out, making budgeting and actuarial analyses challenging for employers in the near term.

Upward Trend for Employer and Employee Contributions for Health Care

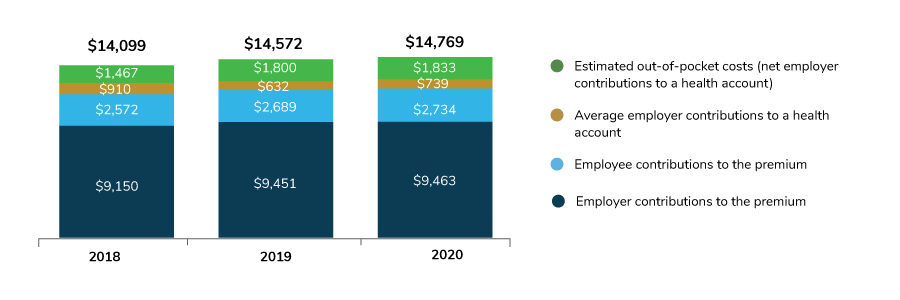

Since 2018, the cost of health care for both employers and employees has been slowly but steadily rising (Figure 2.2). In 2019, total expenses rose to $14,572, with employers contributing $10,083 and employees contributing $4,489.

For 2020, employers are predicting total expenses to reach $14,729, an increase of $197 from last year. Employers will contribute $10,202 to the premium and health accounts, and employees will contribute $4,567.

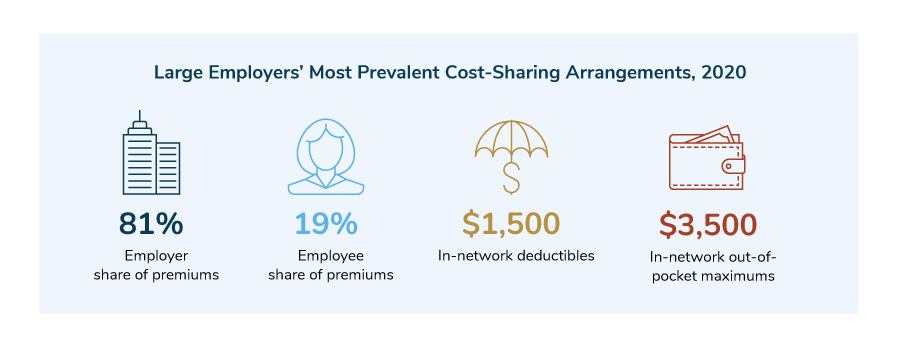

The breakdown of cost share between employers and employees (employee-only and family coverage) for the most popular plan type, consumer-directed health plans (CDHPs), is shown in the infographic below. Also included are in-network deductibles and in-network out-of-pocket maximums.

Conditions Impacting Cost

As of the fielding of this survey, COVID-19 was not among the top three cost drivers. Top conditions cited by employers were similar to those noted in 2019. Musculoskeletal conditions came in first, with 90% of the respondents selecting it as their first, second or third choice, followed closely by cancer, at 78%. Employers also saw diabetes and cardiovascular disease as contributing to rising health care costs, with each cited as a top driver by about a third of respondents. As shown in Figure 2.3, these results are relatively consistent year over year.

Plan Design

CDHPs: Trend Away from Full Replacement Continues

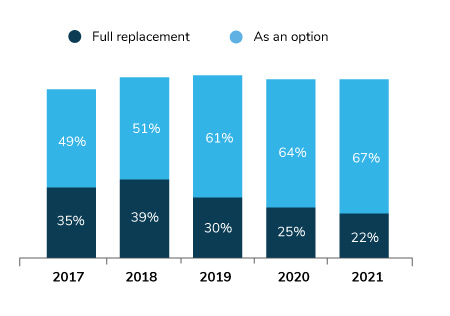

As has been evident over the past 3 years, employers continue to move away from full replacement, or offering consumer-directed health plans (CDHPs) as the only option, to bringing choice back.

In 2021, 67% of employers will offer CDHPs as an option, up 6 percentage points from 2019 (61%) and 3 points from 2020 (64%). As seen in Figure 2.4, the percent of employers offering full replacement has changed little, declining slightly in 2021 (25% vs. 22%). Median enrollment in CDHPs is down slightly, dipping from 46% in 2019 to 42% in 2020.

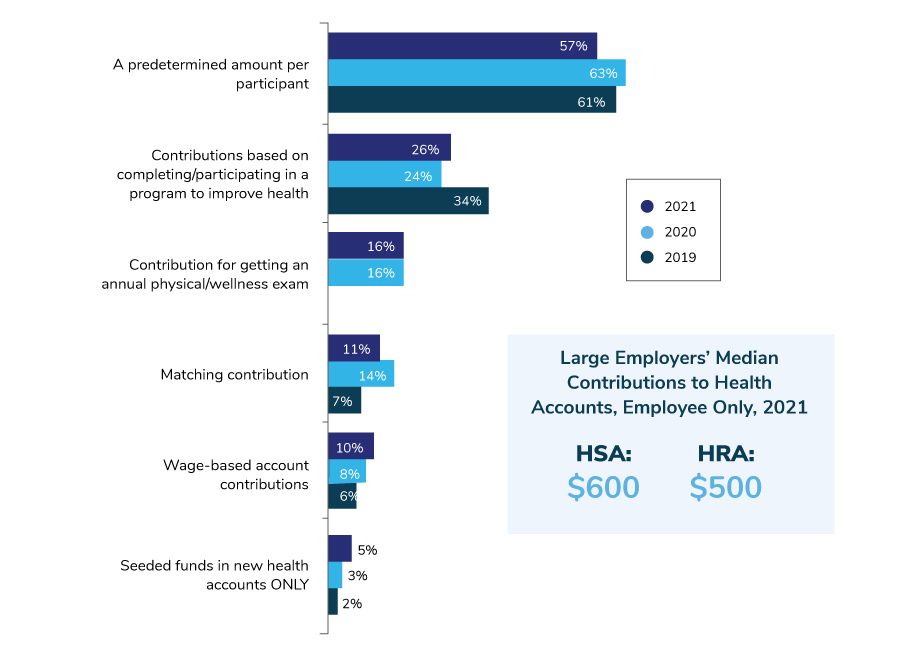

CDHPs have typically been linked to a health account, either a health savings account (HSA) or a health reimbursement arrangement (HRA). Since 2019, employers have been moving away from HRAs and offering HSAs more frequently. In 2021, 97% will offer an HSA, compared to 22% offering an HRA.

Another continuing trend is moving away from basing employer contributions on incentives, such as participating in programs to improve employees’ health. Most often, employers are allocating a predetermined amount to each participant’s account. Figure 2.5 shows this trend for HSAs.

Large Employers' Top Priorities for 2021

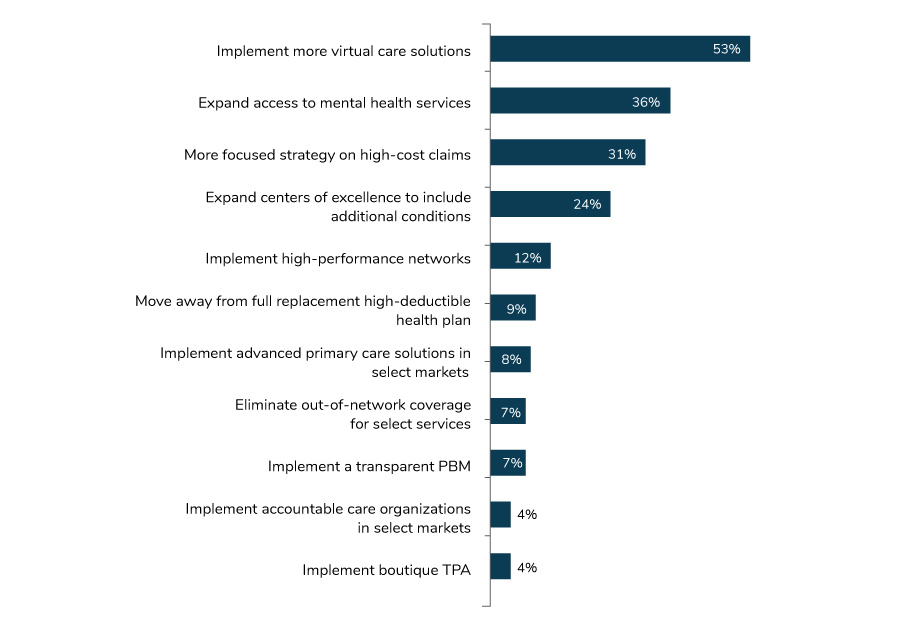

Looking ahead to 2021, employers said that their focus is going to be on broadening the scope of virtual solutions, expanding access to mental health services and developing a more focused strategy on high-cost claims.

Implementing more virtual solutions was also the top priority in 2020, and it’s not surprising to see it again at the top of employers’ initiatives for 2021, likely underscored in large part by the pandemic. Similarly, a focused strategy on high-cost claims was at the top of the priority list for employers in 2020 and remains in the top three for 2021. Likewise, employers have long been focused on expanding access to mental health services to address provider shortages, wait times and stigma associated with seeking care. The COVID-19 pandemic has certainly magnified these concerns and expanded the number of employees seeking these services.

-

Introduction2021 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2021 Plan Design Survey: Full Report

-

Executive Summary2021 Plan Design Survey: Executive Summary

-

Infographic2021 Plan Design Survey: Strategic Implications of COVID-19

-

Chart Pack2021 Plan Design Survey: Chart Pack

-

Part 12021 Plan Design Survey: Employer Perspectives on the Health Care Landscape

-

Part 22021 Plan Design Survey: Health Care Strategy, Plan Design and Medical Costs

-

Part 32021 Plan Design Survey: Health Care Delivery System

-

Part 42021 Plan Design Survey: Pharmacy Strategy and Design

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()