August 25, 2021

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

- While the last several years have seen a move away from full replacement consumer-directed health plans (CDHPs) and a renewed focus on more plan choice, CDHPs still remain the highest enrolled plan for many employers.

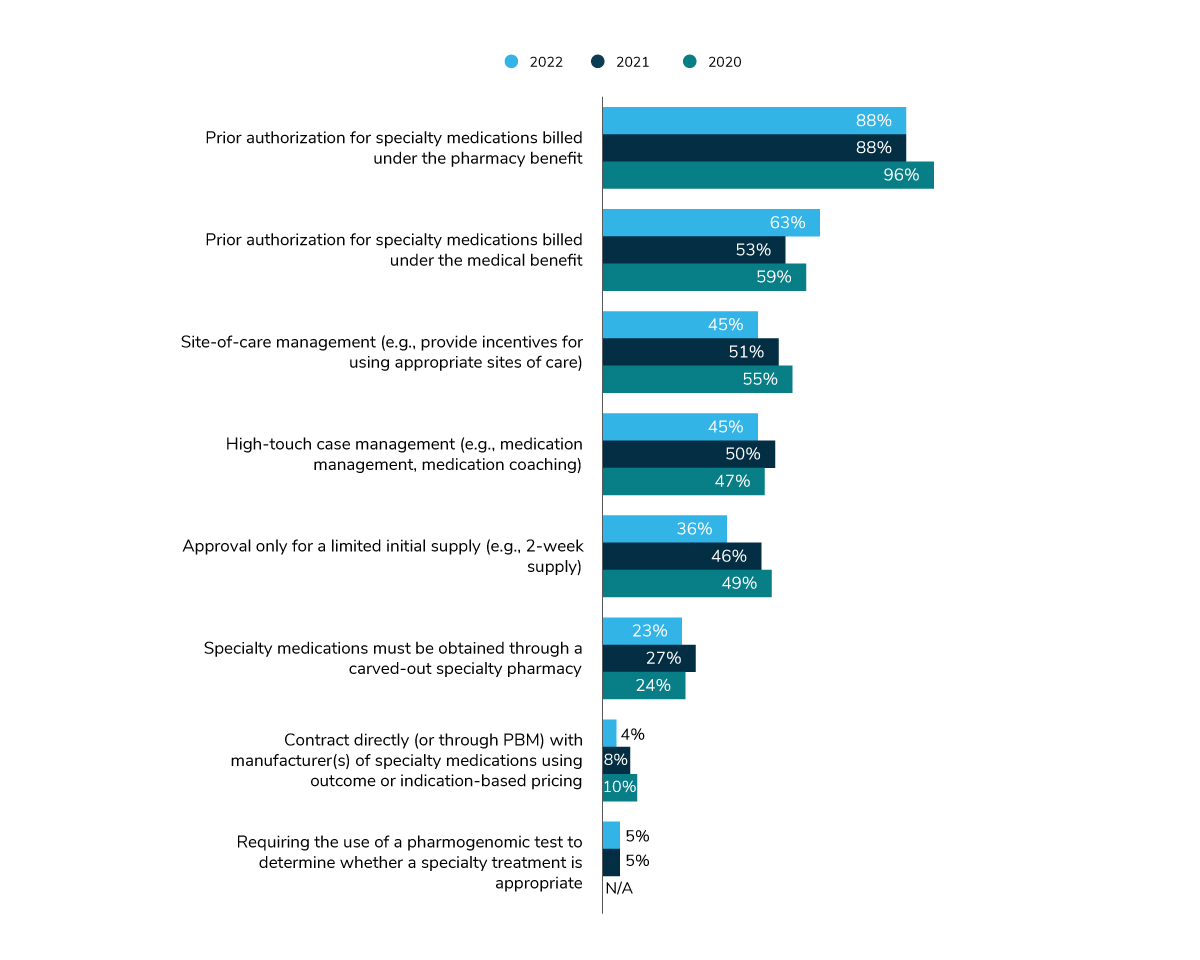

- Employers continue to look to plan management tactics to control specialty pharmacy spend, with prior authorization as the most common strategy (for therapies that fall under both the medical and pharmacy benefit design).

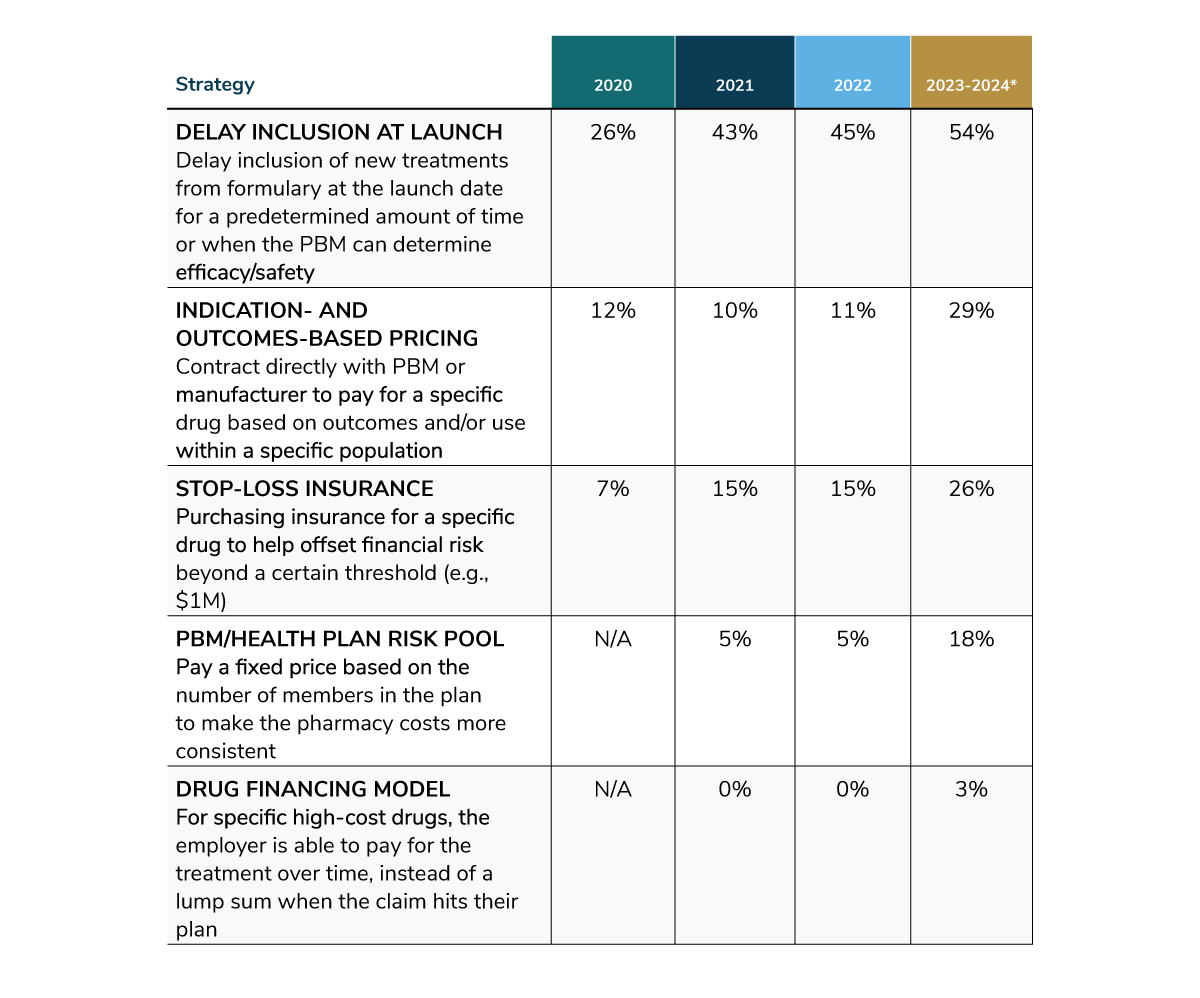

- When it comes to tackling exceptionally high-cost therapies (i.e., gene- and cell-based therapies), employers plan to ramp up next-level cost management techniques – slowly in 2022, then more aggressively by 2023/2024.

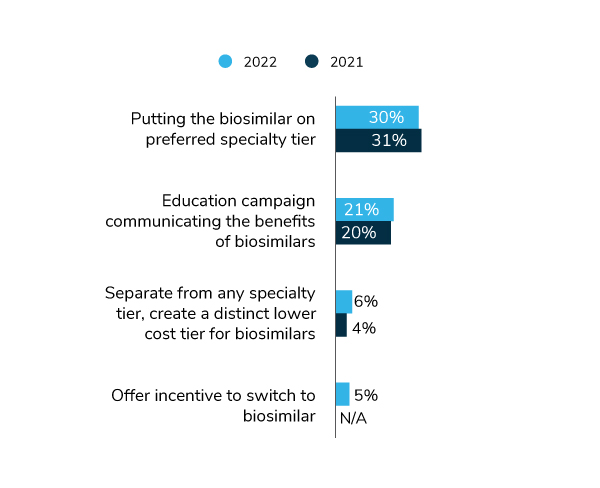

- Early indicators show a wave of biosimilars coming. However, a handful of these drugs will be substitutes for drugs under pharmacy benefit management (PBM) rebate guarantees, posing a challenge to uptake. Employers are increasingly working with their vendor partners to promote adoption through preferring biosimilars on formulary and educating and incentivizing patients to make the switch.

Employers made few changes in plan design and eligibility in 2021, as their focus remained on addressing employee needs that emerged from the pandemic. A relatively similar “holding pattern” could be seen with pharmacy plan design in 2020 into early 2021; however, employers are now more actively exploring new approaches to plan design strategy and vendor partnerships and are ramping up next-level cost control measures to manage a drug pipeline marked by exceptionally high-priced therapies.

Benefit Plan Design Holds Steady

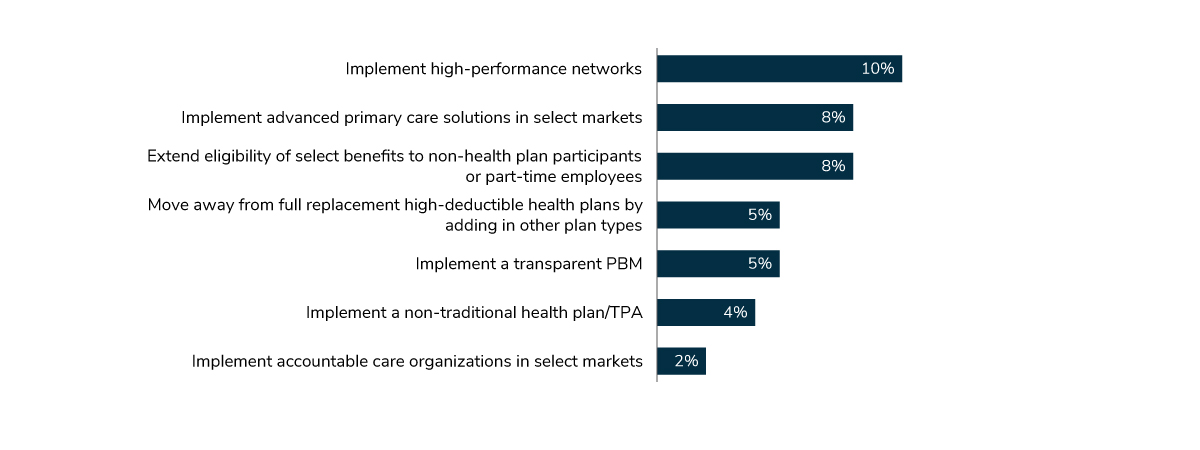

For 2022, few employers are making any major plan design or eligibility changes (Figure 4.1). An area of slight new activity is focused on the implementation of high-performance networks and advanced primary care solutions (see Part II).

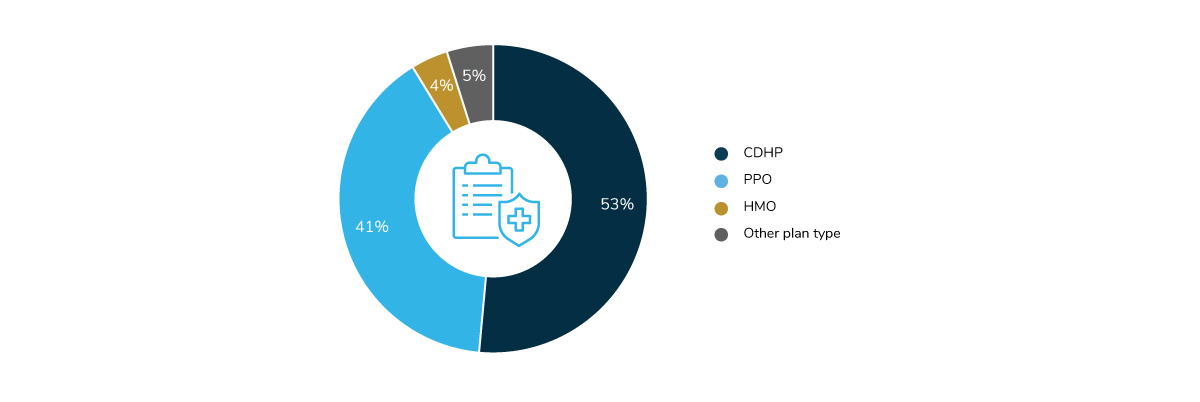

CDHPs continue to be the highest enrolled plan, despite employers adding more choice back into the mix, followed closely by preferred provider organizations (PPOs) (Figure 4.2).

CDHPs: Trend Away from Full Replacement and a Move Toward More Plan Choice

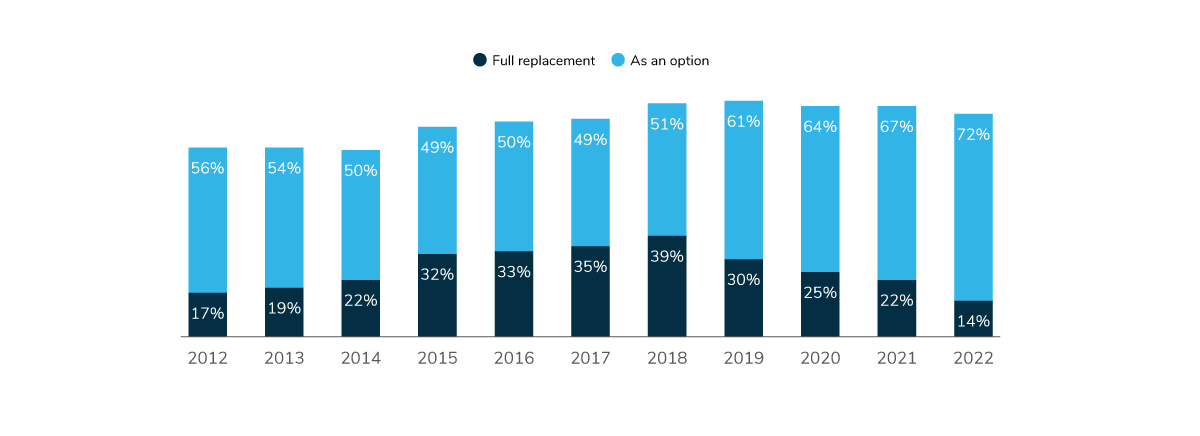

Over the last several years, there has been a steady shift away from full replacement (i.e., CDHPs offered as the only option), and a movement toward bringing choice back to plan design. In 2022, 72% of employers will offer CDHPs as one option, up 8 percentage points from 2020 (64%) and 5 points from 2021 (67%). However, as seen in Figure 4.3, the percent of employers offering full replacement declined substantially, moving from 22% in 2021 to 14% in 2022. Median enrollment in CDHPs is up slightly, increasing from 42% in 2021 to 50% in 2022.

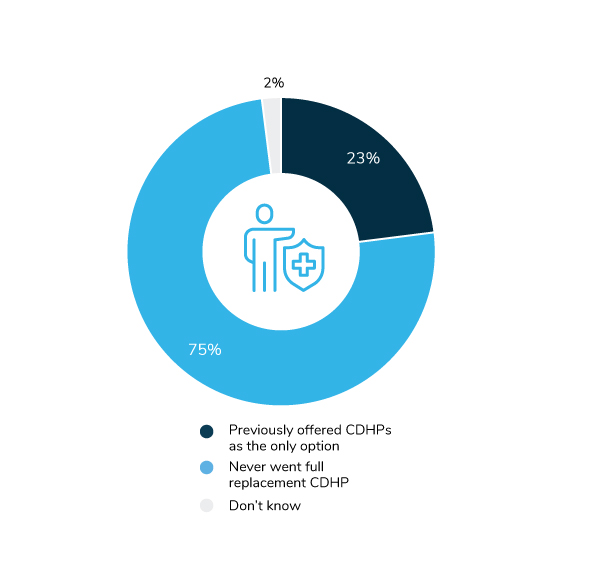

The number of employers offering multiple plan options for employees continues to grow. Of the employers offering choice in 2022, 23% previously had a full replacement strategy in place (Figure 4.4).

Traditionally, CDHPs are linked to either a health savings account (HSA) or a health reimbursement arrangement (HRA). Since 2019, employers have been moving away from HRAs and are offering HSAs more regularly. In 2022, 97% will offer an HSA, the same number as last year.

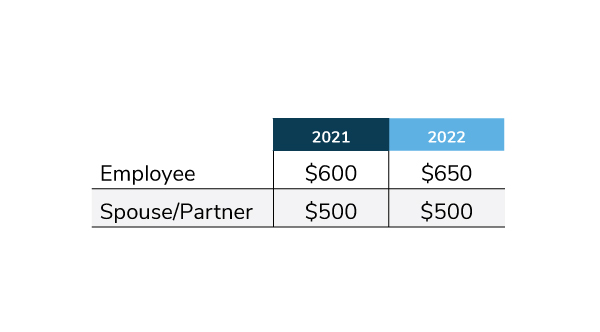

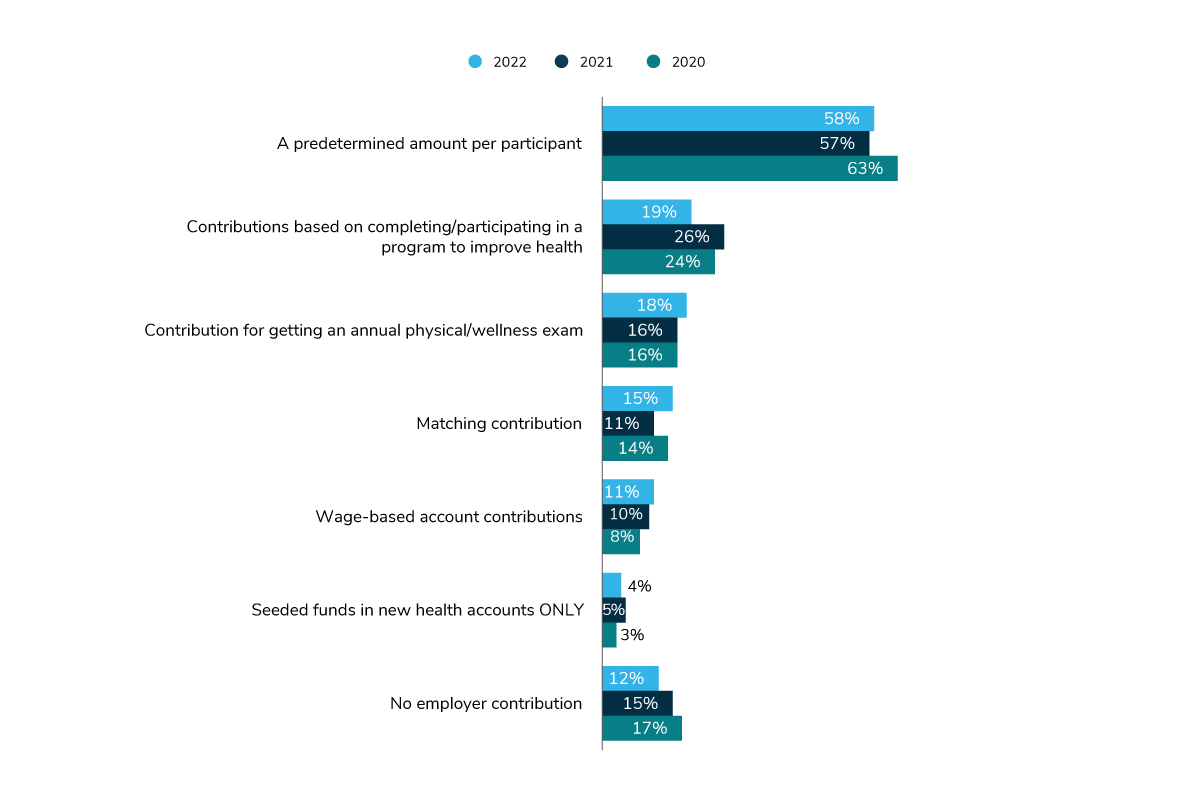

In 2022, employers will make a substantial move away from basing employer contributions on employee participation in health improvement programs (Figure 4.5). Most often, employers are allocating a predetermined amount to each participant’s HSA. Median contributions across 2021 and 2022 were nearly identical, although 2022 did reveal a $50 increase in the amount employees would be able to automatically receive and/or earn through various activities/behaviors (bringing the employee contribution from $600 to $650) (Table 4.1).

Pharmacy Plan Design

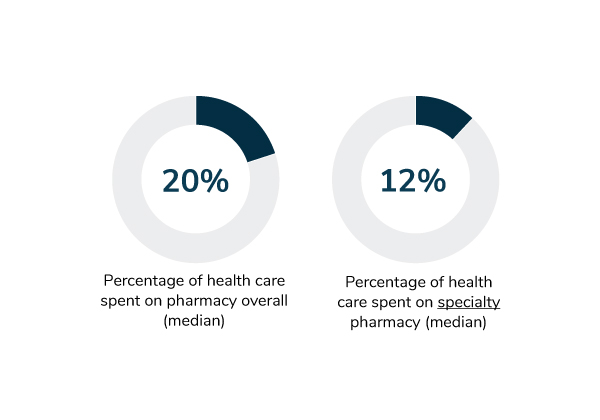

While the pandemic did influence positive change within certain areas of the health care industry, there have been no signs of moderation or rationalization of prescription drug pricing. Pharmacy costs remain a primary focal point for employers seeking to rein in overall health care expenditures. In 2020, 20% of total health care spend was attributed to pharmacy costs. Employers reported that specialty pharmacy alone made up 12% of this overall spend (Figure 4.6).

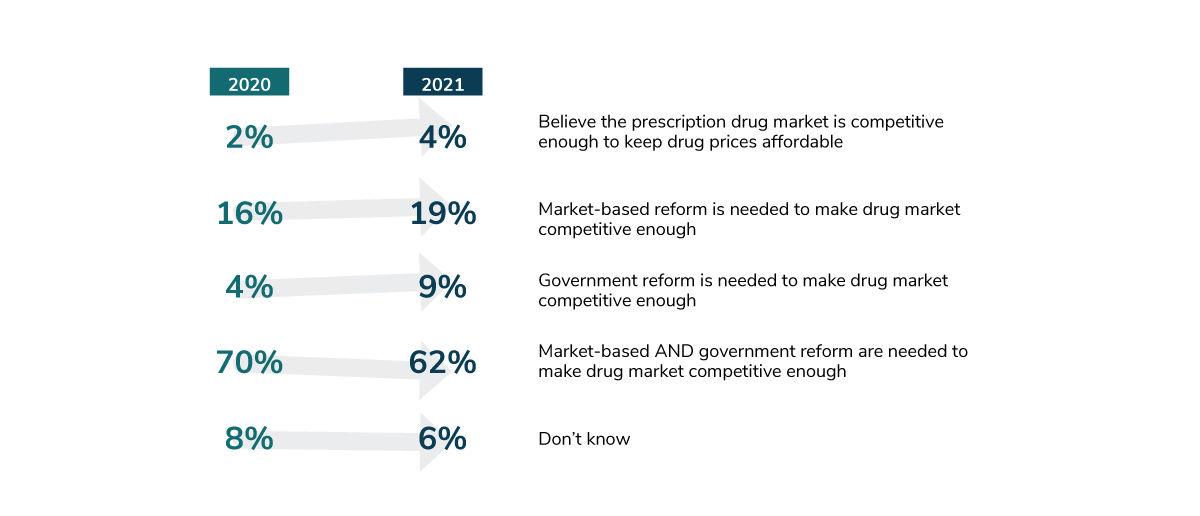

Facing unrelenting pharmacy price tags and a robust drug pipeline promising more of the same, most large employers have identified the need for more competition within the prescription drug market to help keep prices affordable. The majority, in fact, have indicated a willingness for government intervention and/or market-based reform to accomplish this.

In particular, in 2021, 19% advocated for market-based reform (up 3 percentage points from 2020), and 9% advocated for government reform (up 5 percentage points from 2020). Sixty-two percent of employer respondents in 2021 indicated a preference for market- and government-based reform (down 8 percentage points from 2020) (Figure 4.7).

In the meantime, employers are taking more direct and active measures, choosing pharmacy programs and solutions that focus on supply chains, market competitive benefits and data-driven decisions. Among these solutions, prior authorization across both the medical and pharmacy benefit continues to be the most common specialty pharmacy management technique year over year (Figure 4.8). Other approaches, such as site-of-care management and quantity limits, saw a dip in popularity, potentially due, in part, to circumstances created by the COVID-19 pandemic (e.g., site-of-care directives were significantly impacted by travel restrictions, and quantity limits were loosened or removed entirely).

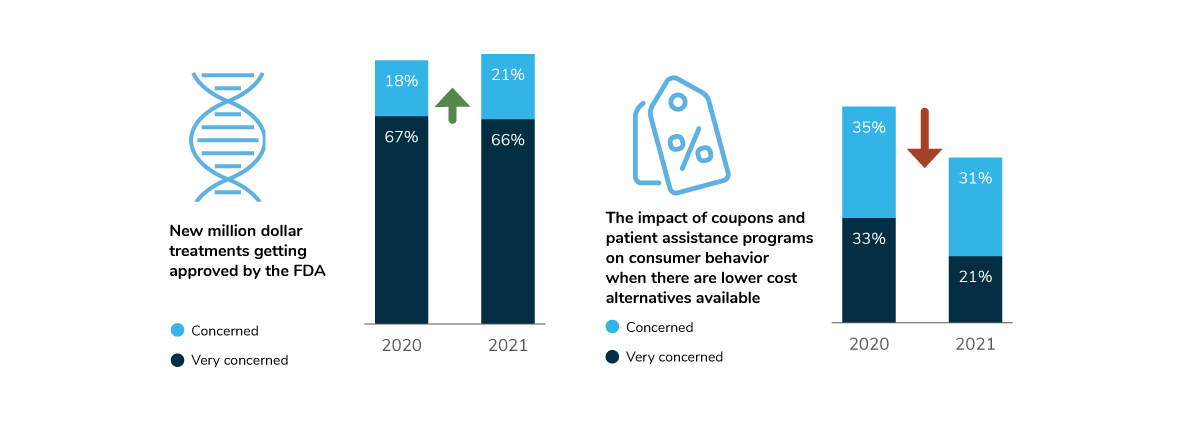

Managing the impact of new million-dollar treatments (e.g., gene- and cell-based therapies), however, seems to be considerably more daunting, and throughout 2020-2021, has remained a top concern for employers. When it came to identifying which solutions employers have (or will have) in place to manage such exceptionally high costs, the response pattern did not fluctuate much across 2021 and 2022, potentially due in part to a pandemic-induced “holding pattern” (Figure 4.9).

Looking ahead to 2023/2024, employer responses point to a significant jump in all five strategic management categories (Table 4.2). By 2024, more than half of large employers could be delaying drug formulary coverage of new market entrants for a set period of time (e.g., 6 months) until further safety and efficacy information has been released/evaluated.

Biosimilar Strategy

In the face of rising drug costs, lower-cost biosimilar alternatives and the promise of savings remain attractive – but an option that has been elusive for some time, given several industry barriers to prioritization and uptake of these medications. Rebating and underlying anticompetitive practices are front and center among these barriers, often precluding biosimilars from ever becoming the lowest net cost option. Other barriers have included a lack of education and thus poor adoption by physicians and the need for more sound biosimilar policies on the health plan side.

In 2022 and beyond, there are hints of dramatic change within the biosimilar landscape, with health plans already starting to prefer biosimilars more widely – some even offering monetary incentives to patients to switch to biosimilar alternatives. Most notably, Humira—a top specialty cost driver for employers—is due to come off patent next year, triggering the release of a biosimilar wave that will hit the employer’s pharmacy benefit. (Today, biosimilars are largely covered under the medical benefit, given more prevalent use in oncology treatment). At that point, rebate guarantees with PBMs may pose the greatest challenge if they ultimately favor the more expensive brand name biologic over the lower cost biosimilar alternative.

Employers have been doing their part, together with their vendor partners, to help ramp up promotion and uptake of biosimilars. When asked about their biosimilar strategy, 31% of large employers indicated that they currently have biosimilars on a preferred tier. In 2022, many (21%) will embark on an education campaign to communicate the benefits of biosimilars to their workforce. Also in the upcoming year, a handful of employers (6%) will create a distinct lower-cost tier for biosimilars, separate from any specialty tier. A slightly smaller percentage (5%) will begin offering patients incentives to switch to a biosimilar alternative (Figure 4.10).

Shifting Away from the Rebate Model?

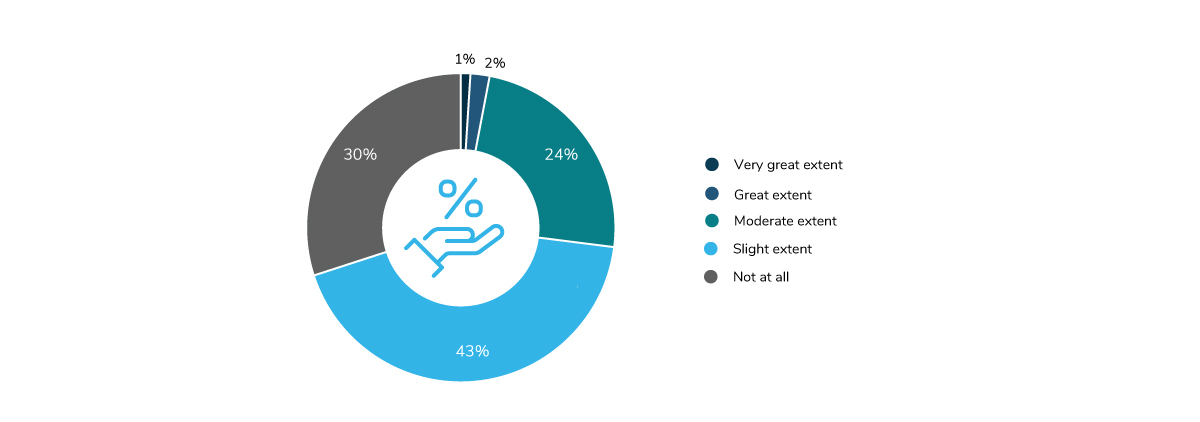

Complicating—and fueling—the drug pricing issue is the antiquated rebate-driven model through which these medications flow. For some time, employers have expressed a desire to see an alternative model based on net price of medications (i.e., list price minus rebates, discounts and fees); two-thirds of employers called for this in 2020 (67%). To date, 43% of employers recognize at least “slight” industry progress in creating alternatives to the status quo, with another 24% recognizing “moderate” progress. But 30% of employers maintain that no true progress has been made at all (Figure 4.11).

Although the response breakdown speaks to the long road ahead, it also highlights the progress that has been made. While PBMs have not moved their business away from rebate-driven negotiations with drug manufacturers, there have been concerted efforts made to promote more transparency and to pass along a larger share of these rebates to payers. Several new PBM entrants to the market have built their models squarely on pass-through transparency principles (i.e., all discounts and rebates are passed through to the employer, and PBM revenue is earned solely through a clear administrative fee charged to the employer). Traditional PBMs have also launched transparent net cost offerings – a large deviation from, and improvement upon, the historic and prevalent model. Finally, the industry has taken incremental steps toward encouraging paying for value, with formulary decisions and drug price negotiations rooted in drug outcomes and impact on total cost of patient care. Combined, these elements represent positive movement toward what employers hope will amount to real progress.

Evolving Role of the PBM

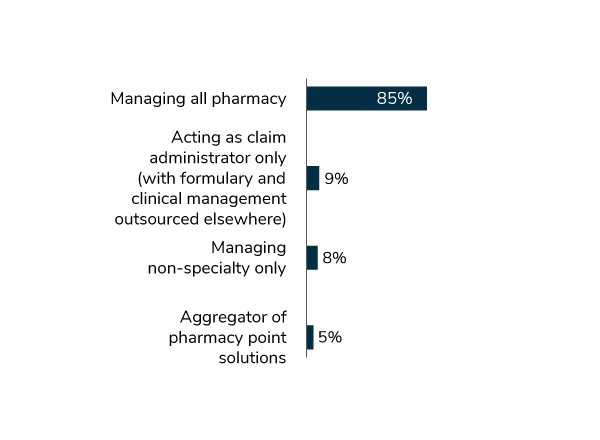

Amid these market developments, some employers are beginning to think about redefining the role of their PBM partners. While the majority of large employers (85%) indicated that their PBM will be managing their entire pharmacy portfolio in 2022, others are leveraging their PBMs a bit differently (e.g., for nonspecialty medication management only) (Figure 4.12). Interestingly, a handful of employers (9%) indicated that their PBM will be operating solely as a claims administrator, with formulary and clinical management being outsourced elsewhere. Other employers (5%) are leaning on their PBMs for point solution aggregation for more streamlined procurement and management of programmatic solutions (or various services provided within their benefits program).

Coupons and Patient Assistance Programs

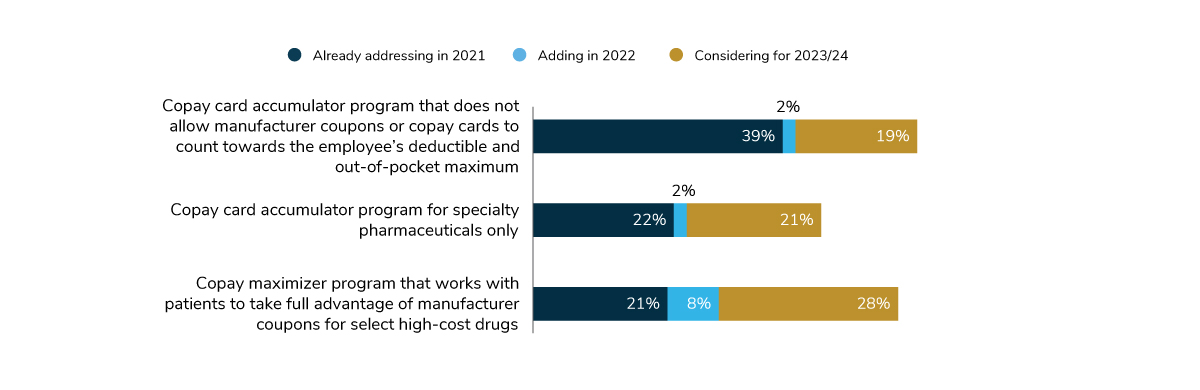

In 2021, employers were slightly less concerned about the impact of coupons and patient assistance programs on consumer behavior (where there are lower cost alternatives available) than they were in the previous year (21% indicated that they were “very concerned,” down from 33%) (Figure 4.9). This shift in sentiment may very well be attributed to the success of safeguards that are increasingly being implemented to counter coupons (i.e., copay accumulator and maximizer programs) (Figure 4.13). In 2022, just over 40% of large employers will have copay accumulator programs in place, barring copay assistance coupons from counting toward the patient’s deductible and maximum out-of-pocket (OOP) spending, and thus protecting pharmacy plan design. Twenty-nine percent will have a copay maximizer in place, which leverages the full monetary value of the manufacturer’s copayment program (applying it evenly throughout the benefit year) and reduces or eliminates the patient’s OOP obligations.

Virtual Pharmacy Solutions and Digital Therapeutics

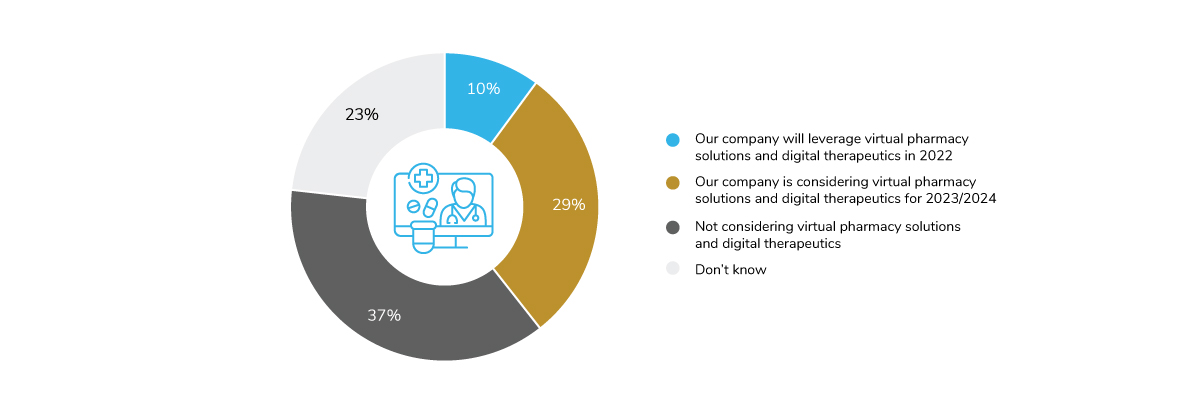

With virtual capabilities gaining enormous momentum within the broader health care sphere, the pharmacy space has naturally also begun to witness a virtual evolution. Indeed, virtual pharmacy solutions and prescription digital therapeutics (PDTs) are picking up steam and are increasingly being integrated into standard of care. These approaches are designed to treat the whole person in a world where several access-to-care challenges exist and where on-demand support is so deeply valued. They can be viewed as an extension of existing health care models, providing support or a full alternative to in-person or pharmaceutical therapies. When asked whether employers planned to leverage virtual pharmacy solutions and digital therapeutics as part of their company’s overall pharmacy management strategy in 2022, 1 out of 10 large employers indicated that they will be tapping into these solutions/approaches, and 29% are considering them for 2023/2024 (Figure 4.14).

-

Introduction2022 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2022 Health Care Strategy and Plan Design Survey: Full Report

-

Executive Summary2022 Health Care Strategy and Plan Design Survey: Executive Summary

-

Chart Pack2022 Health Care Strategy and Plan Design Survey: Chart Pack

-

Infographic2022 Health Care Strategy and Plan Design Survey: Infographic

-

Part 1Employer Perspectives on the Health Care Landscape

-

Part 2Health Equity Within Health and Well-being Initiatives

-

Part 3Employers and the Health Care Delivery System

-

Part 4Health and Pharmacy Plan Design

-

Part 5Health Care Costs and 2022 Priorities

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()