August 23, 2022

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

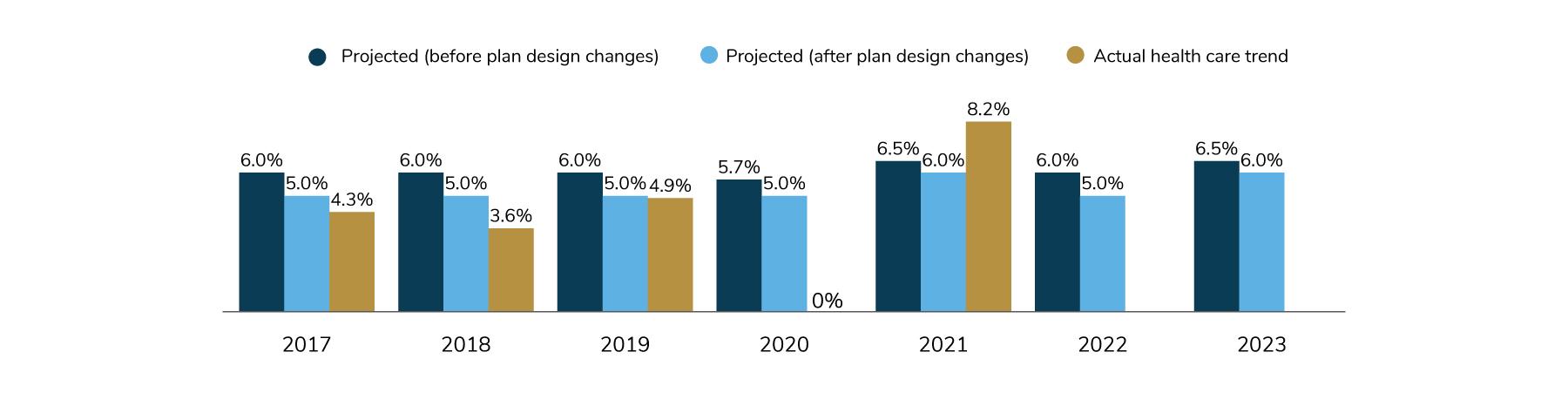

- Health care trend increase for 2021 came in at 8.2%—the largest actual increase seen in many years—after last year’s historic low of 0%. The 5-year average increase (2017-2021) hovers at approximately 4%.

- Projected trend for 2022 is 5%, while the projected trend for 2023 is 6% after plan design changes are made.

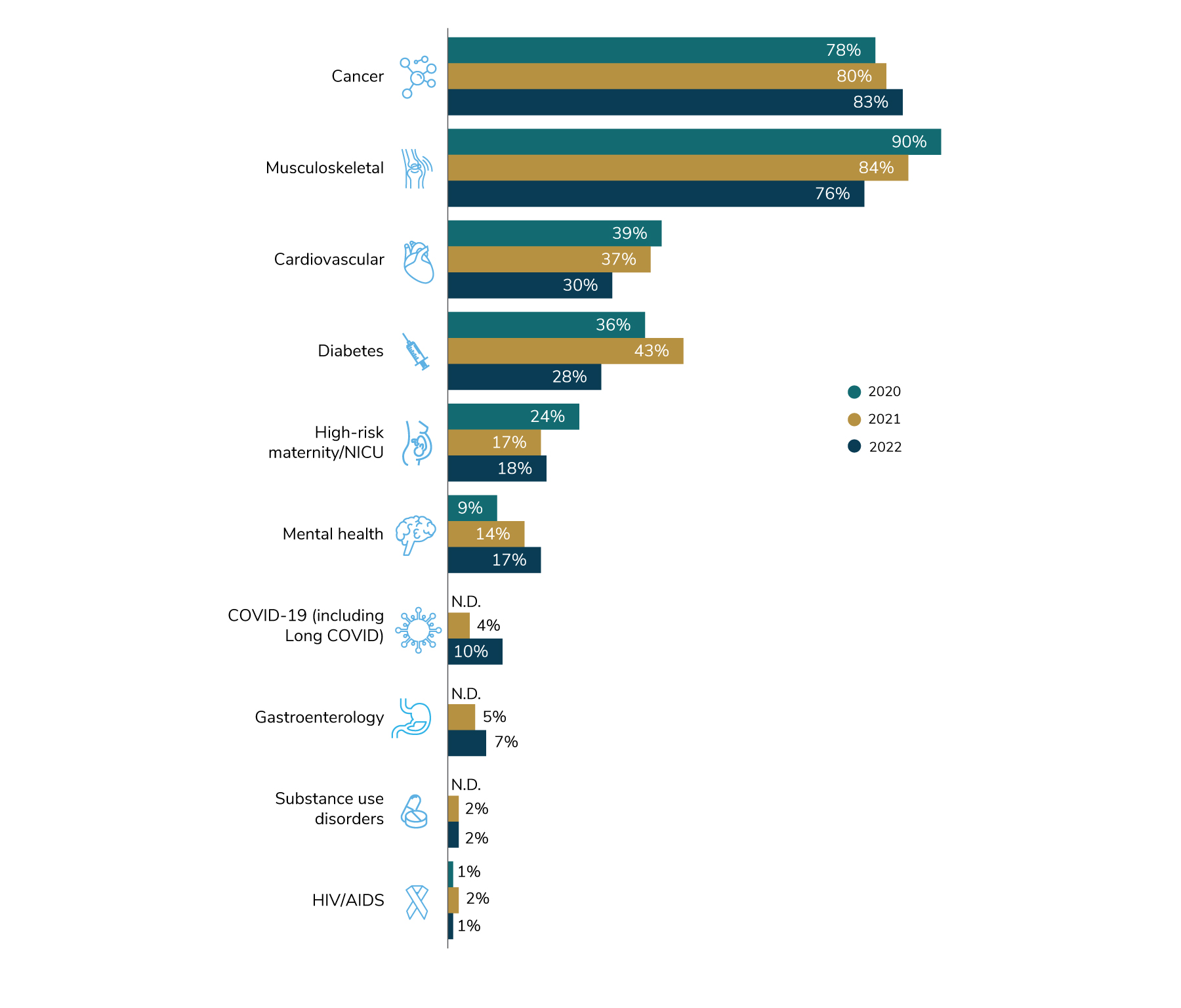

- Cancer is the costliest condition, a spot previously held by musculoskeletal conditions.

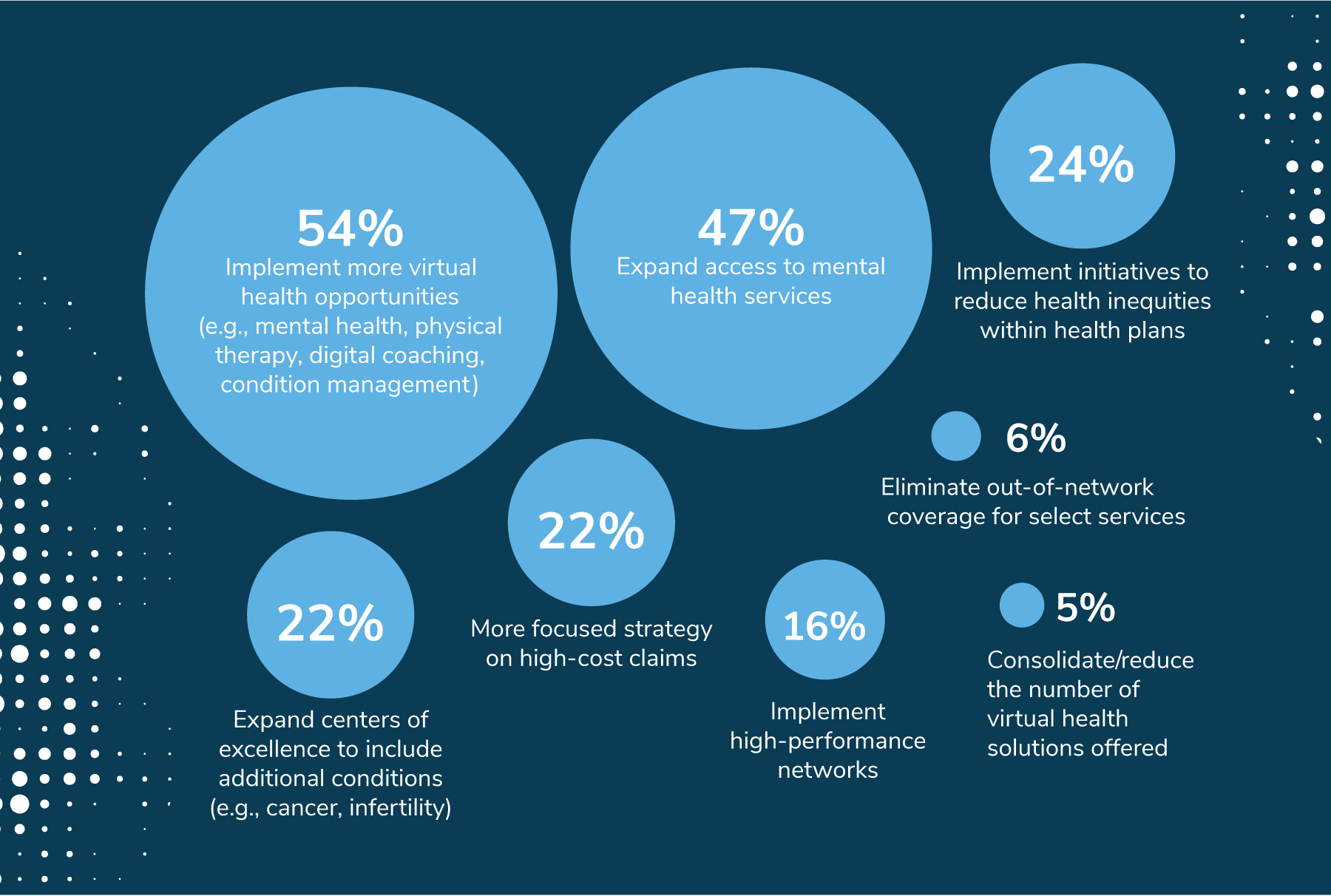

- Employers’ top priorities for 2023 include expanding their virtual solutions, increasing access to mental health services and implementing initiatives to reduce health inequities.

Health Care Trends for 2021 and 2022

After last year’s survey showed an unprecedented drop in health care cost trend, with employers reporting a median increase of 0% in 2020, expectations were uncertain for 2021. Many issues were unclear. Would deferred care rebound? Had chronic diseases and health conditions worsened? How would the pandemic-driven bottlenecks play out now that health care providers are back to normal operations? What would be the impacts of COVID-19 longer term?

In the summer of 2021, employers predicted a reassuring, but perhaps unrealistic, trend increase of 6% for the year, in line with pre-pandemic costs. Jump forward 1 year, and employers are seeing a different story play out. In 2021, actual health care trend was a median of 8.2%. This is the largest increase seen in the past 8 years. In 2022 and 2023, employers are expecting cost trend to stabilize somewhat, but at higher levels than the actual costs for the 2017-2021 period, with expectations of 5%-6% cost increase after plan design changes (Figure 5.1).

Employer and Employee Contributions See Slight Increases

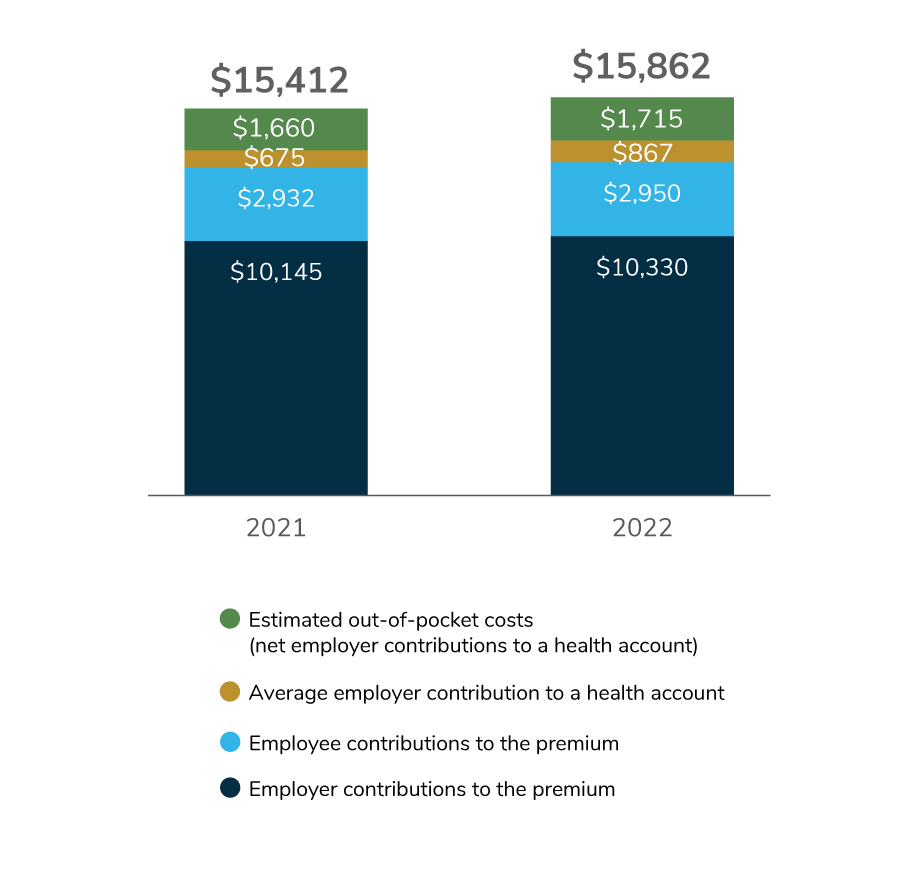

With the increase in health care cost trends, many may be asking how these increased costs are borne by employers and employees. Employers are estimating that the per capita health care cost (premiums + employer contributions to health accounts + employee out-of-pocket costs) will increase by $450 in 2022, from $15,412 in 2021 to $15,862.

Employers and their employees will absorb that $450 increase in different ways. Employees will pay negligibly more ($18) out of their paycheck for premiums while experiencing an increase in out-of-pocket costs ($55). Employers will absorb the majority of the $450 increase, expecting to contribute slightly more to the premium while increasing their contributions to health accounts.

With costs increasing between 2020 and 2021 for employers (Figure 5.1), why aren’t the costs being passed on to employees in 2022? While the cost share amounts in Figure 5.2 are an estimate of that year’s costs, it appears that employers are continuing to protect employees from significant health care cost increases by absorbing most of the higher premium costs and cushioning out-of-pocket costs through health account contributions. Affordability has long been top of mind for employers and will continue to be so despite the cost pressures they face from health care budgets.

Conditions that Drive Costs — Cancer Now Tops the List

One of the most impactful ways to drive down costs is to address specific conditions that expend dollars, either on an individual or aggregate basis. For several years, musculoskeletal conditions were the top conditions driving costs, according to employers that selected their top three most expensive condition groups. This year, cancer has taken the top spot.

Eighty-three percent of employers say that cancer is among their top three most costly conditions, followed by 76% for musculoskeletal care. Cardiovascular conditions and diabetes round out the top four, although they were not reported as commonly as in years past. Interestingly, other conditions are emerging as employers’ top three costly conditions for 2022, including mental health (17%) and COVID-19 (10%) (Figure 5.3).

Top Priorities for 2023

As employers look to 2023, their top priorities mirror those of the past. Again this year, the top health care initiative to expand or put in for the first time will be implementing more virtual health opportunities (54%), which agrees with findings depicted in the Health Care Delivery section. Following close behind, 47% will expand access to mental health services. Only 5% of employers will actively scale back on virtual solutions (Figure 5.4).

About a quarter of employers will implement initiatives to reduce health inequities within health plans. Interestingly, a strategy to address high-cost claims, a common top priority for cost-conscious employers, has fallen to the fourth spot. Given the cost and condition trends portrayed in this section, next year may tell a different story.

Part 5: Health Care Costs and 2023 Priorities

-

Introduction2023 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2023 Large Employers’ Health Care Strategy Survey: Full Report

-

Executive Summary2023 Large Employers’ Health Care Strategy Survey: Executive Summary

-

Chart Pack2023 Large Employers’ Health Care Strategy Survey: Chart Pack

-

InfographicInfographic: Managing Rising Health Care Costs in 2023

-

Part 12023 Large Employers’ Health Care Strategy Survey: Perspectives on the Evolving Health Care Landscape

-

Part 22023 Large Employers’ Health Care Strategy Survey: Health Equity

-

Part 32023 Large Employers’ Health Care Strategy Survey: The Health Care Delivery System

-

Part 42023 Large Employers’ Health Care Strategy Survey: Health and Pharmacy Plan Design

-

Part 52023 Large Employers’ Health Care Strategy Survey: Health Care Costs and 2023 Priorities

-

InfographicInfographic: Prescription Costs and Pharmacy Benefits

-

InfographicInfographic: Cancer - Improve Quality, Reduce Costs

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()