August 23, 2022

Looking for the latest data?

Check out our 2024 Large Employer Health Care Strategy Survey, released in August 2023.

Key Takeaways

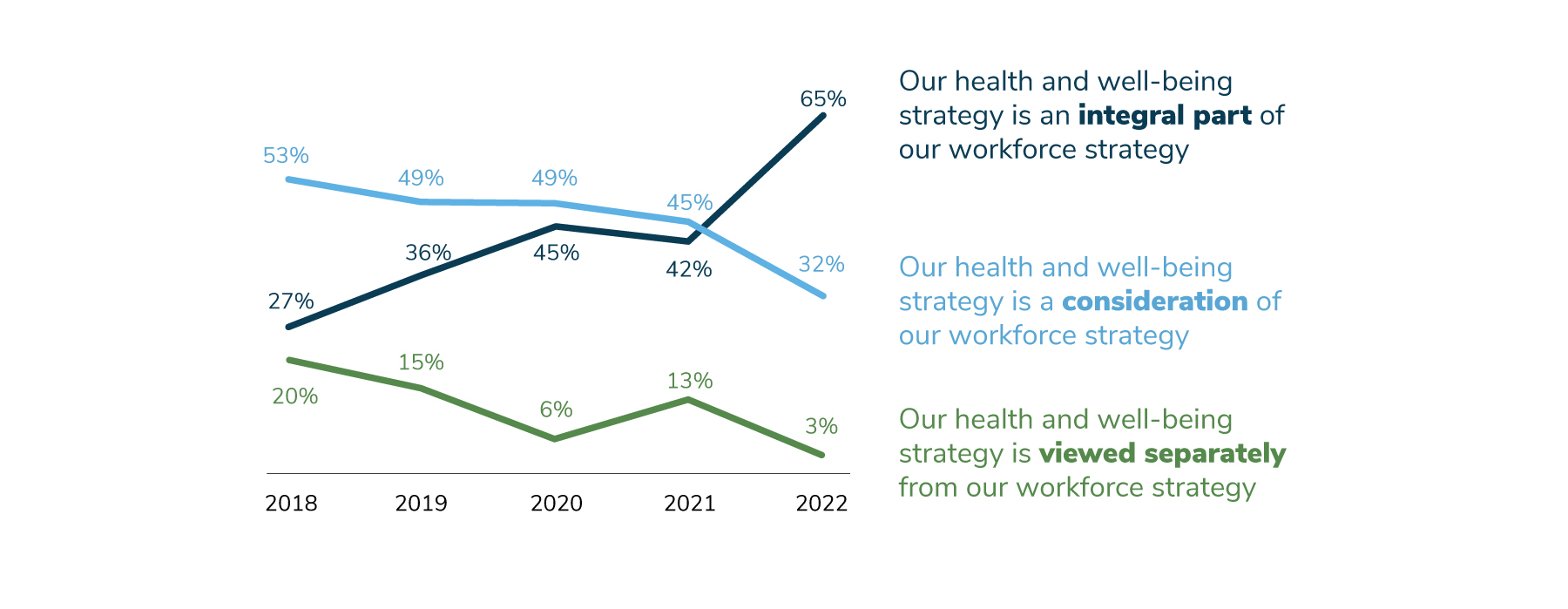

- The percent of employers that view health care strategy as an integral part of their workforce strategy rose from 45% last year to 65% in 2022, an increase that has been building for the last several years.

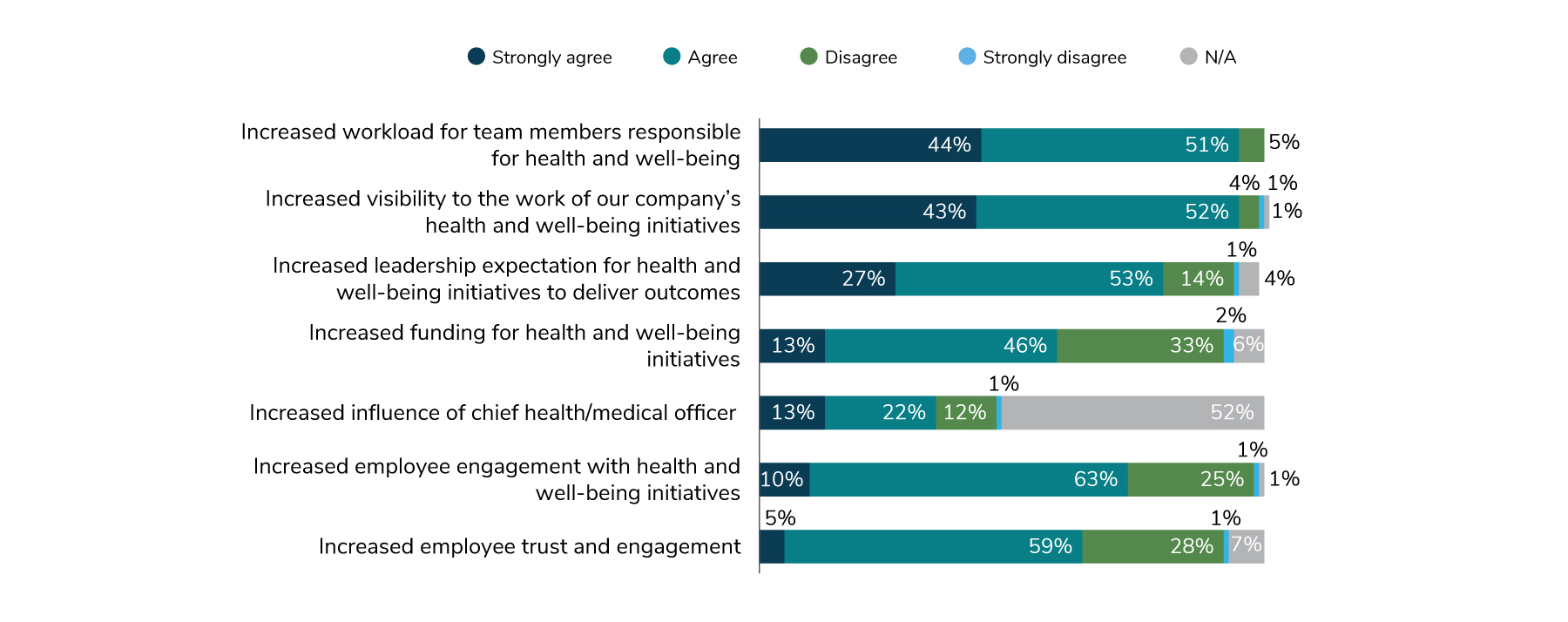

- The effects of COVID-19 are continuing to reverberate through the workplace. Employers have increased workload, visibility and responsibility.

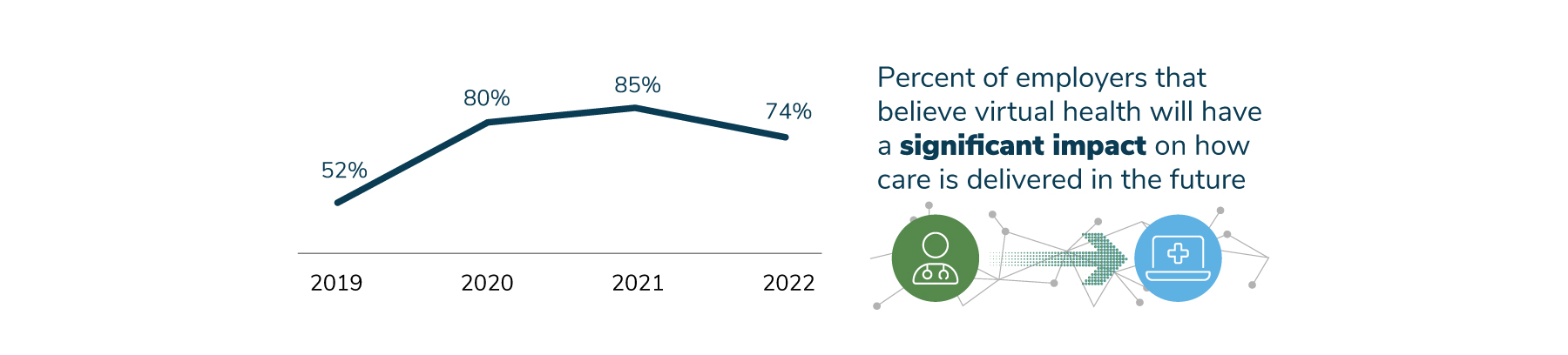

- Although employers still think that virtual health will have a significant impact on health care delivery, the number has declined, from 85% in 2021 to 74% in 2022. This percentage is still significantly higher than it was before the pandemic, when 52% of employers believed virtual health would have an impact.

Increasingly, employers are recognizing the vital role health care plays in their workforce strategy. This trend was accelerated by COVID-19, but it also had been building for several years, the result of the recognition that health care benefits are an effective way to attract and retain talent as well as promote business performance and culture. Virtual health continues to gain traction, yet employers express concern about the lack of coordination between in-person and virtual providers and the need to create an integrated experience for employees.

Emphasis on Health Care Strategy Continues to Grow

The trend of viewing health care strategy as an integral part of workforce strategy took a major leap forward, increasing from 45% in 2020 to 65% in 2022 (Figure 1.1). COVID-19 played a role in this significant increase, but it is also the culmination of factors such as the need to attract and retain talent through benefits and offerings, as well as supporting employees’ overall health and well-being and its impact on business performance and culture.

The greater organizational emphasis on health and well-being has impacted HR and Benefits teams. Looking at how COVID-19 affected HR and Benefits (Figure 1.2) provides a snapshot of the overall impact. Nearly all employers agree that their workload has increased, and their work has a higher profile than it did in years past. Most feel a higher expectation to deliver outcomes through health and well-being initiatives.

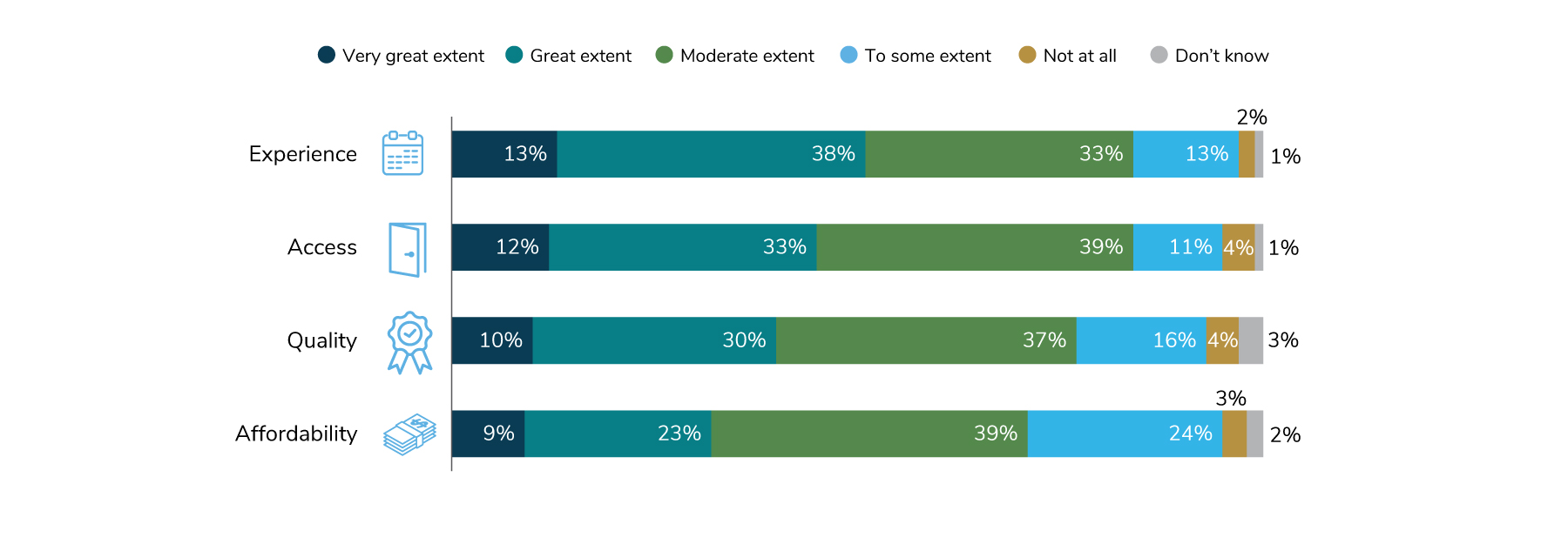

Employers see health care strategy as critical to their efforts to attract and retain talent as well as support business performance and organizational culture. This approach has contributed to higher-quality offerings, especially in the areas of the employee experience and access to these options. Cost, however, continues to be an issue, but considering inflation and other outside factors, employers are doing what they can to keep costs down (Figure 1.3).

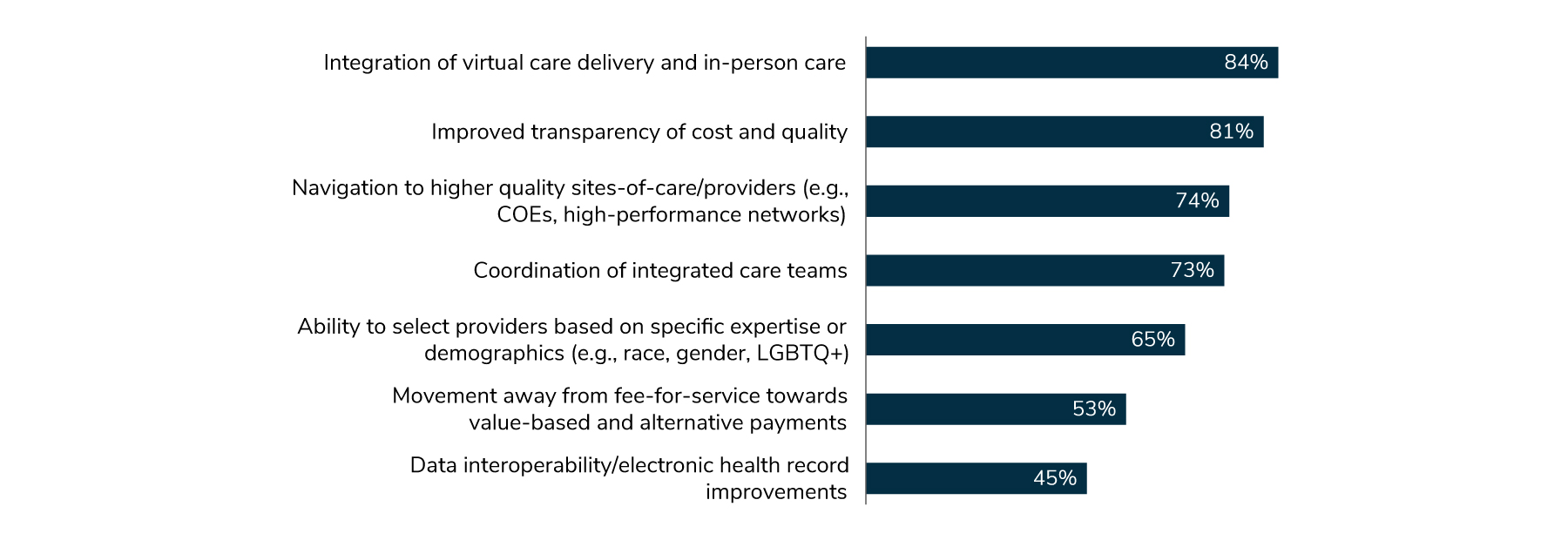

Similarly, employers have identified specific actions they can take to improve the quality of care. Eighty-four percent pointed to integration of virtual and in-person care as key, closely followed by transparency of cost and quality at 81% (Figure 1.4).

The Long-term Impact of COVID-19

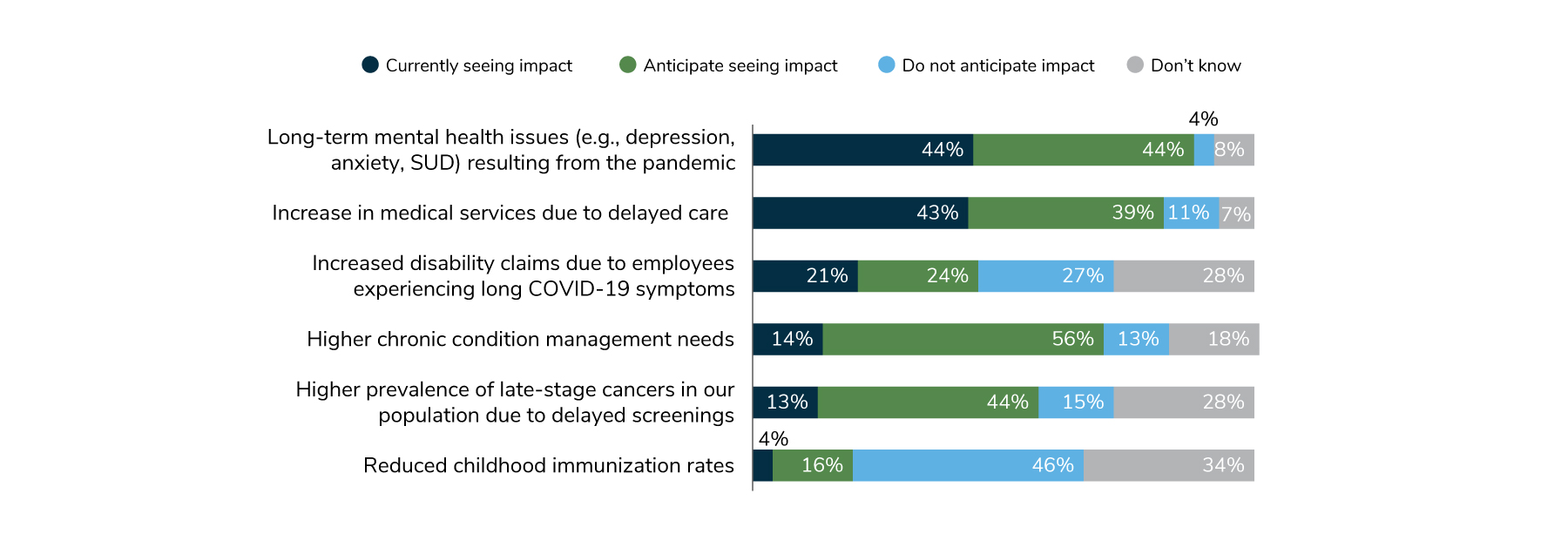

Last year, employers predicted that they would see rising medical costs and long-term mental health issues because of missed or delayed care during the pandemic. Those predictions have turned out to be correct. Forty-four percent of employers have already seen an increase in mental health issues such as depression and anxiety, and another 44% anticipate seeing an increase in the future. More broadly, 43% of employers have noted an increase in services due to delayed care, while 39% anticipate seeing a rise.

Some anticipated increases in care have not yet emerged, but employers expect to see those in the future. Higher chronic condition management needs and more late-stage cancer diagnoses fall into this category (Figure 1.5).

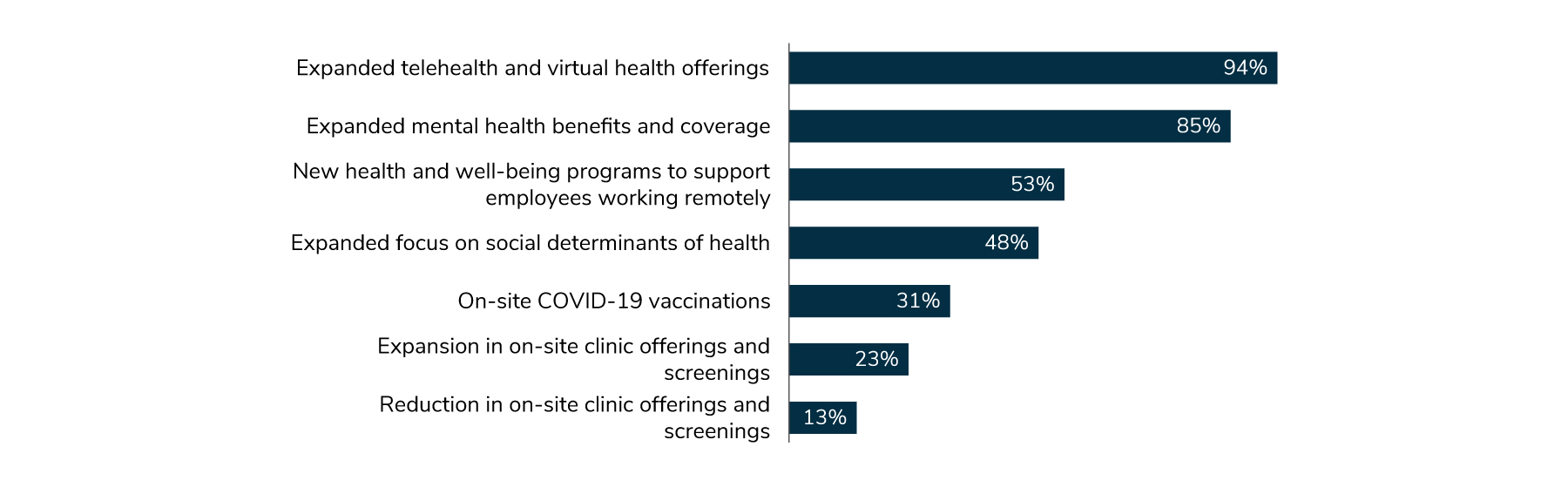

As a result of these anticipated increases in health care needs—and despite rising costs—employers have opted to keep many of the changes they implemented during the pandemic in place. Expanded telehealth and virtual health offerings, along with expanded mental health benefits and coverage, top the list, at 94% and 85%, respectively (Figure 1.6). In addition, these offerings have been well received by employees, another reason they are here to stay.

Evolving Views About Virtual Health

While virtual health offerings have many strengths, employers have become a bit more skeptical and measured about these options for a number of reasons, including lack of integration that can lead to a fragmented experience, unnecessary or duplicative care, potential for increased spending, and emerging concerns regarding quality and outcomes measures. Although 74% still think that virtual health will have a lasting impact on how care is delivered, this is an 11-point decline from last year’s 85%. Put in perspective, however, this is still a robust increase from 2019, before the pandemic, when only 52% of employers thought that virtual health was going to be a significant component in the health care landscape (Figure 1.7).

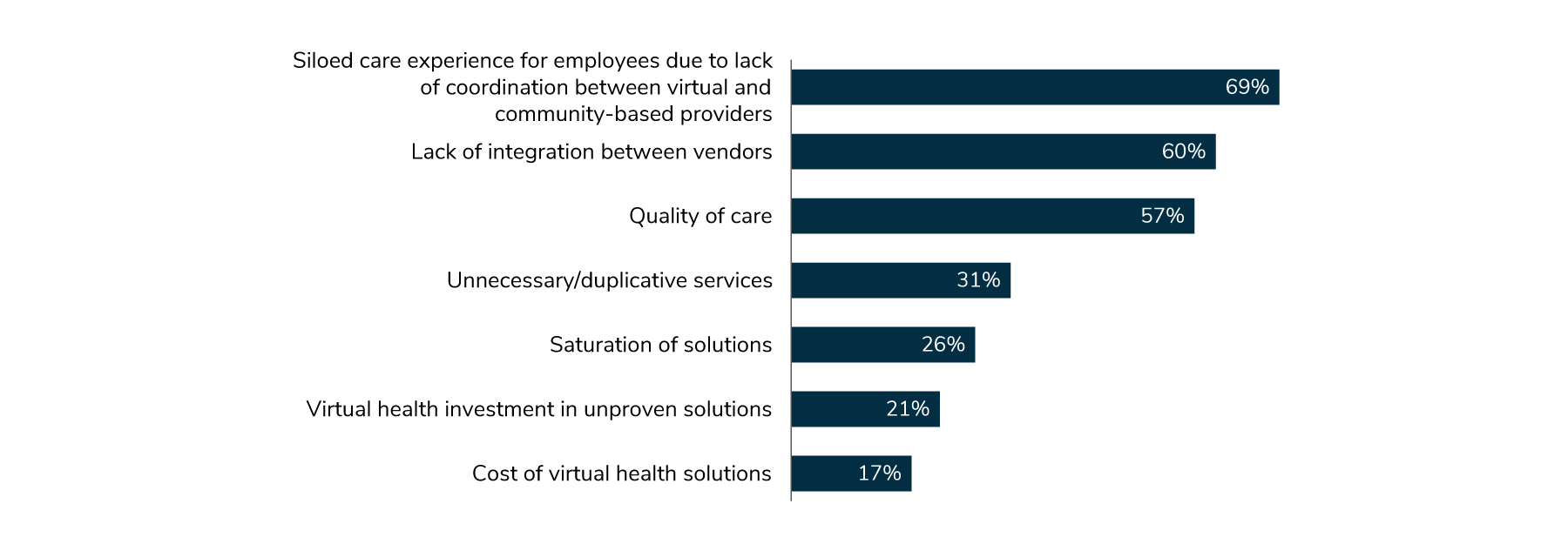

Much of employers’ concern is on the kind of experience virtual health offers; it is often isolated or independent from the care employees are receiving in the community via their traditional brick-and-mortar providers. Sixty-nine percent of employers view lack of coordination between virtual and community-based care as the top concern about virtual health, and 60% see lack of integration between vendors as a significant problem (Figure 1.8).

Yet despite these concerns, employers and employees alike embrace the positive aspects brought forth via virtual health solutions, including improved access and experience. As such, employers plan to retain many virtual health offerings implemented during the pandemic and may look to add select additional virtual health solutions in the coming years.

Approach to Delivery Reform

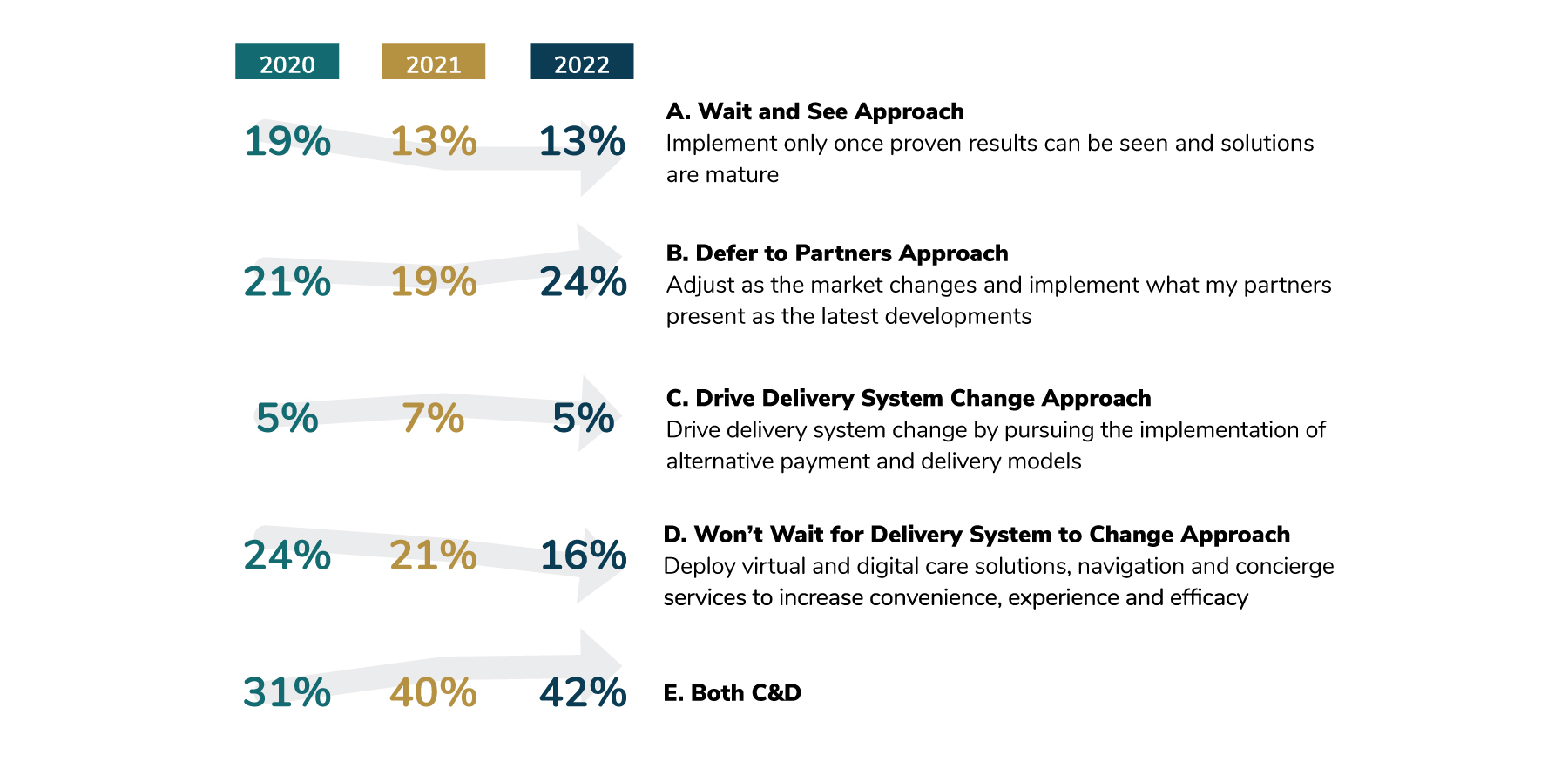

In past years, employers have been ready and willing to implement reform approaches like bringing in virtual and digital care solutions, navigator and concierge services, value-based payment adoption, alternative delivery models or a combination of all of these approaches. While a total of 63% will continue to pursue those efforts, there is a slight uptick this year in employers relying on their partners: 24% in 2022 vs. 19% in 2021 (Figure 1.9).

Essentially, this indicates that employers continue to pursue many paths related to delivery transformation. A multipronged approach remains critical as more employers drive these efforts, and thus, look to their partners for support. On this last point, it should be noted that employers aren’t passively dependent on their partners; rather, they are increasingly expecting and demanding that their partners deliver and innovate on their behalf.

Policy Perspectives

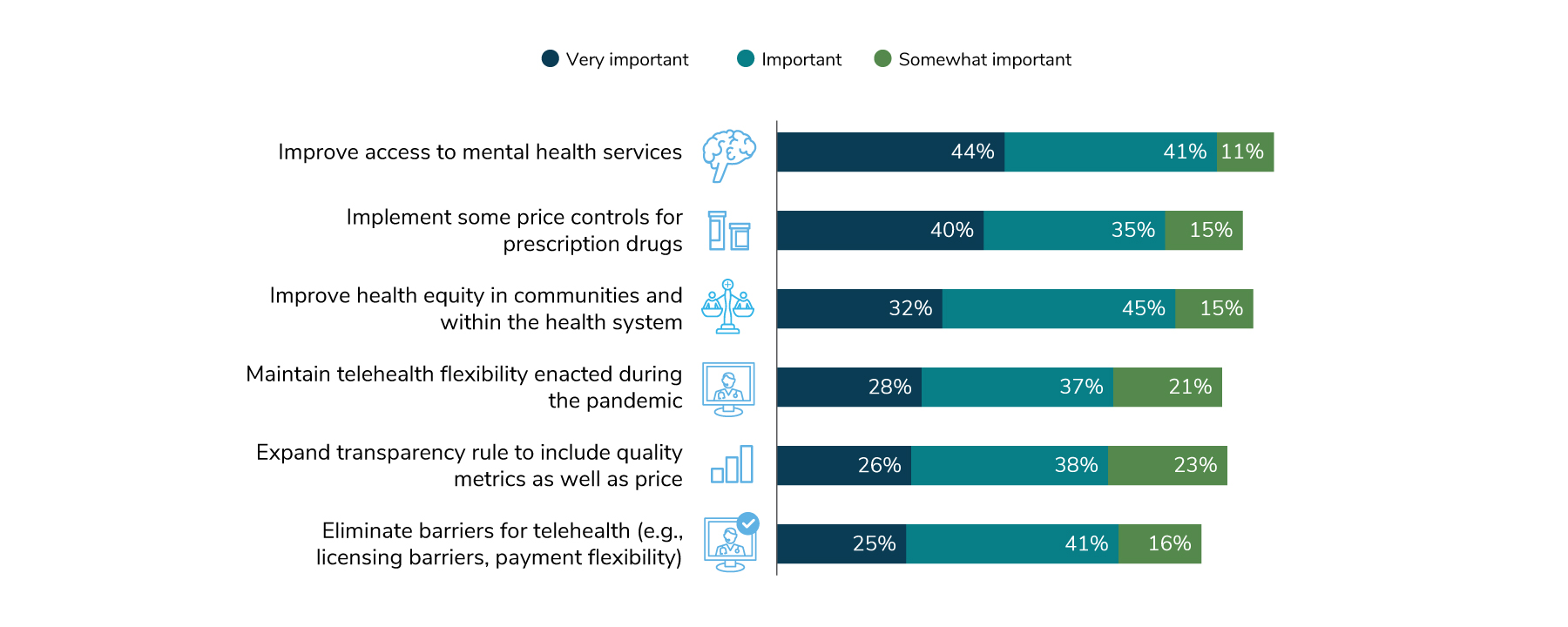

Employers’ legislative policy goals this year focused on two areas: improving access to mental health services (44%) and implementing more price controls for prescription drugs (40%). Improving health equity in communities and within the health system follows at 32%, with the remaining options clustering at about 25% (Figure 1.10).

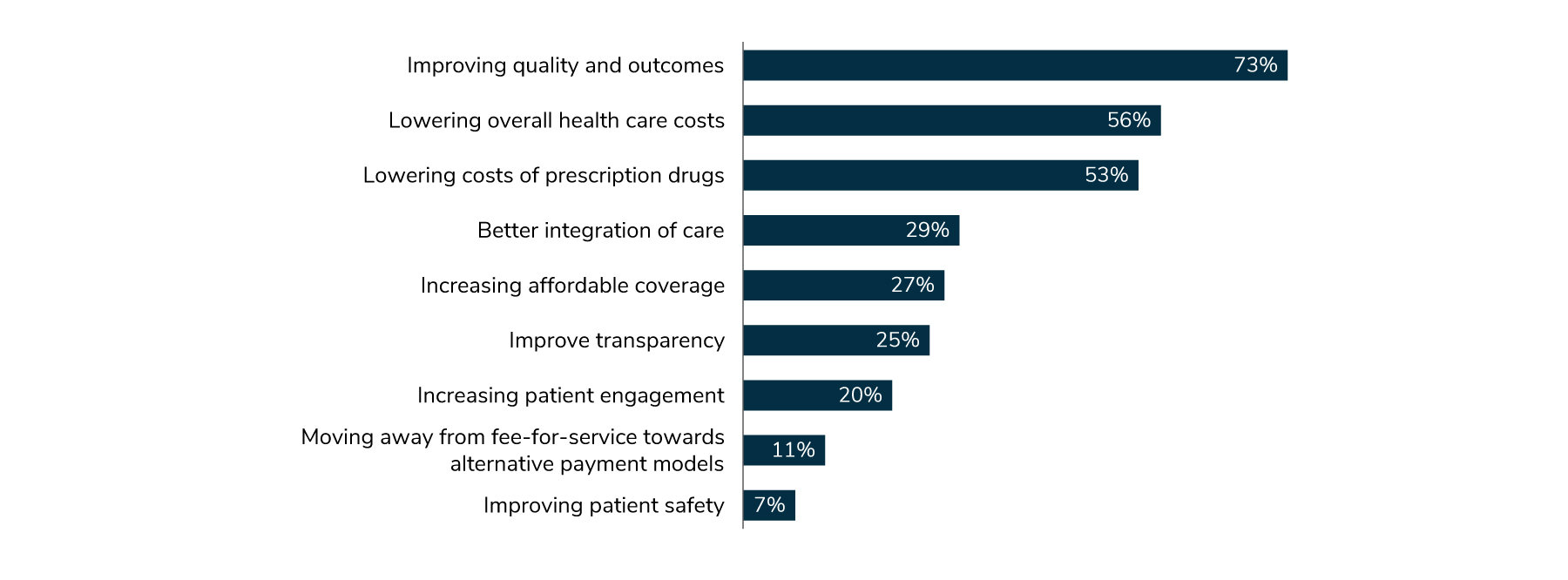

Whereas in 2021, lowering cost was employers’ top overall policy objective (69%), followed by improving quality (65%), in 2022, quality rose above cost: 73% vs. 56%. Lowering the cost of prescription drugs took the third slot at 53% (Figure 1.11). A possible explanation for this decline is that employers may think that lowering prescription drug costs will go a long way toward lowering the overall cost of health care and are opting to work on that area this year. It is interesting to note that although improving transparency is a major federal initiative, only 25% of employers considered it a priority.

Part 1: Perspectives on the Evolving Health Care Landscape

-

Introduction2023 Large Employers’ Health Care Strategy and Plan Design Survey

-

Full Report2023 Large Employers’ Health Care Strategy Survey: Full Report

-

Executive Summary2023 Large Employers’ Health Care Strategy Survey: Executive Summary

-

Chart Pack2023 Large Employers’ Health Care Strategy Survey: Chart Pack

-

InfographicInfographic: Managing Rising Health Care Costs in 2023

-

Part 12023 Large Employers’ Health Care Strategy Survey: Perspectives on the Evolving Health Care Landscape

-

Part 22023 Large Employers’ Health Care Strategy Survey: Health Equity

-

Part 32023 Large Employers’ Health Care Strategy Survey: The Health Care Delivery System

-

Part 42023 Large Employers’ Health Care Strategy Survey: Health and Pharmacy Plan Design

-

Part 52023 Large Employers’ Health Care Strategy Survey: Health Care Costs and 2023 Priorities

-

InfographicInfographic: Prescription Costs and Pharmacy Benefits

-

InfographicInfographic: Cancer - Improve Quality, Reduce Costs

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()