December 08, 2022

‘Lifestyle spending accounts’ (LSAs) are emerging as a benefit to support employee well-being by providing coverage for a range of eligible expenses, from fitness equipment and classes to budget tracking apps and tax preparation services to pet care services and more. These fixed-amount, post-tax accounts for non-medical expenses offer choice, versatility and flexibility for both employers and employees.

On December 8, 2022, Business Group on Health convened an employer-only benchmarking call to provide an open forum for members to pose questions and hear from those already implementing LSAs. The conversation covered the topics listed below.

Implementation

Implementation

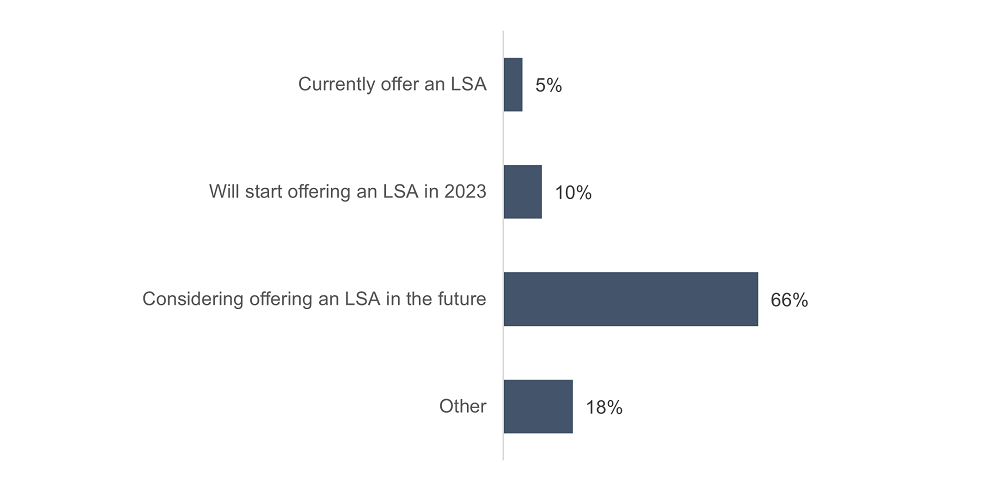

Interest in LSAs has grown in recent years, both in terms of consideration and offerings by large employers. According to a poll of attendees, 5% of respondents indicated that they currently offer an LSA and another 10% stated they will start offering one in 2023 (Figure 1). Poll results also revealed that roughly two out of three respondents who don’t currently offer an LSA to employees are considering doing so in the near future (Figure 1).

Benefit Structure

Benefit Structure

Generally, employers with LSAs shared they provide between $500 and $1,250 to an employee’s LSA every year. The LSAs are paid out to employees in a reimbursement model, or in some cases, seeded upfront. Most employers engage a vendor partner to help manage and administer LSAs. Typically, LSAs are extended to employees only, although some employers may offer this benefit to an employee’s spouse/partner. Among those employers who stated they offer an LSA, most shared that employees do not have to be enrolled in the health plan to be eligible for the funds. Offering an LSA to all employees, regardless of medical plan enrollment, has helped some employers create more equity among enrolled and non-enrolled participants. The benefit can also be extended to both full-time and part-time employees.

- Funding an LSA benefit: One employer that offers $500 in LSA seed money reduced its traditional wellness incentive amount from $500 to $400 to redirect program funding to the newly implemented LSA benefit. This employer also moved funds from a COVID-19 funding program to the LSA.

- Vendor consolidation opportunities: Several employers shared that they did not remove any other benefits when creating their LSAs. Still, some employers also floated the idea that LSAs could consolidate their plethora of well-being vendors/point solution offerings.

Global Implications

Global Implications

Employers acknowledged various challenges when it comes to offering LSAs to a global employee base and provided insights on how to be successful.

- One employer with an LSA shared that its success among U.S. populations has attracted interest from other countries (e.g., Canada), which is considering implementing a similar LSA benefit.

- Tax implications: One employer indicated that in some countries where its employees are located, LSAs are offered on a non-tax basis.

- Global LSA offering: One employer, who has had an LSA in place in the U.S. for the past 6 years, is now offering a global LSA program through the same vendor. This employer shared that the global LSA offers about €600 or less depending on the region/country. Other employers offering a global LSA have noted that they adjust the seed amount based on cost of living and other factors in each region to ensure that the benefit is equitable across their global populations.

Eligible Expenses

Eligible Expenses

A key component of designing an LSA is the selection of the list of eligible expenses. In general, employers seek to be flexible yet thoughtful in their decision-making approach in developing a list of eligible expenses.

- Organized list: One employer on the call categorized its list of eligible items into the following pillars of well-being: Physical, financial, social and emotional. This employer noted that its company’s list is not static, but rather a fluid list that can be updated based on employee feedback. For example, travel expenses were included as an eligible expense; after receiving employee feedback, that category was expanded to include additional areas of travel costs as well.

- Fitness equipment: A few employers on the call mentioned that fitness was the top spend category for their LSAs. Claims included health apps, fitness programs and apps, fitness tracker and gym memberships.

- Experiential events: One employer’s LSA covers experiential events such as concerts and sporting events.

- Other expenses to consider: Other expenses mentioned on the call include those that support hybrid work (e.g., standing desks), work/life balance (e.g., housecleaning services), internet expenses, mobile apps and streaming services, and pet care services.

Engagement and Experience

Engagement and Experience

Ensuring a good end-user experience is top of mind for employers that offer, or are considering offering, an LSA to their employees. Fueling this is the choice and flexibility that LSAs allow and their far-reaching impact on a large portion of employee populations.

- Expanding participation: Employers on the call who currently offer an LSA have seen high employee participation. One employer indicated that its company budgeted for 70% engagement but expects to exceed that number in the first year. Another employer noted that 85% of its employee population registered for the benefit and 60% requested the full reimbursement amount within the plan year. Two employers also revealed that relative to the current wellness incentive programs available through their medical plans, LSAs have amassed increased levels of overall employee enrollment.

- Benefit communications: Employers considering LSAs are cognizant of how important it is to gather employee feedback and be proactive with communications regarding any benefit changes/future strategies.

Outlook

When considering the perspectives discussed throughout this benchmarking call, it appears that LSAs hold potential for supporting employees’ well-being journey in a flexible way. As employers continue to develop plans to implement LSAs, it may prove vital for HR/Benefits leaders to attain leadership support for long-term program success. Moreover, it will be important for employers to remain mindful and purposeful with any changes made, ensuring proper benefit communications and keeping the employee perspective top of mind.

More Topics

Culture and Strategy

This content is for members only. Already a member?

Login

![]()