May 13, 2022

Global Broker

Types of broker relationships

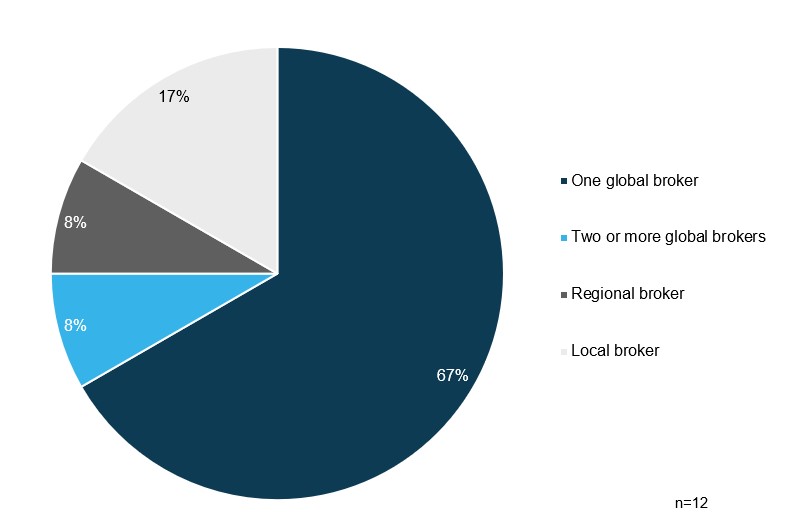

A poll found that 67% of employers have a single global broker, while other companies have different relationships, including multiple global brokers, regional brokers and local brokers (Figure 1).

- Global brokers have been a support system for employers throughout the pandemic, assisting them in auditing their benefits, identifying gaps in medical and disability/life insurance plans, sharing recommendations and working with insurance companies to close these gaps.

- Employers have also faced challenges with their global brokers. Several companies highlighted issues with their global brokers’ abilities to administer consistent services and experiences across the globe, especially in smaller country markets. Language and reporting reliability continues to be an issue as well.

- One company has found success with setting up two different broker relationships, one to handle the general business on a global scale and the other to focus solely on the captive side.

Captives

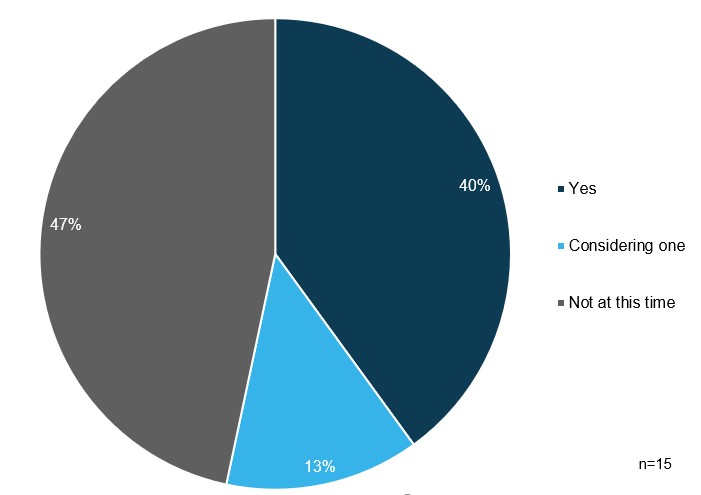

According to a poll, 40% of participating employers utilize a captive (an employer’s self-funded insurance program that provides its own coverage), and another 13% are considering one (Figure 2).

- One company has found that utilizing a captive has allowed for much more flexibility when implementing a global minimum standard strategy. Without the captive, the employer may not have enough options in the market to implement all its prioritized minimum standards.

- The Business Group’s Strategic and Effective Global Broker Partnership article delves deeper into the process of developing and utilizing the strategic relationship with global brokers. For more information on employers’ use of captives for global employee benefits, please review Utilizing Financing Mechanisms to Implement a Global Consistency Strategy.

Minimum Standards

Global minimum core benefits

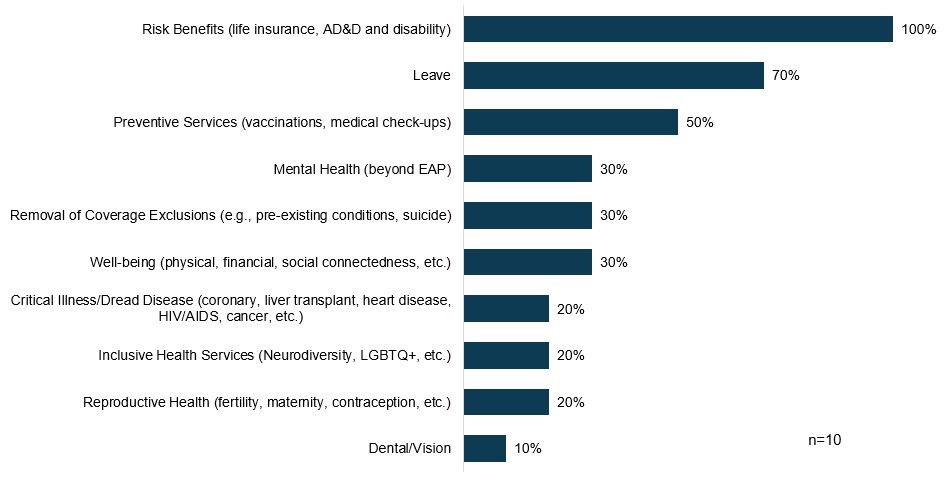

Conversation participants were polled on the minimum core benefits already incorporated into their strategy (Figure 3). The three most common were risk benefits, leave and preventive services. Employers include 1 to 7 different benefits in their minimum standards ranges, with 3.8 benefit types being the average.

- Companies with larger numbers of minimum standards have been working in this space for several years.

- One employer noted that when forming a global consistency strategy, the company takes a strategic approach and identifies one pillar at a time (e.g., health, family-friendly, finance, leave, etc.), identifying where it can enhance each benefit and establish the standards the company would like to see. The ultimate goal is to take a stand within each bucket to provide the most attractive benefits to employees regardless of their geographic location.

- For benefits that might create legal issues in some countries (such as transgender benefits), one company has classified each location into waves to prioritize the rollout process.

- Several employers are looking to prioritize mental health for minimum standards in the future. Beyond Employee Assistance Programs (EAPs), employers can partner with vendors who are able to provide greater language capabilities and local services. One company recently rolled out on-site mental health counselors in the Asia Pacific (APAC) region and has received positive feedback despite perceived stigma concerns, especially in an office setting.

- One company with smaller employee populations spread across the globe is working to build a case for a more comprehensive and united global benefits strategy. Other employers offered two valuable pieces of advice for this process:

- Look at the global benefits strategy and minimum standards through the lens of improving the overall employee experience; and

- Utilize a global broker as a way to help to bolster a company’s global consistency strategy development.

- Minimum core benefits, or global consistency, continues to be a top priority for global employers, and is the underlying theme woven into all of the sessions in our 2022 Global Summit: Breaking Down Borders, on June 8-9, 2022.

Global Administration Challenges

Vendor solutions

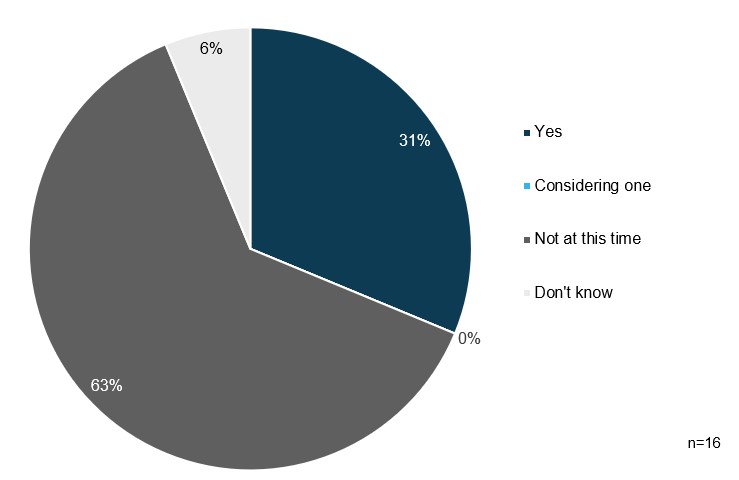

A poll found that only 31% of companies are currently using a vendor solution to manage administration of their global benefits (Figure 4).

- Employers identified several challenges with using such a solution, including fewer options for data integration, lower value in relation to cost and lack of provider options.

- Some companies are in the process of considering options for HR and payroll administration systems that could apply globally.

- Highlighted vendors included Darwin, TBS and Workday.

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()