January 09, 2020

There are many options when determining your purchasing strategy for health and benefit programs. Determining the right solution will depend on your company’s goals & objectives, size & complexity.

Sometimes companies evolve their solutions. Using one initially and then overtime migrating to another. Other companies may choose one implement a couple of these solutions simultaneously targeted at different needs.

By choosing the right one for your company you can balance risk, optimize cost for value, address gaps, and increase data transparency

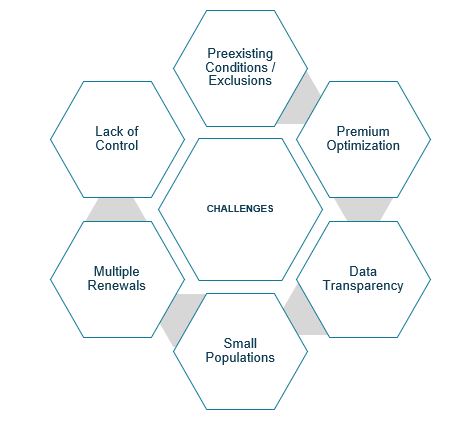

Common Challenges & Purchasing Alternatives

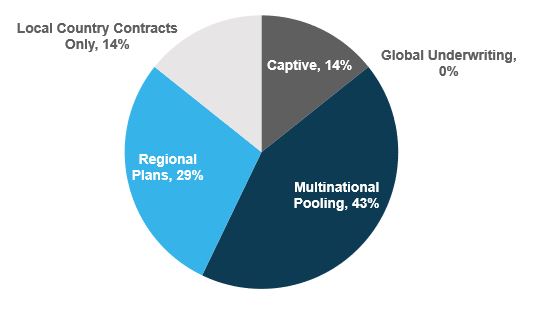

Multiple countries, volumes of policies. To help address the many challenges companies are increasingly exploring purchasing alternatives. Pooling and Captives have long been fundamental purchasing strategy considerations by benefit professionals. Recently Global Underwriting and Regional Plans have been growing in member interest.

Global Underwriting & Regional Plans

Pooling and Captives have long been fundamental purchasing strategy considerations by benefit professionals. Recently Global Underwriting and Regional Plans have been growing in member interest. This summary will discuss these two alternatives and how member companies are thinking about them.

Why a Regional Umbrella Plan?

- Companies with small employee headcount in certain countries have greater risk finding insurance policies

- Companies experience high annual premium increases

- Exclusions and limits on coverage

Example Employer Experience

- 50%+ of countries with fewer than 100 employees, ~40% fewer than 20 employees.

- Premium increases in some countries in excess of 200% due to low population

- Considered Global Underwriting – But didn’t want to lose pooling dividends

- Considered offering employees cash instead of medical coverage - But that did not align with the company’s equity effort or talent strategy (war for talent highlights importance of benefits)

- Decided on regional plan - success with its Middle East regional plan (included a number of African markets)

What is the Regional Umbrella Plan?

Advantages

- Regional plan allows the company to have one policy for all in scope smaller populations (multiple riders may apply)

- Creates stability

- Able to provide coverage for services that may otherwise be excluded - alignment with any minimum core benefits strategy

Design

- Some companies have found a regional plan to be akin to a high-end expat-style plan – which can impact cost

- When designing consider how it compares to existing country design. One company decided design had to ensure coverage was equal to or greater than current local coverage

Other Considerations

- Depending on insurer selected product will be licensed in a particular country. For one company, this was licensed by expat health plan insurer in the U.K.

- When developing this strategy, companies often work with their global broker and/or insurers such as those who offer expat plans

Process & Implementation

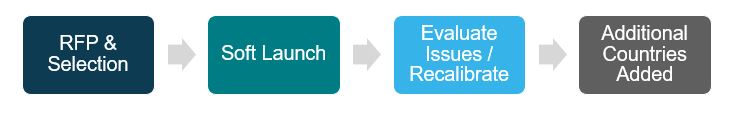

The process may look different by company. One example of an approach is:

The company experienced pushback from local business on the transition. Vendor partner did not follow company procedures. Company ensured future rollouts would follow company’s process & had further discussions with locals on timing.

As countries are added, consider harmonizing the renewal cycle. The company moved policies to a January cycle as they were added (some contracts were for 14+ months for the transition year)

Implementation Considerations

Evaluation

- Admitted versus non – admitted. Regulatory analysis may need to be done to see which markets allow the regional plan (i.e., admitted). For one company 60% were admitted and 40% were non-admitted. Companies should vet the non-admitted countries for risk/ exposure

- Determine which countries may be excluded due to regulatory challenges

Communication

- Lack of communication with local leaders ahead of benefit rollout. They learned when everyone else did. Getting local leader buy-in is critical to success.

- Communications and plan details were not localized or available in local language.

Logistics

- ID cards may come from one country. The international mailing can delay when employees receive them.

Tax Implications

- Make sure to consider tax implications where benefits are considered in-kind.

Cost Sharing

- With some arrangements, employees may be reimbursed out of the country where the plan is licensed (i.e., U.K.) and may be charged for international currency transfers

Premium Cost

- Underwriting Estimates Versus Actual Enrollment Numbers: To quote the premium the insurer will underwrite based on an assumption of headcount. If following implementation, actual enrollment numbers are significantly lower than what was anticipated, this can impact premium costs

- For some countries premiums can significantly increase (one employer experienced a doubling of premium in one country). Often this is due to the enhanced design, so businesses may see value for an increase

Why a Global Underwriting Arrangement?

For companies with a presence in multiple countries they often are managing a high volume of policies requiring regional negotiations for renewals/ remarketing. With limited internal resources to support this can become burdensome

Employer Example Experience

- For one employer they turned to a Global Underwriting Arrangement for the following objectives:

- Streamline negotiation process to address limited internal resources

- Save money with a new solution,

- Improve oversight for global centralized management, and

- Improved data via one global report with individual country data

- Considered captive but felt too many unknowns/ risk exposure

Advantages

- Allows the company works with one global vendor to facilitate coverage locally in as many markets

- Renewal frequency can reduce to every 2 to 3 years

- Can cover risk benefits such as life, disability and medical. For one company in particular the main focus is life and disability with only some medical plans intended to be included

- The global insurer is responsible for finding a local provider where there are gaps in coverage

- Company receives one global, standardized report with individual country data to provide better transparency over the company’s benefit spend globally

Other Considerations

- Insurers often have a minimum premium requirement for this arrangement

- Fee structure - one company is pursuing a cost plus fee model given the volume of premium to a single insurer which far exceeded the insurers minimum premium

- Consider how rates may change, given experience and no longer bidding competitively in remarketing

- Consider service level differences. Will plan designs be different?

- Local/ regional concerns – some regional colleagues have concerns regarding local impact

Global Underwriting Implementation Considerations

- Stakeholder Engagement

- Engage regional and global stakeholders early to ensure alignment and more successful transition

- When conducting an RFP for an GU insurer, determine selection criteria. Some include:

- Price

- Number of direct relationships in countries

- Ability to clone existing plans without changes

- Reviewing local provider experience

- Transition can take multiple years

- One company estimates a 3 year transition.

- One approach is that as contracts expire, they roll over to new global underwriting arrangement with a January 1 renewal

- Determine Exceptions criteria for opting out (One company decided on a case-by-case basis evaluation)

- Evaluate any open claims and how they will be addressed when transitioning

Summary

There are many options when determining your purchasing strategy for health and benefit programs.

Determining the right solution will depend on your company’s goals & objectives, size & complexity.

Sometimes companies evolve their solutions. Using one initially and then overtime migrating to another. Other companies may choose one implement a couple of these solutions simultaneously targeted at different needs.

By choosing the right one for your company you can balance risk, optimize cost for value, address gaps, and increase data transparency.

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()