May 29, 2024

Introduction

Employers have gained tremendous ground in supporting employees’ well-being. When Business Group on Health and Fidelity began surveying employers on their efforts 15 years ago, the top initiatives were limited to tobacco cessation, employee assistance programs (EAPs), flu shots and nurse lines. Fast forward to 2024 and it is clear that employers have expanded their definition of well-being beyond physical health to include an array of initiatives spanning mental, financial, social and community well-being as well as job satisfaction and purpose in life.

Based on the strategies of 160 employers, the 15th Annual Employer-Sponsored Health and Well-being Survey explores the changes within employer well-being offerings and provides insights on the direction employers will be taking with their well-being investments over the next 3-5 years.

The following seven insights were gleaned from the survey that was conducted in January-February 2024.

1. Employers have entered a period of assessment and scrutiny as they revisit approaches.

In numerous areas of well-being, the survey found little change between 2023 and 2024 in both employers’ overall strategy and individual initiatives. This suggests employers’ continued prioritization of employee well-being within their workforce strategy. However, it’s important to reflect on the ongoing macroeconomic, cost and affordability pressures that employers face; for some, it may limit their ability to further expand well-being offerings.

In addition, in 2023, after years of adding a variety of well-being resources to their portfolios, employers may have reached a plateau; in 2024, many are assessing the effectiveness of those programs. This is consistent with two main trends: 1) the Business Group’s prediction in its Trends to Watch in 2024, which forecast that employers will begin to place heightened expectations on their partners to deliver and 2) an emerging theme of benefits optimization to improve the employee experience.

The survey results give an impression of how this may play out for employers and their partners. For example, employers may be looking to streamline and rationalize the number of vendor partners, seeking more comprehensive and holistic offerings—for instance, newer EAP models that go beyond the traditional referral engine—to fill roles previously assumed by multiple point solutions. As seen in Figure 1, newer EAPs are on the rise amid declines in siloed well-being initiatives. Employers pursuing this approach appear to be prioritizing programs that deliver outcomes, simplify the benefits experience for employees and optimize the benefits portfolio.

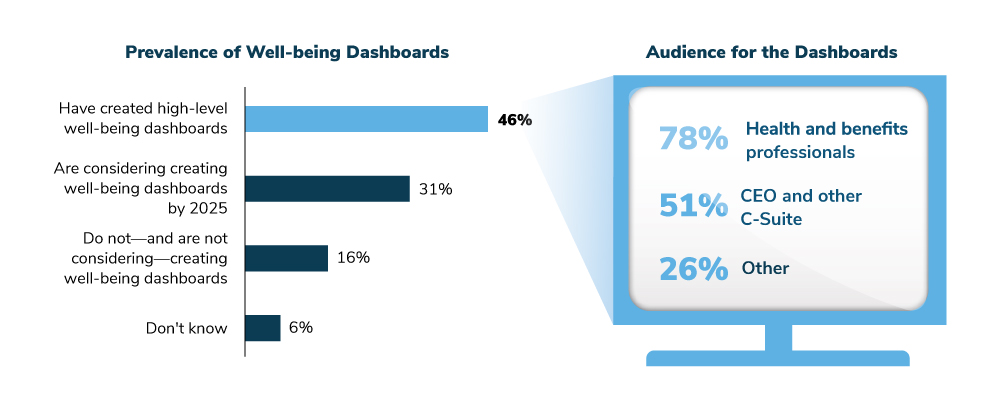

Many employers are approaching this period of assessment using data. Figure 2 shows that nearly four in five employers either have a well-being dashboard or are working to create one by 2025. These dashboards can be monumental in showing if well-being is improving and correspondingly, where vendor programs are succeeding or failing to provide value. Participation rates and employee outcomes are the main focus of these tools, which are commonly shared with other internal health and benefits professionals and with the C-Suite.

2. Employer dollars invested in well-being continue at the same level.

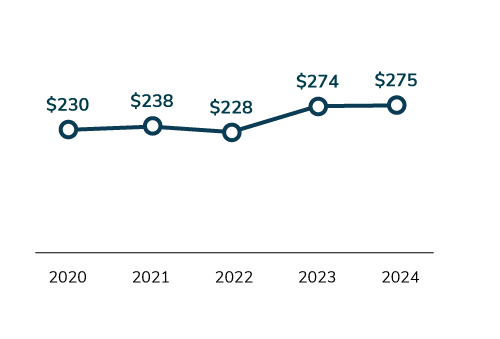

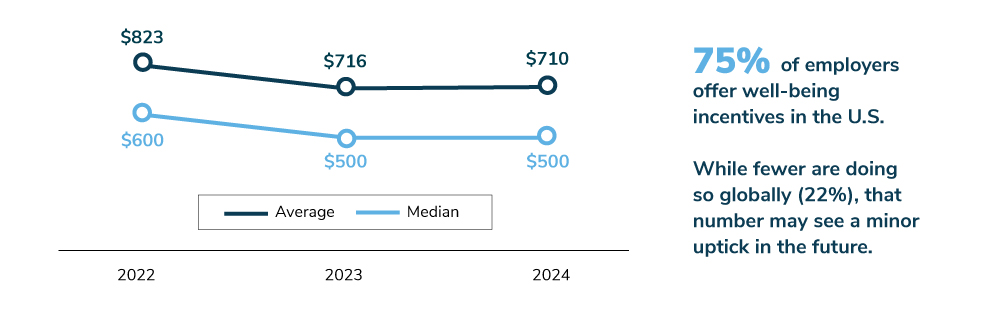

The average amount employers budgeted for well-being did not fundamentally change between 2023 and 2024 when viewed on a per employee basis (Figure 3). Additionally, for the 75% of employers that provide incentives for well-being activities in 2024, the amounts will also stay consistent from the prior year. Beyond 2024, a majority of employers plan to either maintain or expand their incentive amounts (Figure 4).

The stable level of employer investment in well-being may well be the function of two competing realities. Employers have viewed—and continue to view—these initiatives as vital to workplace health and well-being and count them as a key aspect of their overall workforce strategy. However, as health care costs continue to climb, employers must devote resources to medical and pharmacy expenditures; balancing these realities necessitates a maintenance, not expansion, of well-being budgets.

3. Global employers press forward with key priority areas.

While employers in the U.S. are maintaining well-being programs in 2024, global well-being strategies are making incremental gains in key priority areas. Responding to the critical need to reduce employee health risks, increase engagement and reduce costs, employers are looking to key areas such as striving for consistency in offerings between countries/regions and expanding mental health supports with counseling and newer forms of EAPs.

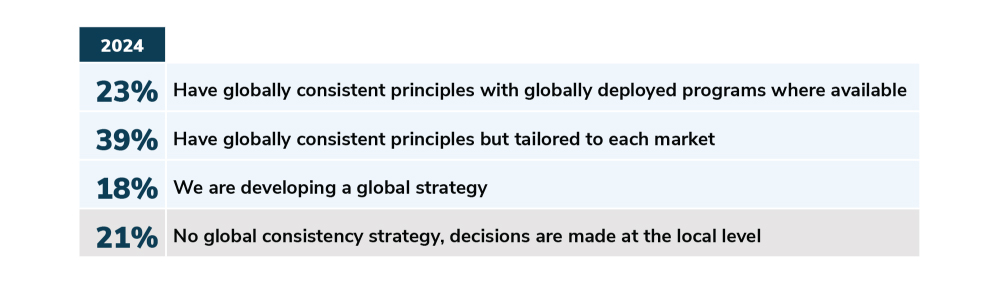

Zeroing in on global consistency, Figure 5 depicts the gain in support from employers. Seventy-nine percent of global employers either have a global consistency approach for well-being or are developing one. However, it’s important to recognize that implementation of a global consistency approach will differ by company, with some striving to offer the same programs to all employees (regardless of location) while others are allowing more leeway so that they can adapt to regional and/or local country needs.

4. Employers are eyeing other rapidly evolving issues that impact employee well-being.

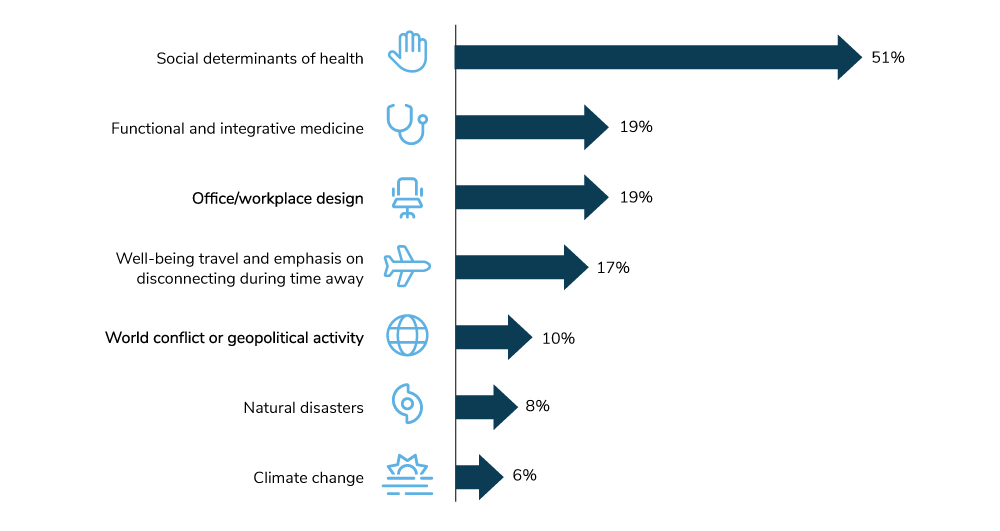

Employers are keeping a watchful eye on new areas to actively address in the next 3-5 years based on the changing world and evolving employee needs. As seen in Figure 6, the leading area of expansion is addressing social determinants of health (SDOH) – the circumstances in which people are born and live that contribute to their physical and mental health, their ability to be productive at work and their overall quality of life. SDOH includes early childhood experiences and educational opportunities; employment status and livable wages; housing, food, water, transportation, public safety, gender and racial equality; and health care. Some of the growth in SDOH efforts can be attributed to health plans and other vendors developing more robust capabilities, which employers can then leverage on behalf of their workforce. About half of employers have SDOH on their roadmap for the coming years.

5. Employers will continue to provide family-forming benefits and reproductive support.

Employers have taken note of the value that employees place on family-forming benefits and reproductive support and in turn, are working to maintain these offerings given their role in workforce strategy, including talent attraction and retention.

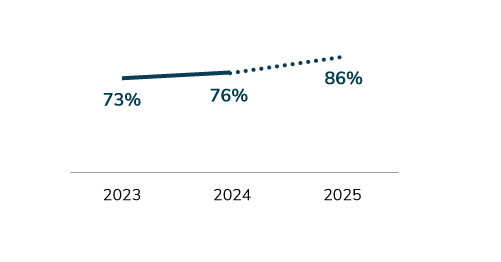

By 2025, upwards of 86% of employers could offer family-forming and reproductive support to their employees, making it one of the greatest areas of growth among initiatives covered in the survey (Figure 7). These services are typically provided via a standalone point solution. Employers should require that their partners work together to ensure proper navigation across the vendor ecosystem and optimal integration of care. Lastly, recent state and local laws and regulations impacting access to some reproductive services may have garnered increased attention from employers.

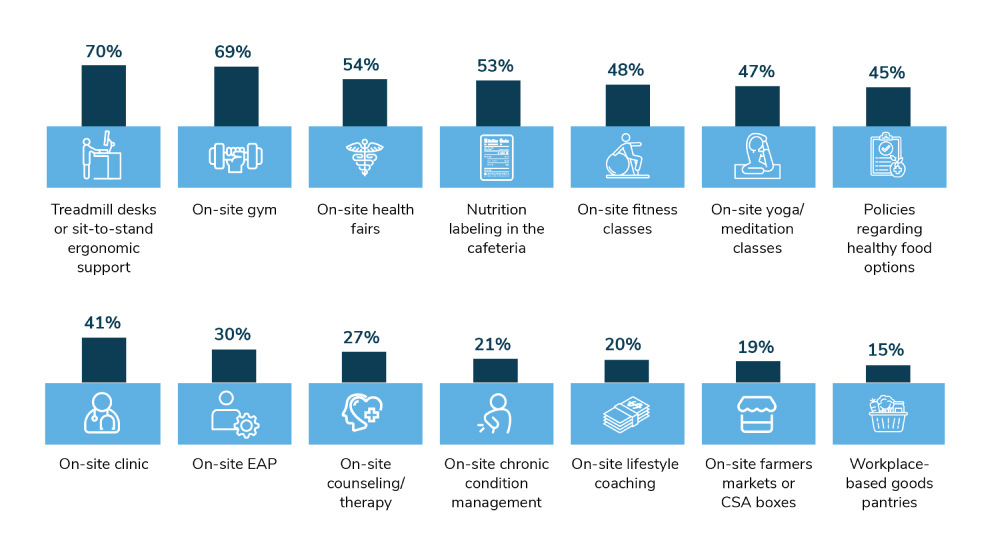

6. On-site offerings at the worksite level out.

As employers continue to evolve their well-being strategies, on-site services and offerings remain a core component. While the early post-pandemic years revealed some uncertainty – mainly, whether employers would “bring back” certain on-site offerings – 2024 shows that employers have established that on-site offerings are an integral part of their approach to creating a healthy worksite.

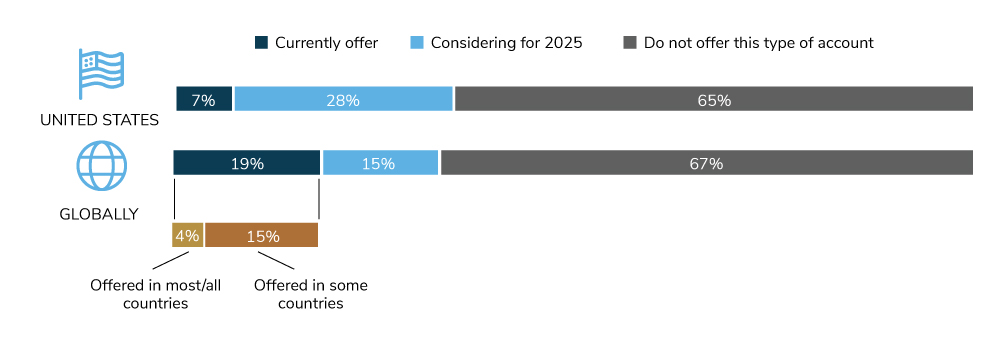

7. Lifestyle spending accounts (LSAs) continue to generate buzz and curiosity, but many employers are still weighing implementation.

LSAs are accounts that allow employers to fund a variety of well-being activities. They have piqued employers’ interest, likely because they provide a flexible mechanism to facilitate choice across a diverse range of employee needs.

While these benefits are reportedly popular among employees who have used them, employers are still a bit reluctant about implementing them. This hesitation is primarily due to the cost of providing these benefits. Among employers who haven’t made the leap to LSAs, two in three say that costs are a hurdle. For employers who have put an LSA in place, anecdotes suggest that LSA utilization often exceeds budgets before the year is over. While this level of engagement is potentially encouraging, employers should carefully consider the assumptions used for budgeting purposes. Costs in excess of budgets pose challenges to employers overall, threatening the long-term success of these programs.

Future Outlook

The 15th annual survey findings reflect a measured view of future investment and effectiveness of employer well-being initiatives. Employers remain committed to providing these services and programs to their workforce and will continue to treat well-being as an important component of their workforce strategy. Yet increasingly they are approaching partnerships and providers of these services with a more discerning view. Nonetheless, employers will continue to seek solutions that demonstrate outcomes, are cost effective and drive the appropriate level of member engagement. In all, employers remain committed to investing in their well-being strategy and potentially growing their investments in the coming years.

15th Annual Employer-Sponsored Health and Well-being Survey: Full Report

More Topics

Data Insights

This content is for members only. Already a member?

Login

![]()