August 22, 2023

Key Takeaways

- Employers are keenly focused on providing high-quality health care services while managing overall costs. For too long, costs have been increasing at an intolerable pace with no improvement in patient outcomes or experience. This confluence of factors is leading employers to examine their partnerships with health plans, vendors and others to ensure that employees and their dependents are receiving high-quality, cost-effective services that deliver the outcomes expected. Increasingly, employers will hold vendors accountable through greater transparency of results, pricing and contractual terms.

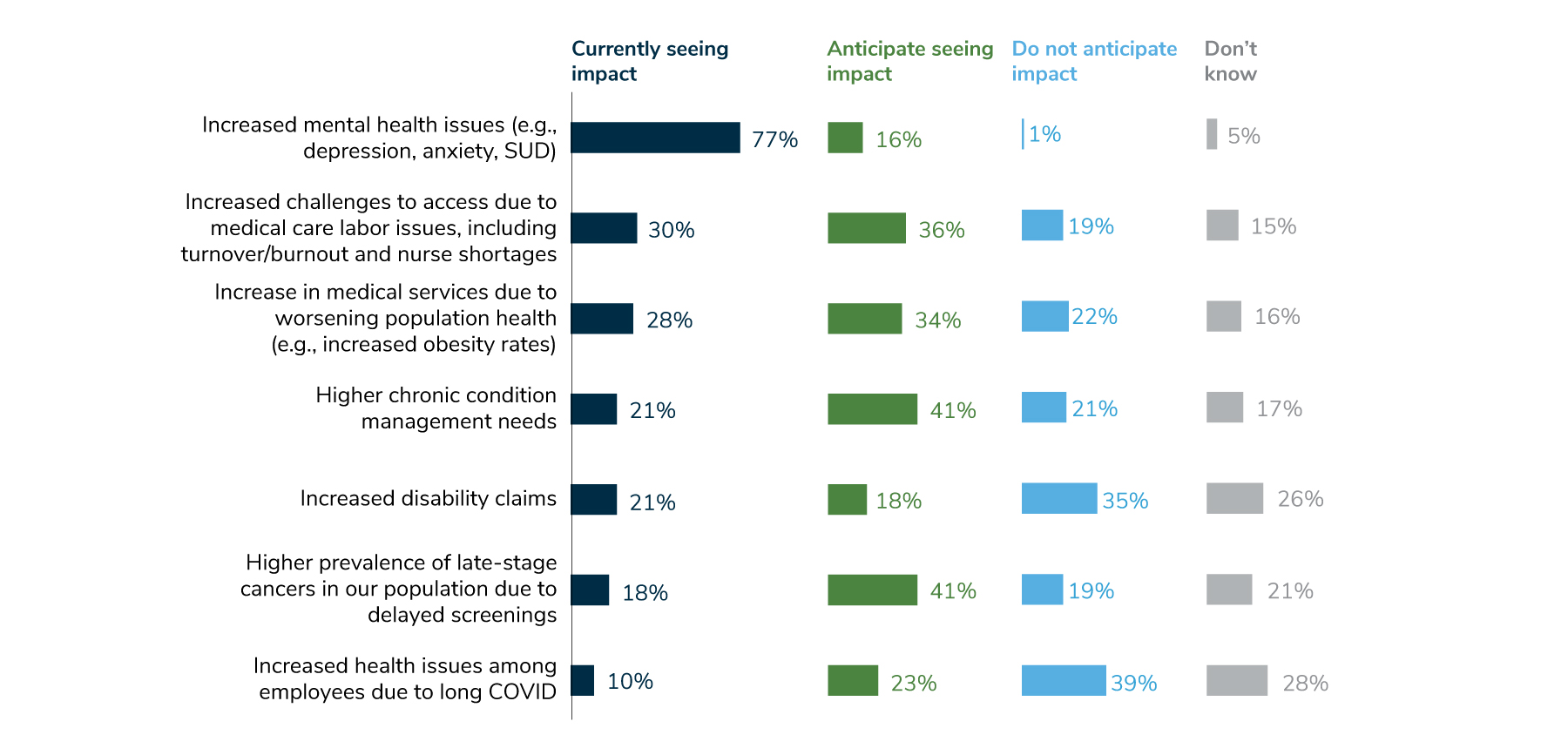

- A lingering effect of COVID-19 is an increase in mental health concerns, with an accompanying need for more services. Whereas last year, 44% of employers saw an increase in mental health needs, this year, 77% of employers reported an increase, with another 16% anticipating such an increase in the future.

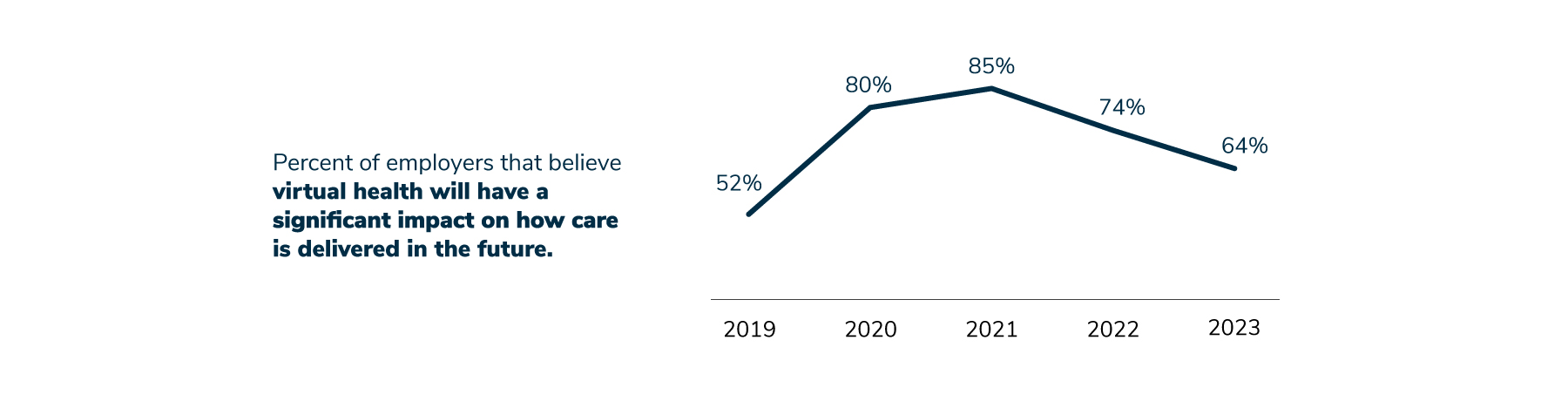

- Employers’ perceptions about virtual health continue to evolve. Their belief that virtual health will significantly impact health care in the future has declined since 2021, when 85% of employers said this was the case. In 2022, that number dropped to 74% and went down to 64% in 2023.

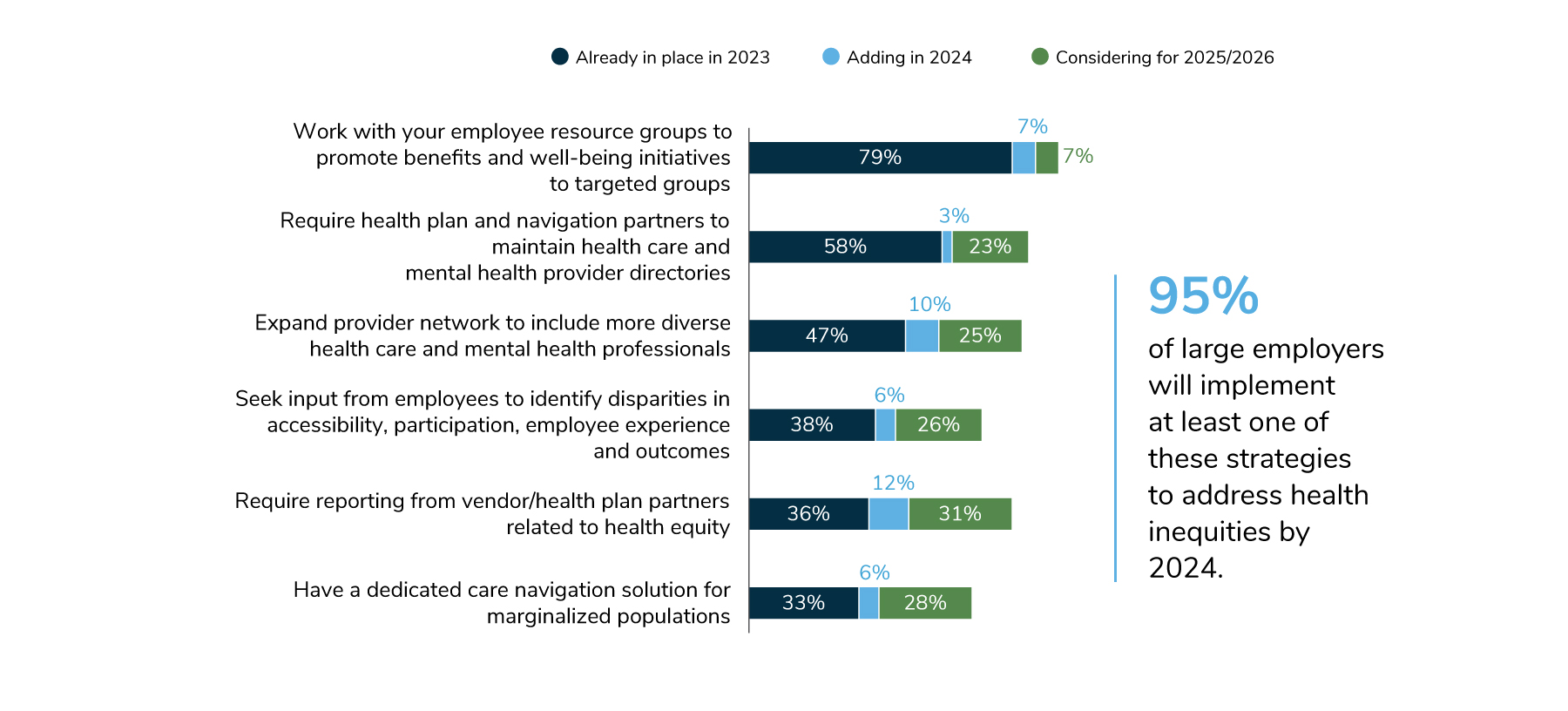

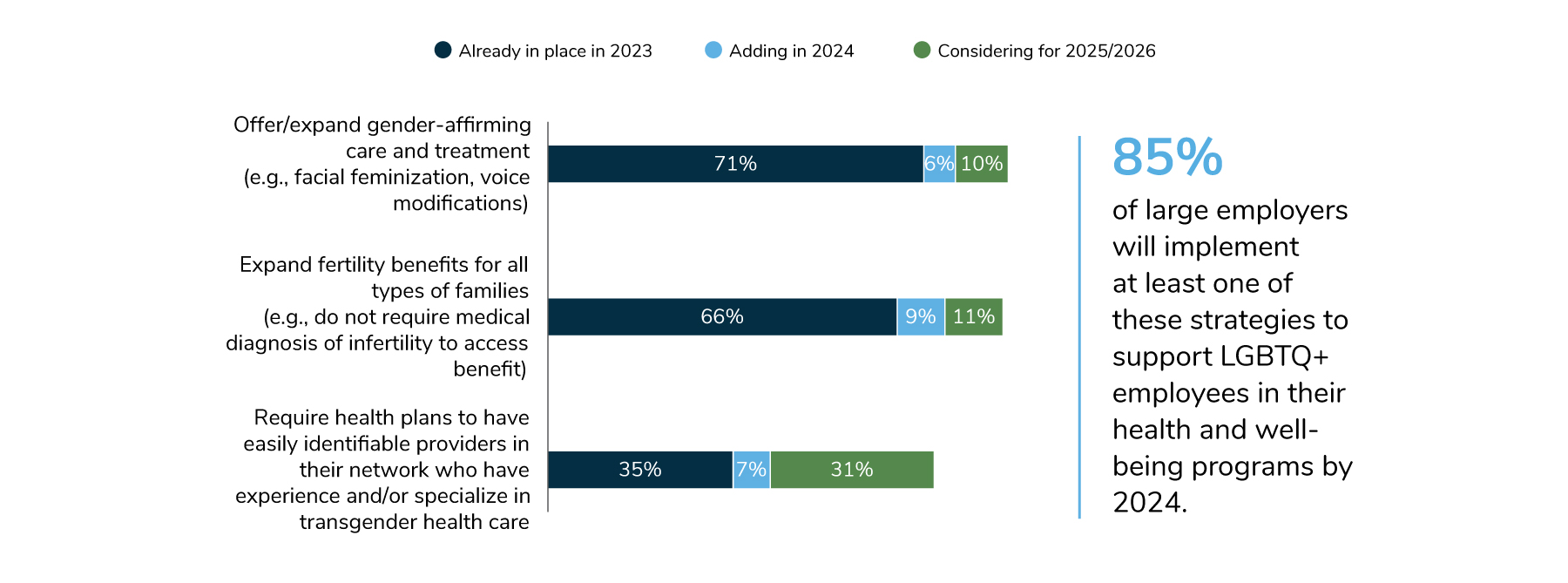

- Employers’ health equity approaches are evolving and expanding, with a focus on serving specific communities and populations within the workforce. In particular, 85% of employers will implement at least one strategy to support the health and well-being needs of their LGBTQ+ employees. Others are expanding fertility and family-forming benefits, and still others are offering health plans with lower cost sharing to address affordability concerns. In total, 95% of employers will implement at least one strategy to address health inequities by 2024.

As employers look ahead to 2024 and beyond, they are balancing many priorities while addressing emerging challenges. They continue to deal with the lingering effects of the COVID-19 pandemic, including an increased need for mental health services as well as provider shortages straining an already fragile delivery system in need of reform. In addition, employers anticipate that delays in care will result in more late-stage cancer diagnoses and a more pressing need for chronic disease management.

These realities are set against a backdrop of increasing costs that will have to be addressed as employers strive to maintain quality and improve access to care. Furthermore, while employers once saw virtual health as holding promise as a way to address significant issues in the health care system, they are increasingly aware of its limitations.

The data emerging from the survey emphasize the mounting tension between cost, quality, outcomes, affordability, equity and experience. The findings also point to possible strategies that employers are considering, including greater accountability of those they entrust to provide health and well-being services to their workforce.

More Employers See Health and Well-being as Integral to Workforce Strategy

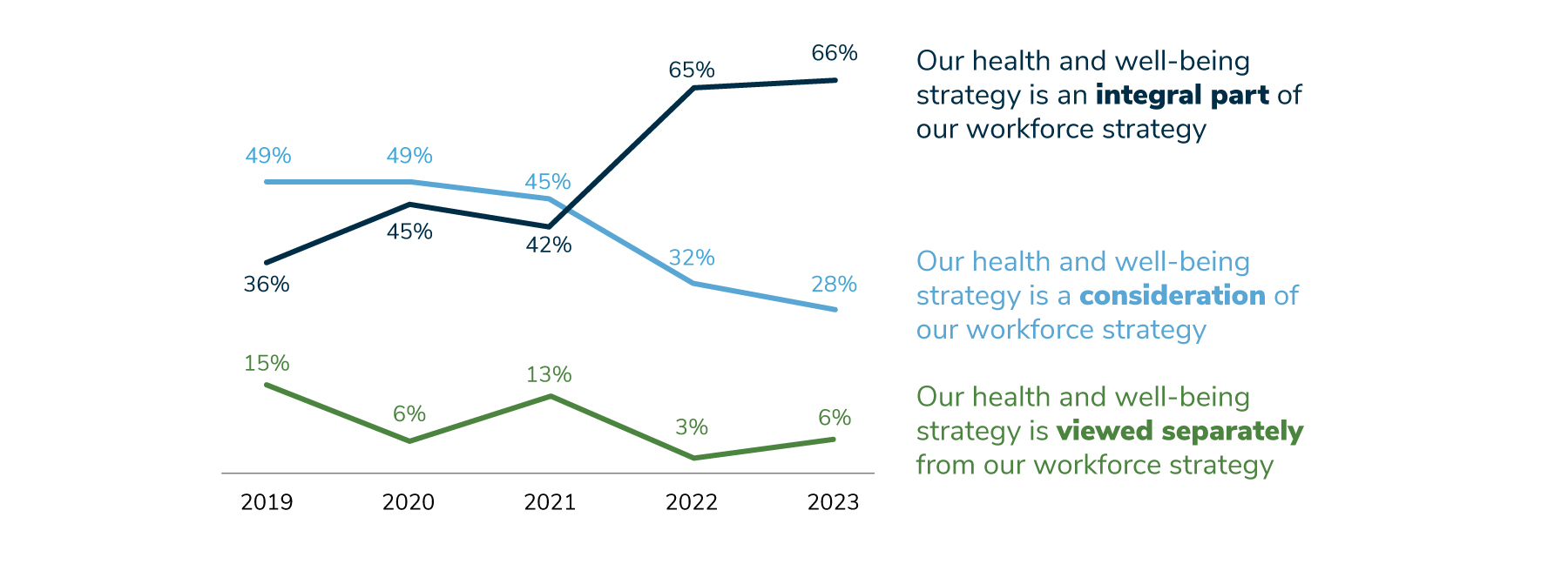

For the past several years, this survey has asked employers how they view their health and well-being strategy in relation to their workforce strategy – integral, a consideration or completely separate. Between 2021 and 2022, there was a substantial leap in the percent of employers that view their health and well-being strategy as integral to their workforce strategy, increasing from 42% of employers having this perspective in 2021 to 65% in 2022. In 2023, the trend went up one point to 66%, building on last year’s jump (Figure 1.1). These changes provide some insight into employers’ mindset, indicating that fewer employers are seeing these strategies as separate.

Quality, Affordability and Partnerships: Employer Vision for Change

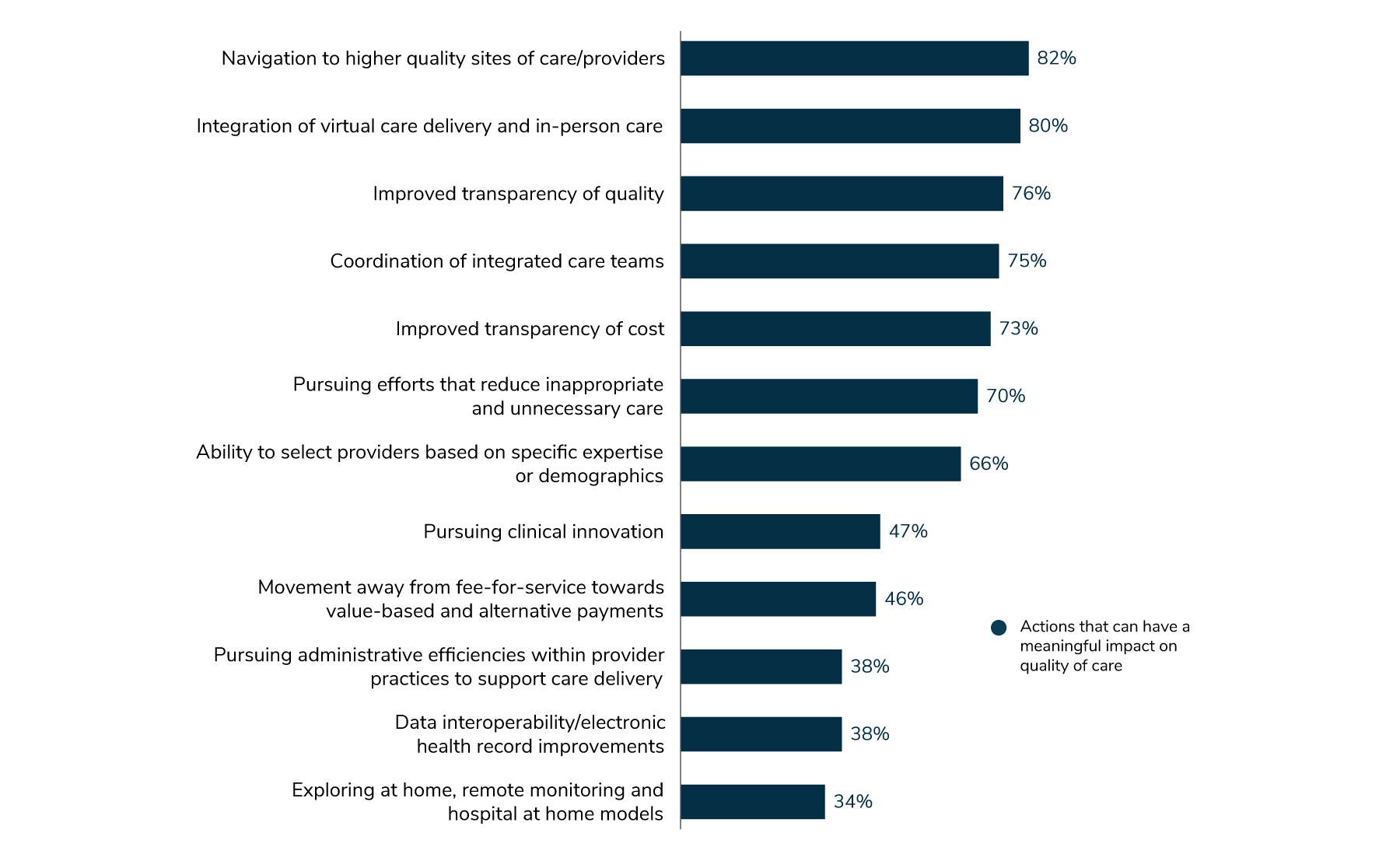

Employers were asked to select actions that could be taken to have a meaningful impact on the quality of health care. About 80% agreed that improved cost transparency and navigation support to sites of care such as centers of excellence (COEs) and high-performance networks (HPNs) are key to improving quality of health care (Figure 1.2).

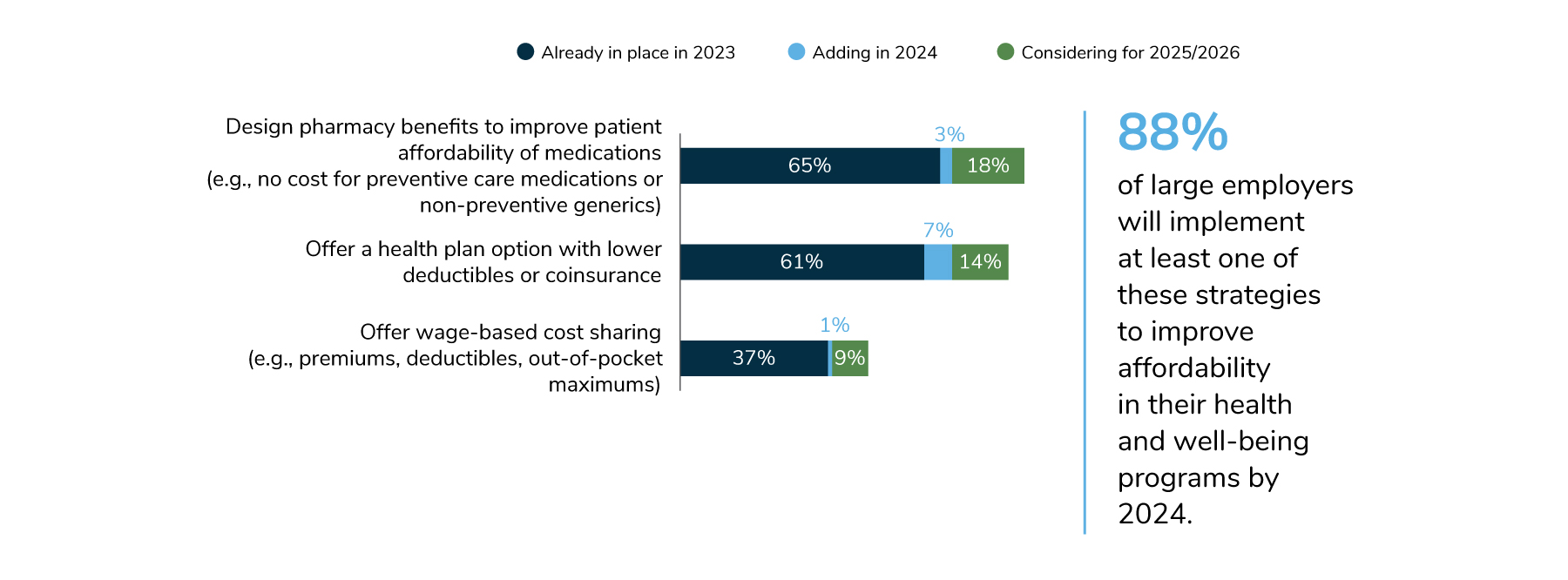

Along with looking at quality, employers are aware that addressing overall plan affordability, as well as affordability for their employees, is a high priority. Sixty-five percent of employers are striving to reduce patients’ out-of-pocket drug costs, and 61% are offering health plans with lower deductibles. These and other strategies are shown in Figure 1.3; 88% of employers will implement at least one of them by 2024.

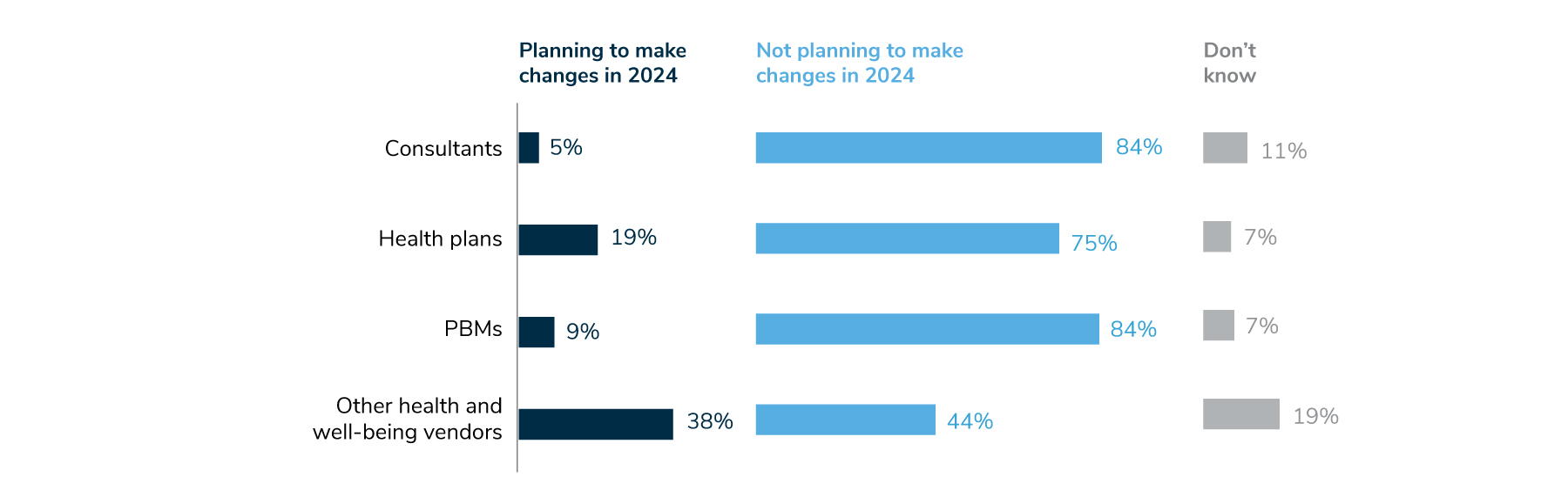

Employers also reported that they are examining their partnerships, including those with health plans and other vendors, to ensure that they are receiving value through higher quality, cost-effective services. Increasingly, employers are holding vendors accountable through greater transparency of results, pricing and contractual terms. Specifically, employers are reviewing partnerships, conducting RFPs and streamlining existing partnerships (Figure 1.4).

Lingering Effects of COVID-19 Play a Role in Current Health Care Needs

In recent years, employers saw an increase in mental health needs, such as depression, anxiety and substance use disorder, and this year, that trend accelerated. Whereas last year, 44% of employers saw an increase in mental health concerns, this year, 77% of employers reported an increase, with another 14% anticipating such an increase in the future. While the pandemic has amplified the demand for mental health services, employers have been focused on mental health for some time and will continue to pay close attention to this area into the future.

Solving the mental health crisis and other health concerns, however, remains a challenge. A finding that emerged this year is that 30% of employers recognize that a shortage of health care providers is making it harder for employees to access care, and another 36% expect to see this issue in the future. Exacerbating these problems is that health care needs are increasing: 41% of employers expect to see higher chronic care management needs as well as more late-stage cancer diagnoses, a result in delays in receiving care during the pandemic (Figure 1.5).

Changing Views on Virtual Health

Although employers recognize that virtual health will continue to play a key role in health care, some no longer see it as quite the transformative solution as they once did. The numbers tell the story: In 2021, 85% of employers said that virtual health will have a significant impact on how health care is delivered in the future, while in 2022, that percentage dropped to 74%, with an additional 10-point decrease in 2023 (Figure 1.6). In part, this decrease is not entirely surprising given the prominence and necessity of virtual health during the peak of the pandemic.

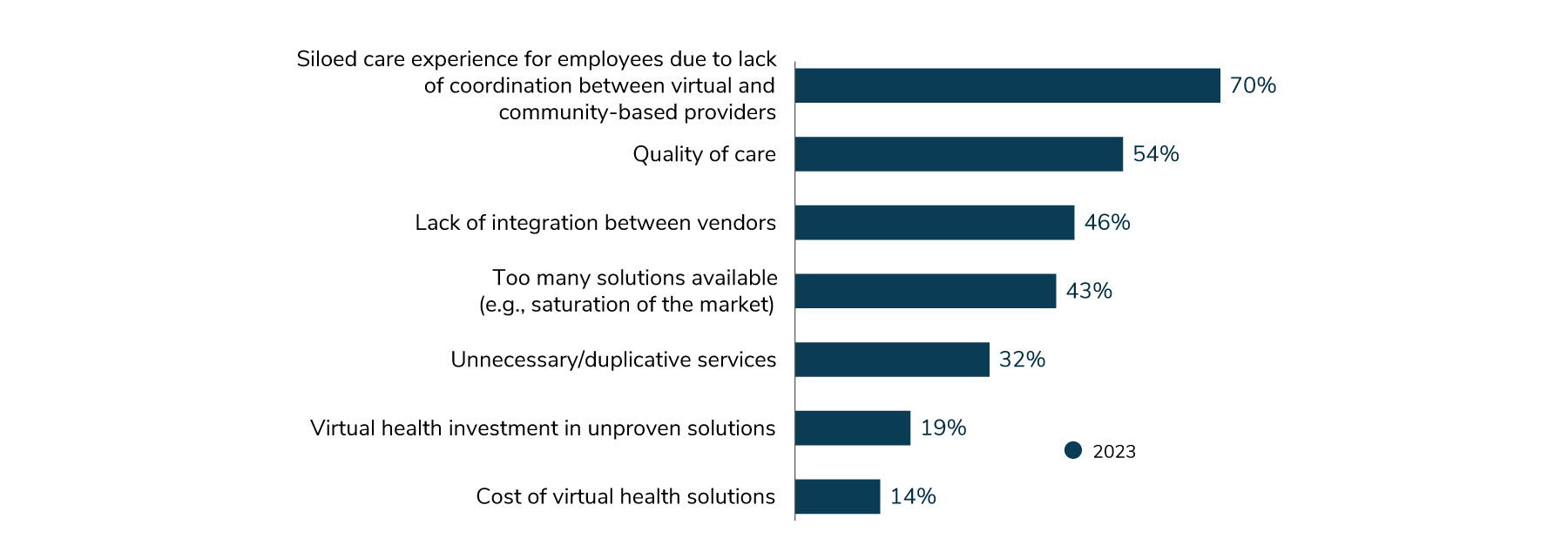

This decline is also reflective of employer concerns post-pandemic. Specifically, they question whether virtual health has had a positive impact on outcomes, quality, cost, experience and integration. Issues related to each have emerged in recent years, with employers becoming increasingly discerning in their selection of virtual health partners. In order for virtual health to achieve its potential, a heightened focus must be placed on delivering high-quality services that improve patient outcomes in a cost-effective, integrated manner.

This year, employers are particularly worried about the lack of coordination between virtual and community-based in-person care (70%). Employers are also concerned about quality of care (54%) and lack of integration between vendors (46%). Further, employers say there are too many solutions on the market, with 43% seeing this as an area of concern (Figure 1.7).

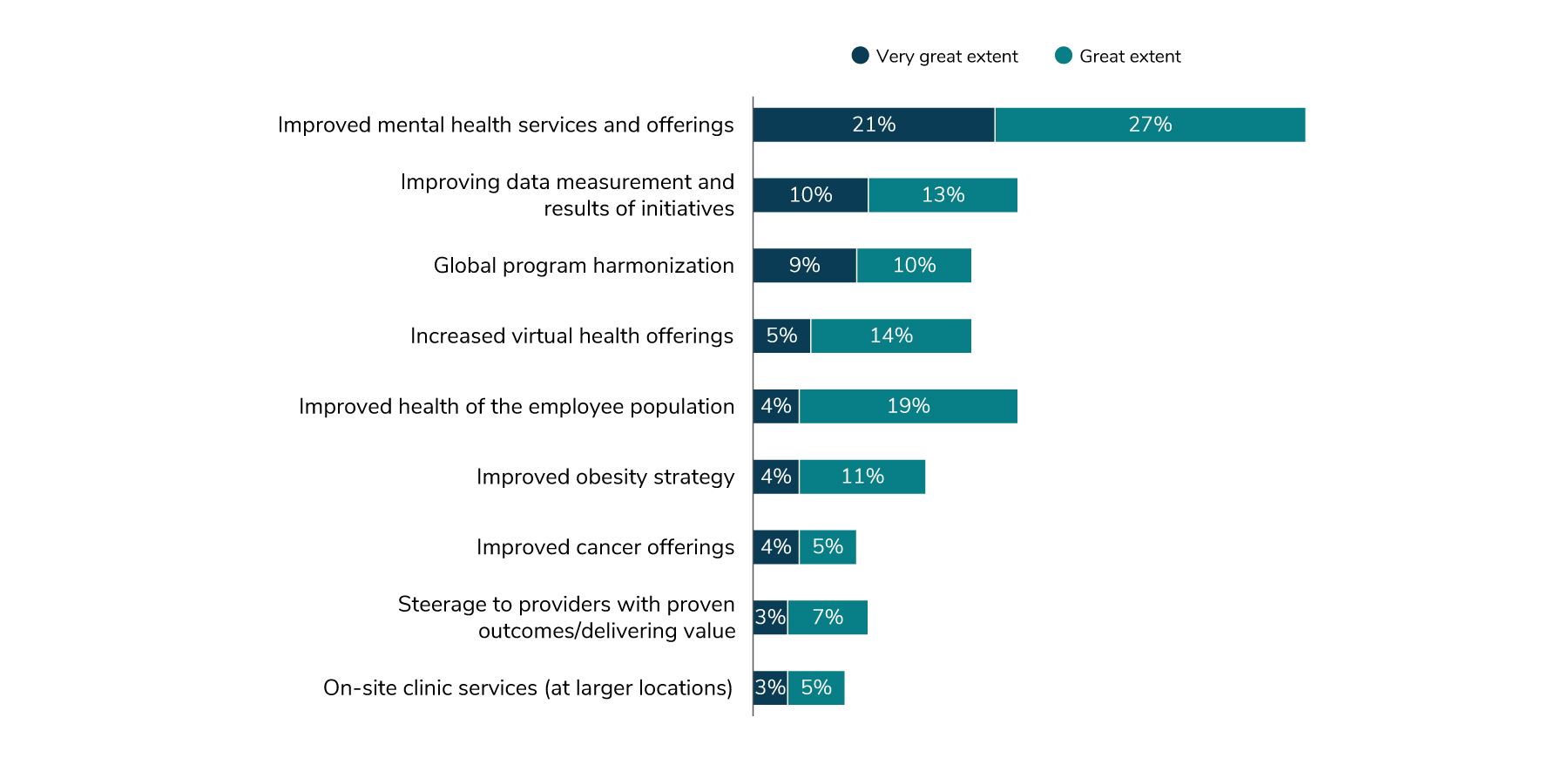

Global Health Care Priorities

The issues that multinational employers are focused on mirror those cited in other parts of this report. Forty-eight percent of global employers identified improving mental health initiatives as a significant priority area, and 23% said that improving data measurement and reporting of outcomes of initiatives were areas of focus. Another area of interest is harmonizing global offerings; 19% of employers are pursuing this in 2023 (Figure 1.8).

Driving Delivery System Reform

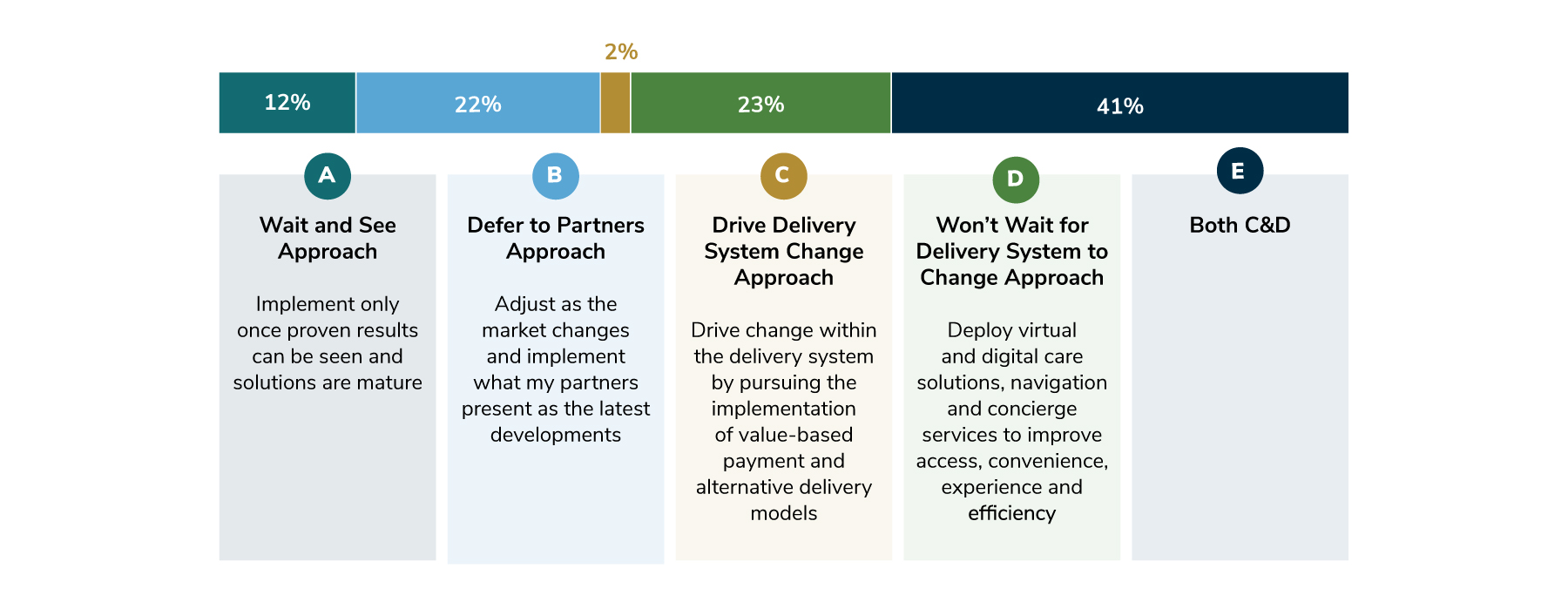

As in past years, employers were asked to characterize their approach to health care delivery reform: A) a wait and see approach; B) deferring to partners; C) driving change within the delivery system; D) not waiting for the delivery system to change before taking action; and E) both C and D. This year, 41% of employers indicated that they are taking a two-pronged approach – driving delivery system change through valuebased and alternative delivery models plus moving forward with improving access, convenience, experience and efficiency through solutions, navigation and concierge offerings. This approach was the most commonly selected.

The approach of deferring to partners (B) continues to experience an incremental decline year over year. As more employers are weighing the value of their partnerships (see Figure 1.4), they may not be looking to these vendors for direction on delivery reform. The approach that saw the biggest change from 2022 was not waiting for the delivery system before taking action (D); this option increased seven percentage points in 2023 (Figure 1.9).

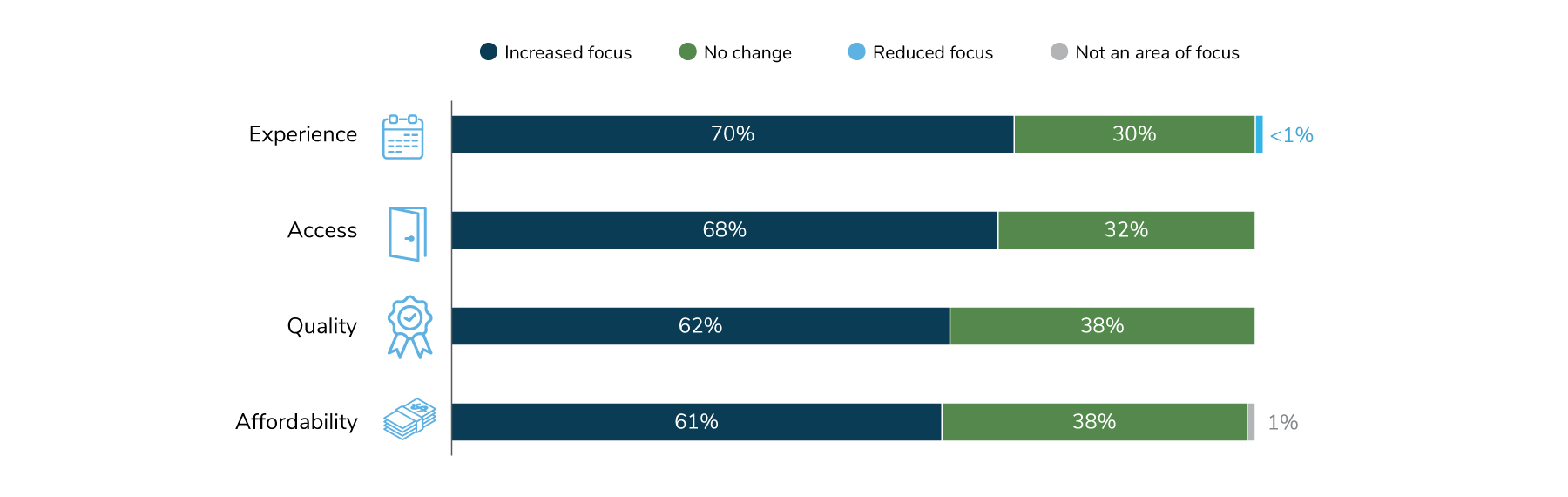

In terms of areas of focus, employers are concentrating on improving access to health care for employees, as well as improving their overall experience. Quality of care also ranked high, with 62% of employers mentioning this issue (Figure 1.10).

Policy Perspectives

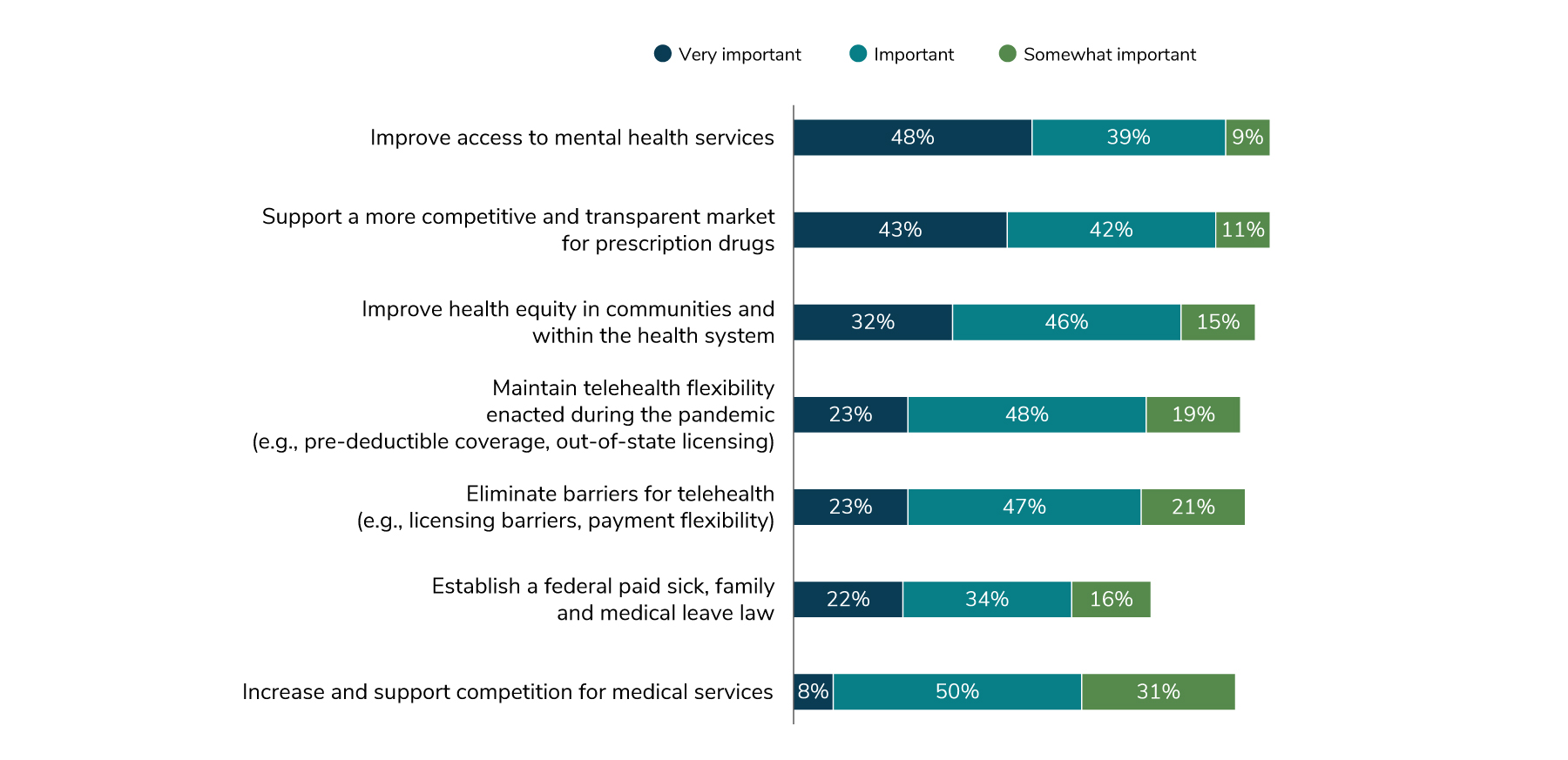

Two of the themes emerging from this year’s survey are that mental health and transparency are top of mind for employers. This focus is also reflected in their legislative and policy priorities. Eighty-seven percent of employers viewed improving access to mental health services as either a very important or important legislative priority. Support for a more transparent and competitive market for prescription drugs took the second spot, with 85% of employers deeming it as very important or important, while 78% of employers selected improving health equity in communities and within the health system as a policy priority (Figure 1.11).

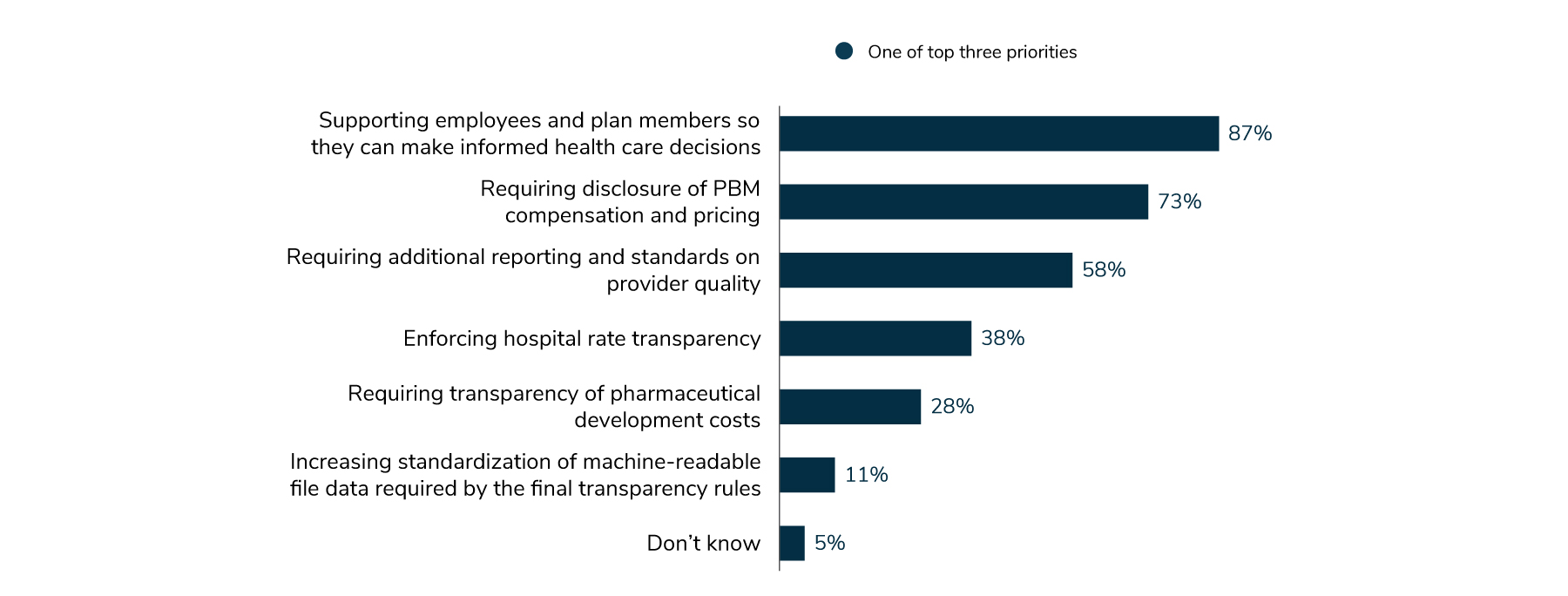

This year’s survey looked more closely at what employers view as their top three priorities for transparency. Overall, eight out of ten employers identified service provider transparency as a top priority over the next 3-5 years. Specifically, they singled out greater transparency for employees and plan members so they can make informed decisions about their health care (87%). Employers also supported requiring disclosure from pharmacy benefit managers (PBMs) on prescription drug compensation and pricing (73%) and additional reporting about provider quality (58%) (Figure 1.12).

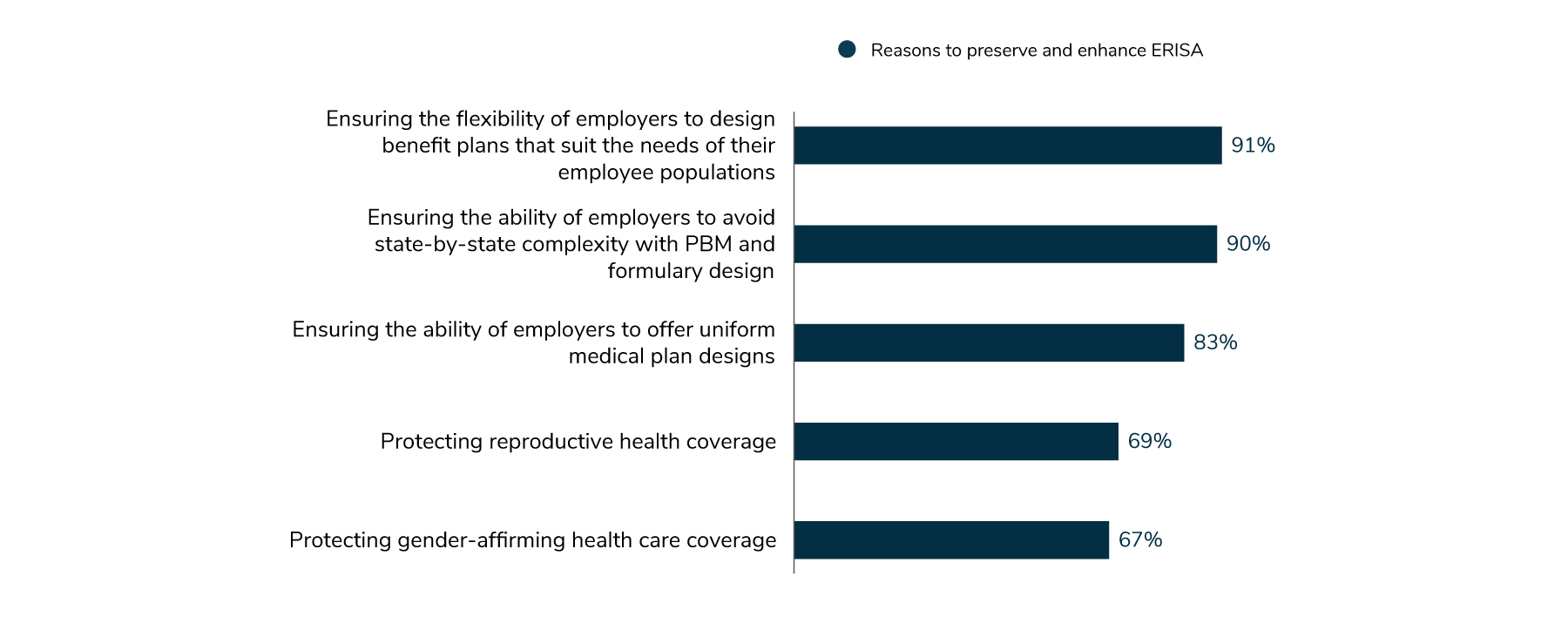

With clear legislative priorities in mind, employers want a straightforward path for moving ahead. For this reason, the vast majority of employers (93%) feel a level of urgency in preserving and enhancing ERISA preemption. This law prohibits states from forcing employers to create or amend an employee benefit plan or from attempting to control the administration of benefit plans in any way.

When asked why employers felt so strongly about this issue, 91% said that it was to make sure that they had the flexibility to design plans that meet the needs of their employees. Ninety percent of employers stated that they wanted to avoid any complexity introduced by the states in designing their prescription drug plans and formularies (Figure 1.13).

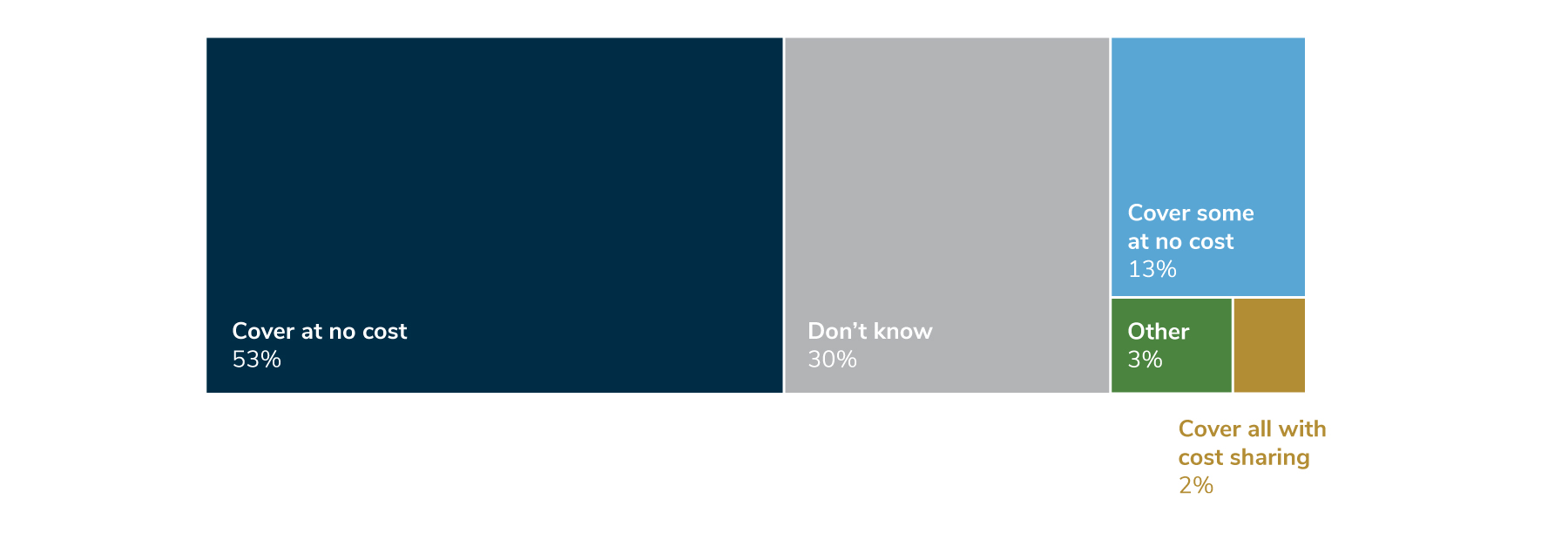

In terms of preventive care coverage, employers have traditionally covered recommendations from the United States Preventive Services Task Force (USPSTF) at 100%. These include breast cancer screenings, Pap tests and colonoscopies. However, with the USPSTF’s authority being called into question, the survey asked employers if they would continue this level of coverage should it not be required.

Survey findings show that 53% of employers will continue to cover all A and B recommendations at no cost, with 13% agreeing to cover some services at no cost. Thirty percent of employers were unsure about their position (Figure 1.14).

Health Equity Continues to be a Priority

This year, employers are building on the foundation laid in years past and are taking specific actions to improve health equity. In 2024, many employers (86%) will collaborate with employee resource groups (ERGs) to promote benefits and well-being initiatives to targeted groups, and 61% will require health plan and navigation partners to maintain directories of health care and mental health providers. To help ensure accountability, nearly half of employers will require vendors to report on health equity measures. In summary, 95% of employers will implement one of these strategies by 2024, as shown in Figure 1.15.

Ensuring that Marginalized Groups Receive Appropriate Care

The survey results indicate that employers are continuing to refine their offerings for specific communities within their workforce, including LGBTQ+ and BIPOC populations, employees with disabilities and those who are neurodiverse. Employers are also addressing the unique health concerns of women.

Health care for the LGBTQ+ population is an area of growth, particularly for gender-affirming care and fertility benefits. Employers are recognizing all types of families, and in 2024, 75% will offer fertility benefits to a wider range of families, without the need for an infertility diagnosis (Figure 1.16). That’s up from 48% in 2022. Overall, 85% of employers plan to implement one of the strategies shown in Figure 1.16 by 2024.

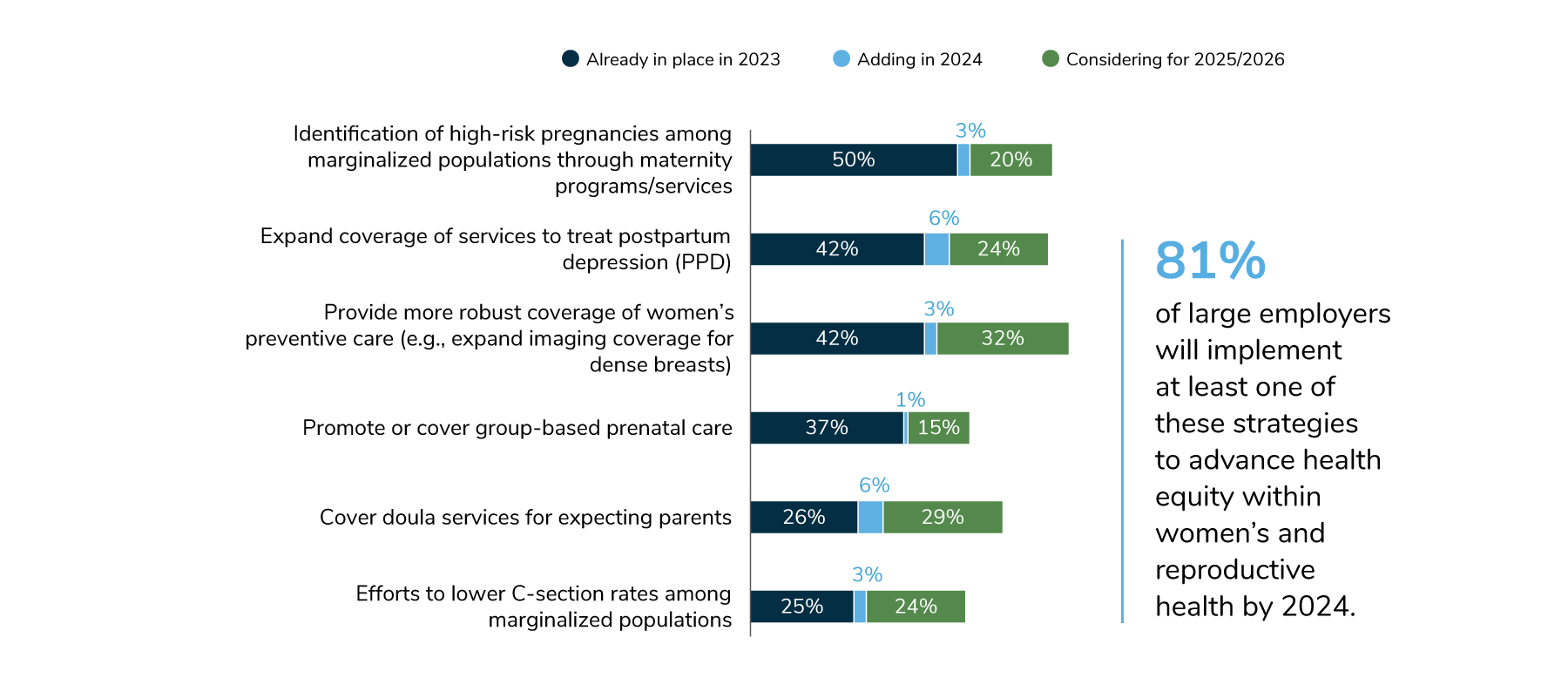

In the area of women’s health, the focus continues to be on the identification of high-risk pregnancies among marginalized groups and expanded coverage for postpartum depression. In 2023, 50% of employers are offering programs to identify high-risk pregnancies and 3% are planning to do so in 2024. Furthermore, 42% offer expanded coverage for services to treat postpartum depression in 2023 and another 6% are planning on adding these services in 2024 (Figure 1.17).

In the area of women’s preventive care, employers have increased their efforts in 2023, with 42% of employers providing more robust coverage and 3% planning to do so in 2024. Employers are also promoting or covering group-based prenatal care; 37% are doing so in 2023 and 15% are considering it for 2025/2026. Doula services are also on the rise, with 26% of employers covering doulas in 2023, another 6% expected to do so in 2024 and 29% thinking about it for 2025/2026. Across the board, 81% of employers will implement at least one of the strategies shown in Figure 1.17 by 2024.

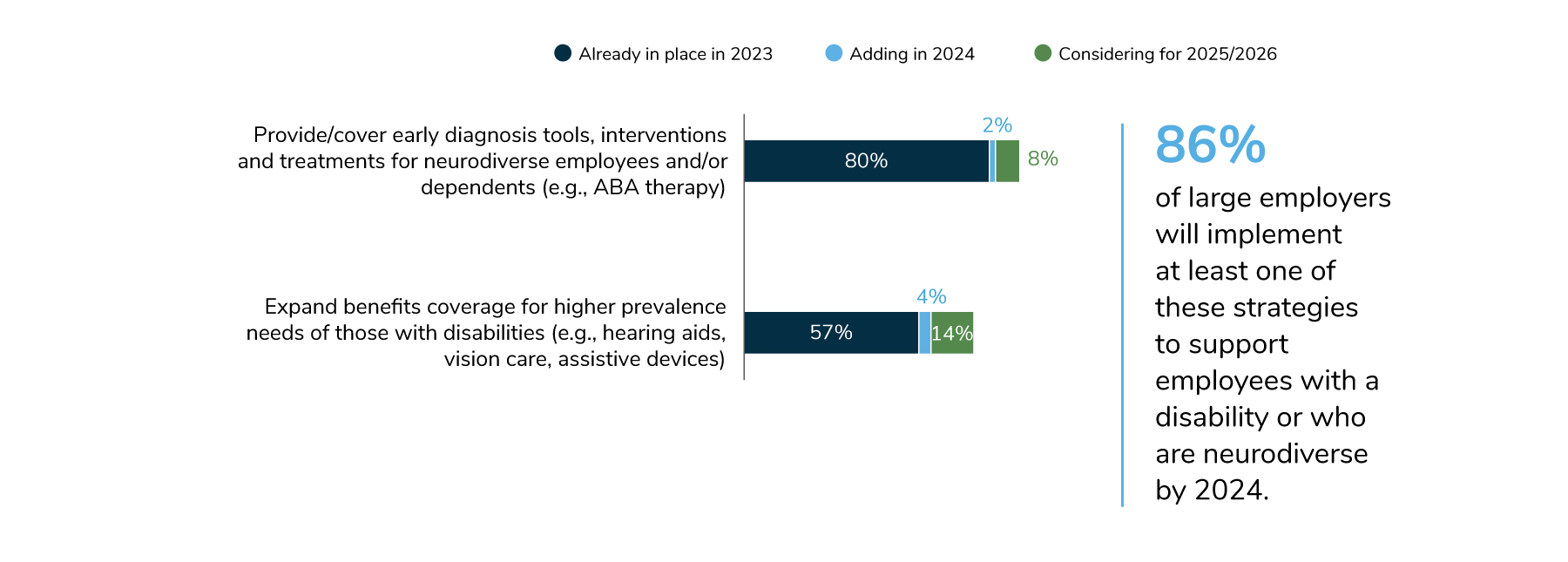

Expanding coverage of benefits for employees with disabilities or who are neurodiverse continues to grow. In 2022, 76% of employees provided services for employees and their dependents who are neurodiverse, but 80% did so in 2023. In 2024, 61% of employees will expand their benefits to support those with disabilities (e.g., hearing aids, eyeglasses and other assistive devices), with another 14% considering doing so in 2025-2026. Eighty-six percent of employers plan to implement at least one of the strategies shown in Figure 1.18 by 2024.

Additional Resources

To learn more on how to address the topics in this section, see the following Business Group member resources:

Part 1: Employer Perspectives

-

Introduction2024 Large Employer Health Care Strategy Survey

-

Full Report2024 Large Employer Health Care Strategy Survey: Full Report

-

Executive Summary2024 Large Employer Health Care Strategy Survey: Executive Summary

-

Part 1Part 1: Employer Perspectives

-

Part 2Part 2: Health Care Delivery

-

Part 3Part 3: Health and Pharmacy Plan Design

-

Part 4Part 4: Health Care Costs and 2024 Initiatives

-

Chart Pack2024 Large Employer Health Care Strategy Survey: Chart Pack

More Topics

Articles & Guides

This content is for members only. Already a member?

Login

![]()